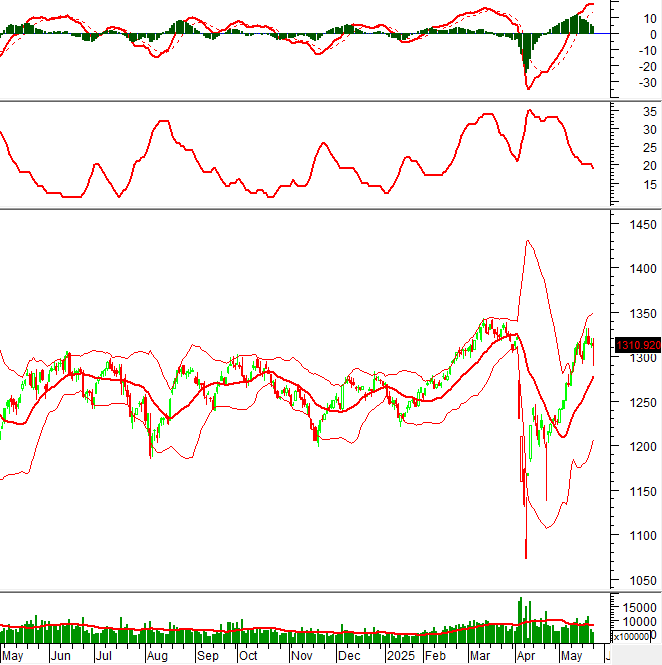

Technical Signals for VN-Index

During the morning trading session of May 26, 2025, the VN-Index witnessed a decline, and volume is expected to surpass the 20-day average by the end of the day, indicating a somewhat negative sentiment among investors.

Currently, the index continues to fluctuate and sits above the Middle line, while the Bollinger Bands are narrowing (Bollinger Squeeze). Meanwhile, the ADX indicator is moving within the gray area (20 < ADX < 25)

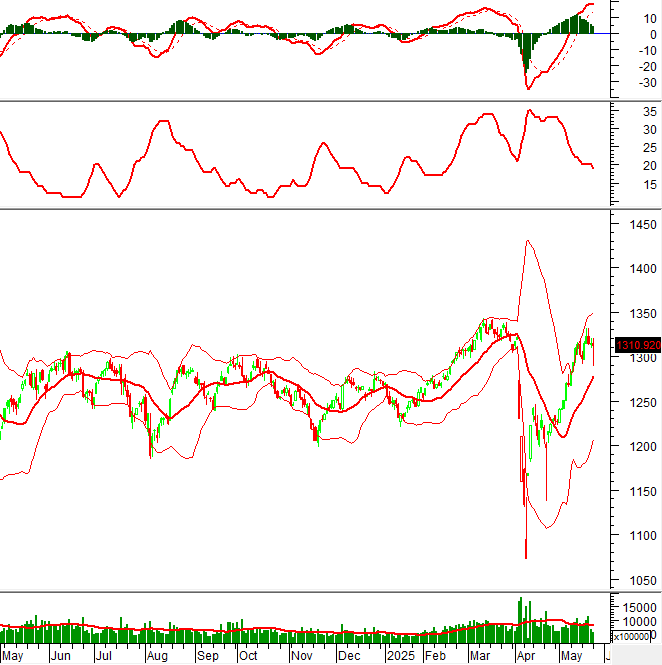

Technical Signals for HNX-Index

On May 26, 2025, the HNX-Index rose, forming a Doji-like candle, while trading volume surged in the morning session, reflecting investors’ uncertainty.

Additionally, the Stochastic Oscillator has dropped out of the overbought zone after previously signaling a sell-off. The index is approaching the 38.2% Fibonacci Retracement level (corresponding to the 211-215 point range). This paints a rather pessimistic picture for the upcoming sessions if the HNX-Index loses this support.

GMD – Gemadept Joint Stock Company

The appearance of a long green candle on May 23, 2025, and the MACD reversal suggest that a sell signal is not yet present, indicating a reduction in short-term risks.

On a positive note, trading volume for GMD shares shows signs of recovery and may surpass the 20-day average.

With the price breaking above the 50-day SMA, the long-term uptrend is reasserting itself.

VPB – Vietnam Prosperity Joint Stock Commercial Bank

The price underwent significant volatility, but dip-buying emerged swiftly during sharp declines, keeping the price above the mid-term MAs.

The Relative Strength indicator remains above the 20-day average, signifying that VPB is outperforming the broader market.

VPB’s near-term objective is the 20,000-21,000 range (equivalent to the October 2024 peak)

Technical Analysis Department, Vietstock Consulting

– 12:08, May 26, 2025

Expert Take: Stock-Picking Opportunities Wane as Cash Takes a Cautious Stance Ahead of Trade Talks Outcome

Let me know if you would like me to make any changes or modifications to this title.

The divergence among stocks may become more pronounced this week, as the lack of fresh supportive news may lead to a further distinction between strong and weak stocks. With limited positive catalysts, the ability to identify robust stocks becomes increasingly crucial, and cautious capital deployment is expected.

‘The Privileged Few’: A Tale of Stock Market Privilege

Mr. Nguyen Trong Minh, the son of former Ha Do Group’s Chairman, Nguyen Trong Thong, is planning to purchase 4 million HDG shares, amounting to over a hundred billion VND. Meanwhile, Mr. Le Viet Hieu, the son of Le Viet Hai – the Chairman of Hoa Binh Construction Group – will be investing approximately 3 billion VND to acquire 500,000 HBC shares.

The Capital is Calling: Over $73 Million Raised Last Week

The domestic institutional investors went on a buying spree, netting a purchase of 1,777.6 billion VND, with a remarkable 1,060.5 billion VND in matched orders alone.