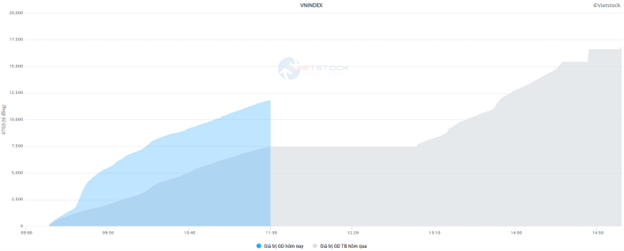

Market liquidity has significantly improved since last week’s lows, with transaction values reaching nearly VND 12 trillion on the HOSE and over VND 632 billion on the HNX exchange, up 59% and 26%, respectively, from the previous session.

Source: VietstockFinance

|

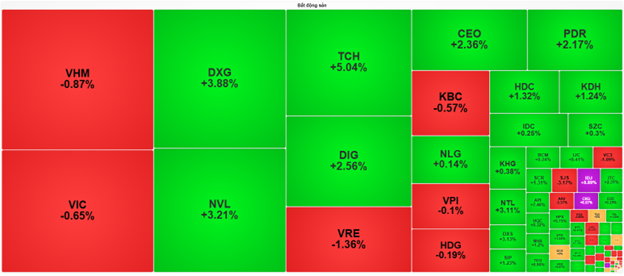

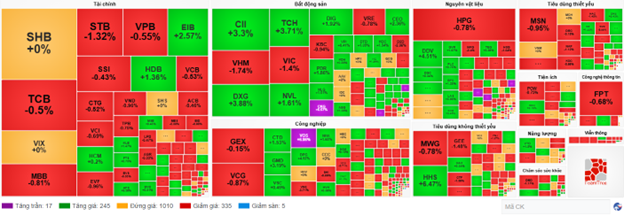

In terms of index impact, VCB, BID, and VHM were the main pillars exerting the most pressure, taking away nearly 2 points from the VN-Index. Meanwhile, GVR is holding the index from falling too sharply by contributing almost 1 point.

Sector performance continued to be mixed within a narrow range. Information Technology was the sector with the largest temporary decline of -0.7%, mainly affected by FPT (-68%) and CMG (-0.75%).

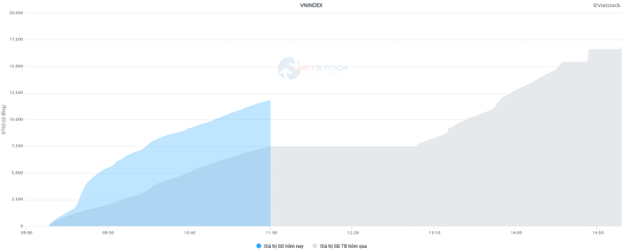

In the key sectors, most financial stocks fluctuated slightly around the reference price, except for some stocks with significant margins such as EIB (+2.57%), HDB (+1.58%), FTS (+2.05%), BVH (+2.92%), VAB (+5.22%), STB (-1.32%), and SSB (-1.34%). Meanwhile, the real estate sector index is slightly in the red due to pressure from the Vingroup trio, including VHM (-0.87%), VIC (-0.65%), and VRE (-1.36%). However, the rest of the industry traded brightly in the late morning session, with many stocks surging strongly, such as NVL (+3.21%), TCH (+5.04%), DXG (+3.88%), DIG (+2.56%), PDR (+2.17%), CEO (+2.36%), and even IDJ and CKG hitting the ceiling price.

Source: VietstockFinance

|

Foreign investors increased selling pressure with a net sell value of nearly VND 370 billion on the three exchanges in the morning session. Among them, HPG was the most net-sold stock with a value of over VND 81 billion. On the buying side, VSC led with a value of over VND 58 billion.

10:35 am: Switching to a tug-of-war after a sudden selling pressure

The market gradually stabilized and switched to a tug-of-war around the reference price after a sudden selling pressure. The VN-Index fell 0.65%, indicating the current adjustment pressure and the cautious sentiment of cash flow in the face of unpredictable developments.

The VN-Index is currently trading at 1,305.89 points, down 0.65%. The index representing the large-cap stock group, VN30, recorded a deeper decline, falling 0.9% to 1,396.73 points, indicating that the pressure mainly came from blue-chip stocks. Meanwhile, the HNX-Index maintained a slight loss of 0.07% to 216.16 points. The differentiation was also reflected in the capitalization-based indices: VS-LargeCap fell 0.7%, VS-MicroCap fell 0.78%, while VS-MidCap rose 0.2%, indicating that some mid-cap stocks are attracting cash flow.

Witnessing the adjustment pressure on the VN30 basket. The market breadth leaned towards the downside with 25 falling stocks, while only 3 stocks rose and 2 stocks stayed at the reference price. The stocks with the most positive impact were HDB, contributing 0.42 points, GVR with 0.08 points, and BVH with 0.04 points. Conversely, the group of stocks exerting the strongest downward pressure was VIC with 2.25 points, VHM with 1.86 points, HPG with 1.27 points, and FPT with 1.13 points. The downward trend is currently dominant in the mid-session.

Source: VietstockFinance

|

Looking at the overall picture of the sectors, the market is under significant pressure from the consumer services group, which fell 2.77%. Large-cap sectors also could not escape the negative trend: Real estate fell 0.93%, credit institutions fell 0.58%, and financial services fell 0.72%.

On the other hand, some sectors remained in the green, notably media and entertainment, up 1.35%, and insurance, up 0.78%. Transport also recorded a gain of 0.42%.

Specifically, the credit institution group (accounting for 29.84% of market capitalization) fell 0.58% across the sector, with many large-cap stocks still under selling pressure. Typical codes include TCB down 0.66%, MBB down 0.81%, VPB down 0.55%, CTG down 0.54%, STB down 1.20%…

Real estate (accounting for 15.82% of market capitalization) fell 0.93%. Codes such as NVL fell 0.96%, DXG fell 2.44%, KBC fell 1.93%, PDR fell 1.34%, TDC fell 1.87%, and LHG fell 1.84%.

The food, beverage, and tobacco industry (accounting for 8.96% of market capitalization) fell 0.31%. Notable codes include VNM down 0.60% and MSN down 0.14%.

In contrast, transportation (accounting for 7.23% of market capitalization) had a positive performance, up 0.42%. Code PHP fell 0.27%, but other codes in the industry may be supporting the overall uptrend, such as VOS hitting the ceiling price, GMD up 3%, VSC up 0.23%…

As of 10:30 am, the market breadth was clearly differentiated. Notably, more than 1,000 codes stood still, indicating a prevailing wait-and-see attitude. The buying side recorded 17 ceiling-hitting codes, 228 rising codes. Conversely, there were 335 falling codes and 6 floor-hitting codes reflecting the existing selling pressure.

Source: VietstockFinance

|

Opening: Cautious sentiment prevailed at the beginning of the session

Today’s trading session opened with a positive market picture, with most of the main indices recording gains. Although the VN-Index rose slightly, the indices on the HNX and UPCoM exchanges broke out impressively, reflecting the spread of cash flow to mid- and small-cap stocks. The VN-Index opened up 0.03% to 1,314.89 points, indicating a cautious start for the overall market. Meanwhile, the HNX-Index performed more strongly, rising 0.31% to 216.99 points.

The VN30 basket started with a dominant red tone. The market breadth showed 18 falling stocks, outnumbering 11 rising stocks and 1 stock holding the reference price. On the supportive side of the index, HDB made the most positive contribution with 0.50 points of influence, followed by VNM with 0.37 points, SHB contributing 0.22 points, and VPB contributing 0.13 points. In contrast, the main pressure came from large-cap stocks. HPG was the most negative influencing factor, reducing 1.01 points, followed by VIC down 0.81 points, MWG down 0.64 points, and STB down 0.58 points. This development reflects the cautious sentiment at the beginning of the session.

Overall, the stock market recorded a 0.21% increase across 1,613 trading codes. Sectors with large capitalization contributions such as credit institutions (accounting for 29.84% of market capitalization) maintained a slight increase of 0.10%, indicating the stability of this pillar group. In contrast, the real estate sector, with 15.82% of market capitalization, recorded a 0.12% decrease in the sector index. However, many large-cap and liquid real estate stocks rose, including VHM up 1.02%, VIC up 1.08%, TCH up 1.33%, NVL up 0.40%, KBC up 0.57%, and PDR up 0.62%. This shows a clear differentiation within the industry.

Some other sectors stood out with positive momentum, including media and entertainment, up 5.60%, specialized services and trading, up 2.34%, and consumer and decorative goods, up 1.20%. In the consumer and decorative goods industry, codes such as GEE, up 2.46%, and GEX, up 2.67%, contributed significantly to the industry’s overall increase. The transportation sector also recorded a gain of 0.60%, with code HAH, up 1.14%, as a bright spot. The software industry, with FPT up 0.51%, also showed stable growth.

As of 9:30 am, the stock market opened with a clear differentiation. Notably, there were up to 1,146 codes standing at the reference price, indicating a prevailing cautious sentiment. However, the number of rising codes outnumbered the falling codes, with 294 green codes and 13 ceiling-hitting codes, while only 156 red codes and 3 floor-hitting codes. This reflects positive signals from the market breadth.

However, after 9:30 am, selling pressure started to increase, and the VN-Index fell by more than 25 points at one point, recovering to a loss of 15 points as of 9:50 am.

“Market Trends Analysis for May 26: Uncertainty Prevails”

The VN-Index and HNX-Index experienced a tug-of-war session in the morning trade, with a significant spike in liquidity, indicating investors’ cautious sentiment.

Expert Take: Stock-Picking Opportunities Wane as Cash Takes a Cautious Stance Ahead of Trade Talks Outcome

Let me know if you would like me to make any changes or modifications to this title.

The divergence among stocks may become more pronounced this week, as the lack of fresh supportive news may lead to a further distinction between strong and weak stocks. With limited positive catalysts, the ability to identify robust stocks becomes increasingly crucial, and cautious capital deployment is expected.

‘The Privileged Few’: A Tale of Stock Market Privilege

Mr. Nguyen Trong Minh, the son of former Ha Do Group’s Chairman, Nguyen Trong Thong, is planning to purchase 4 million HDG shares, amounting to over a hundred billion VND. Meanwhile, Mr. Le Viet Hieu, the son of Le Viet Hai – the Chairman of Hoa Binh Construction Group – will be investing approximately 3 billion VND to acquire 500,000 HBC shares.