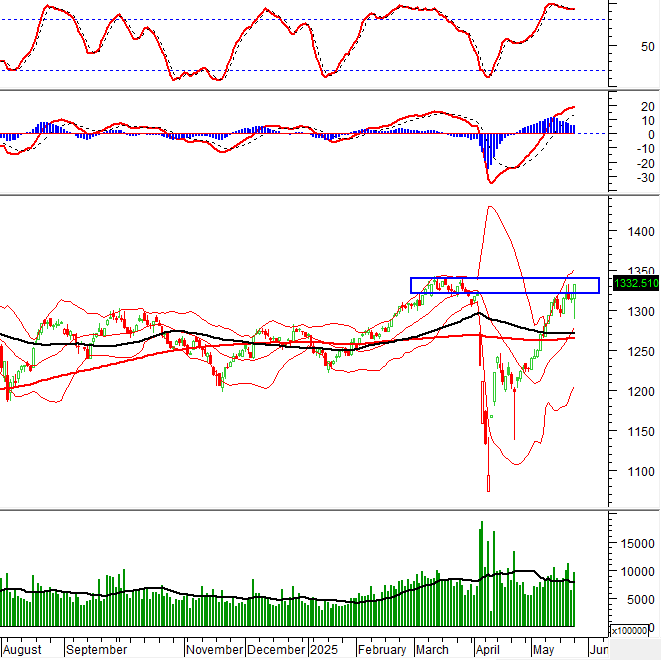

The VN-Index is currently retesting the March 2025 peak (equivalent to the 1,320-1,340 range). This is an important resistance level, so the VN-Index is likely to experience volatility to retest this range. The Stochastic Oscillator indicator is venturing deep into overbought territory. Investors should exercise caution if the indicator falls out of this region in the coming days.

I. MARKET ANALYSIS OF STOCK MARKET BASICS ON 05/26/2025

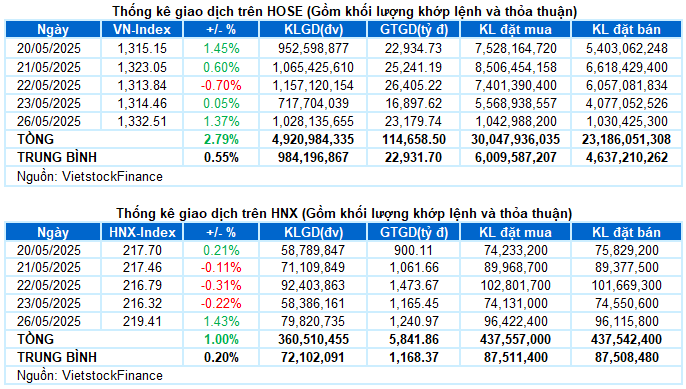

– The main indices witnessed a robust performance during the trading session on May 26th. Specifically, the VN-Index surged by over 18 points, equivalent to a 1.37% increase, reaching 1,332.51 points; while the HNX-Index also broke through with a 1.42% gain, attaining 219.39 points.

– Market liquidity witnessed a substantial increase compared to the lows of the previous week’s closing session. The matched order volume on the HOSE floor rose by 50%, reaching nearly 960 million units. Meanwhile, the HNX floor recorded over 79 million units, marking a 39% increase.

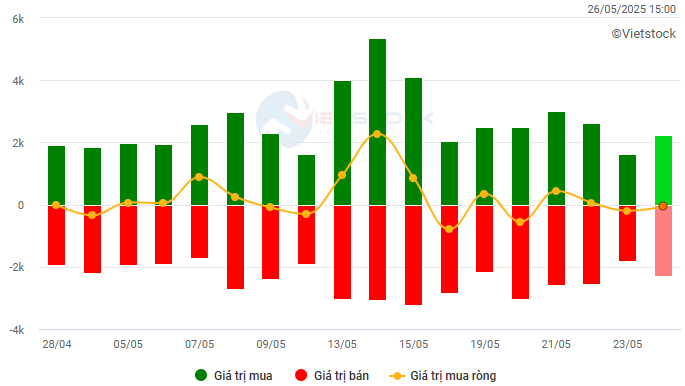

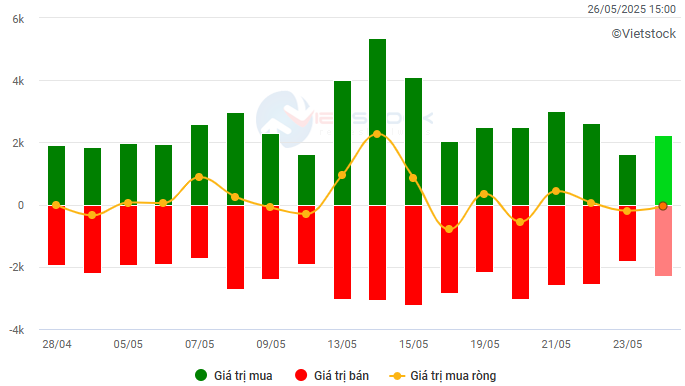

– Foreign investors net sold with a slight value of over VND 35 billion on the HOSE and nearly VND 14 billion on the HNX.

Trading value of foreign investors on HOSE, HNX, and UPCOM. Unit: VND billion

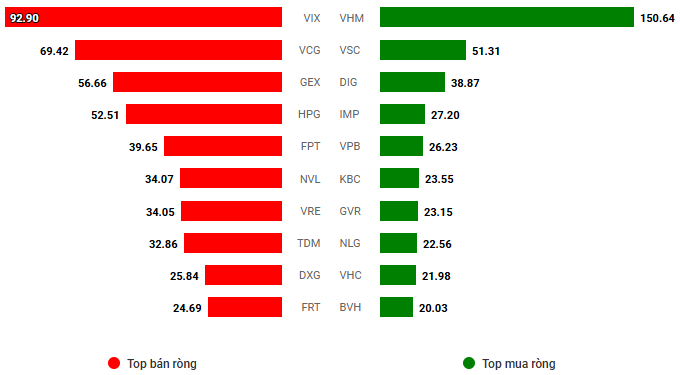

Net trading value by stock code. Unit: VND billion

– The first trading session of the week witnessed several surprising developments. Following the market opening, the VN-Index plummeted by more than 25 points but swiftly recovered, regaining balance around the 1,300 threshold. Subsequently, the market maintained a state of differentiation below the reference mark until the end of the morning session. During the afternoon session, buying demand significantly intensified amid the emergence of positive news pertaining to tax policies. Specifically, US President Donald Trump affirmed that the objective of tax policies is to promote domestic technology production. This information spurred a robust rebound in stock groups that had previously endured substantial pressure due to concerns about tax policies, such as textiles, seafood, and industrial parks. The positive sentiment permeated broadly, propelling the VN-Index to continuously expand its gains and conclude the session at 1,332.51 points, reflecting a 1.37% increase compared to the previous session.

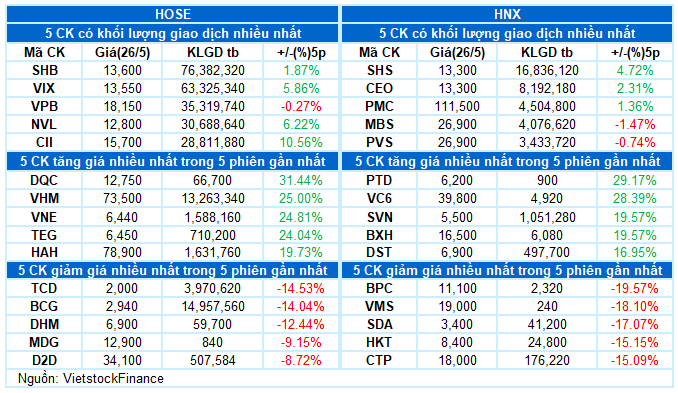

– In terms of influence, VHM, GVR, and VIC were the primary pillars contributing the most, yielding nearly 8 points of increase for the VN-Index. Conversely, no particular stock exerted a significant negative impact. Collectively, the top 10 negative stocks caused the overall index to lose merely half a point.

– Following numerous fluctuations, the VN30-Index concluded the session with a gain of over 1%, reaching 1,423.85 points. The buying side executed a remarkable “turnaround,” resulting in 21 advancing stocks, only 4 declining stocks, and 5 stocks remaining unchanged at the session’s close. Among them, GVR stood out in the leading position with a vibrant purple color, while VHM and BCM trailed closely with increases of 6.83% and 4.93%, respectively. In contrast, VRE, STB, and HPG moved against the overall trend, ending with a slight decrease.

The pervasive buying demand propelled all industry groups to witness positive gains. The real estate group spearheaded the rally with numerous stocks breaking through strongly, including VHM (+6.83%), DXG (+3.88%), DIG (+3.53%), TCH (+5.57%), CEO (+4.72%), KHG (+3.42%), KBC (+3.02%), BCM (+4.93%), SIP (+5.99%), IDC (+6.6%), and SZC hitting the ceiling price.

Nearly half of the remaining industry groups also recorded increases of over 1%, encompassing materials, telecommunications, non-essential consumer goods, energy, and essential consumer goods. Notably, textile and seafood stocks became the focal point, with numerous stocks surging to the maximum extent, including TCM, VGT, TNG, MSH, GIL, HTG; VHC, ANV, ASM, IDI, and FMC.

The VN-Index unexpectedly reversed course and surged robustly towards the session’s conclusion following the earlier volatility. Simultaneously, the trading volume surpassed the 20-day average, signifying an increasingly proactive participation of cash flow. Presently, the index is retesting the March 2025 peak (equivalent to the 1,320-1,340 range). This is a crucial resistance level, so the VN-Index is likely to experience volatility to retest this range. At present, the Stochastic Oscillator indicator is venturing deep into overbought territory. Investors should exercise caution in the coming days if the indicator falls out of this region.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Retesting March 2025 Peak

The VN-Index unexpectedly reversed course and surged robustly towards the session’s conclusion following the earlier volatility. Simultaneously, the trading volume surpassed the 20-day average, signifying an increasingly proactive participation of cash flow. At present, the index is retesting the March 2025 peak (equivalent to the 1,320-1,340 range). This critical resistance level suggests that the VN-Index is likely to experience volatility as it retests this range.

Currently, the Stochastic Oscillator indicator is venturing deep into overbought territory. Investors are advised to exercise caution in the coming days if the indicator falls out of this region.

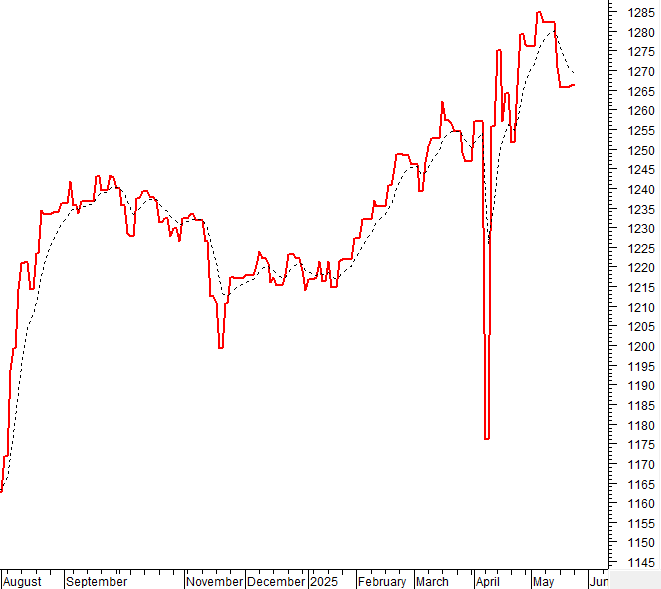

HNX-Index – Sustaining Above Middle Bollinger Band

The HNX-Index witnessed a positive increase while halting the three consecutive declining sessions, with the trading volume surpassing the 20-day average. Additionally, the index continues to sustain itself above the Middle Bollinger Band. If it maintains its position above this threshold, the situation will become more optimistic.

Presently, the MACD indicator sustains a buy signal and may surpass the 0 threshold in the upcoming sessions. Should this state emerge, the short-term optimistic outlook will be sustained.

Money Flow Analysis

Fluctuation of Smart Money Flow: The Negative Volume Index indicator of the VN-Index dipped below the 20-day EMA. Should this state persist in the upcoming session, the risk of an unexpected downturn (thrust down) will elevate.

Fluctuation of Foreign Investment Flow: Foreign investors resumed net selling during the trading session on May 26, 2025. Should foreign investors maintain this stance in the forthcoming sessions, the situation will become less optimistic.

III. MARKET STATISTICS ON 05/26/2025

Economic and Market Strategy Analysis Department, Vietstock Consulting and Research

– 17:10 05/26/2025

Market Beat: Afternoon Surge, VN-Index Soars Over 18 Points

The trading session concluded on a positive note, with the VN-Index climbing 18.05 points (+1.37%) to reach 1,332.51, while the HNX-Index gained 3.09 points (+1.43%), closing at 219.41. The market breadth tilted in favor of advancers, with 509 gainers versus 216 decliners. A dominant blue hue was observed in the VN30 basket, as 21 stocks advanced, 4 retreated, and 5 remained unchanged.

What’s Capturing the Attention of Stock Investors?

The VN-Index is inching closer to its 2025 peak after three consecutive weeks of gains. The looming profit-taking pressure could trigger short-term market volatility. Next week, investors’ eyes will be glued to news of potential tariff negotiation support between Vietnam and the US, which could provide a fresh impetus for the market.

Market Pulse for May 26: A Tale of Two Markets as Real Estate Sector Steals the Show

The market remained volatile and highly divided during the morning session. By the midday break, the VN-Index had shed 3.54 points, settling at 1,310.92. Conversely, the HNX-Index rebounded into positive territory, edging up 0.11% to 216.55. The market breadth was relatively balanced, with 314 decliners outweighing 300 advancers.