“Net Interest Margin (NIM) Plunge in Q1 2025: Structural and Cyclical Factors at Play”

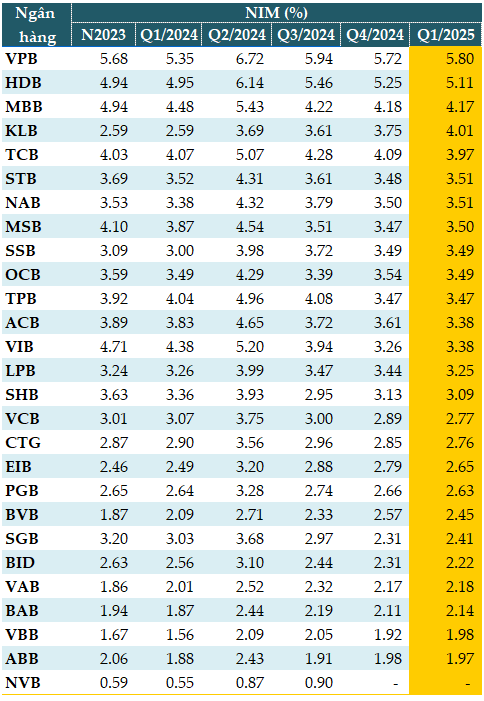

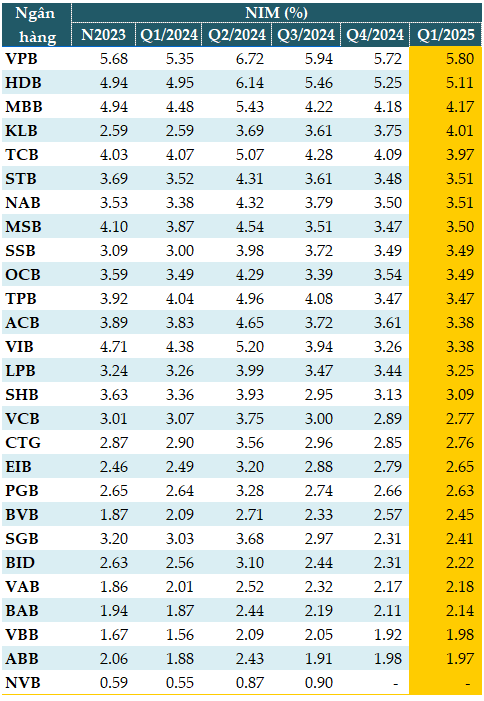

Net interest margin (NIM) witnessed a notable decline in Q1 2025, as per VietstockFinance data. The average NIM of 27 banks stood at 3.09%, down from 3.11% in Q4 2024. Among these, 15 banks experienced a drop in their NIM compared to the previous quarter.

VPBank boasted the highest NIM at 5.8%, followed by HDBank (HDB) at 5.11%, MB (MBB) at 4.17%, Kienlongbank (KLB) at 4.01%, and Techcombank (TCB) at 3.97%.

|

NIM performance of banks in Q1 2025

Source: VietstockFinance

|

This decline in NIM can be attributed to a combination of structural and cyclical factors, including accommodative monetary policies, system-wide competition, and subdued credit growth.

Between 2024 and early 2025, the State Bank of Vietnam (SBV) implemented rate cuts to stimulate economic recovery and boost credit growth. Commercial banks had to adjust their lending rates downwards to stay competitive, while deposit rates, or the cost of funds, adjusted slower due to the pressure of retaining depositors. This narrowing of the interest rate spread between lending and deposit rates resulted in a decline in NIM.

Although credit growth picked up in Q1 2025, it fell short of expectations as businesses remained cautious and households reduced consumer loans amid weak income recovery and defensive psychology. The low loan-to-deposit ratio (LDR) meant that interest-earning assets were not optimized, leading to a decrease in NIM as interest-earning assets declined while funding costs remained fixed.

The shift in credit structure towards safer and lower-yield segments also played a role. To manage risks, many banks focused on lending to large corporates, industrial real estate, or government bonds—all of which offer lower profit margins. Additionally, an increase in concessional loans (social housing, recovery support) further contributed to the downward pressure on NIM.

The intense competition among small and medium-sized banks to attract deposits drove up funding costs. At the same time, to attract customers, banks had to lower lending rates, squeezing profit margins. Furthermore, the reliance of Vietnamese banks on net interest income (70-80%) and the modest income from fees, insurance, and investments have collectively failed to alleviate the pressure on NIM.

Heading into Q2, will NIM recover?

According to Mr.

If public investment disbursement and consumer spending pick up, credit demand will likely increase, especially during the mid-year tourism and production peak seasons. This will boost income from interest-earning assets, supporting NIM. Additionally, short-term deposit rates are expected to follow the downward trend set by the accommodative monetary policy. Should inflation remain under control, banks will be able to optimize funding costs.

There is also an opportunity to increase income from services, with some banks focusing on bancassurance, cards, and digital banking, potentially improving NFI (Net Fee Income) and reducing reliance on NIM. However, the recovery in NIM may not be uniform across the industry and is faced with challenges.

The economy still faces uncertainties, such as weak export recovery due to US countervailing duties and subdued domestic consumption. The potential for hidden bad debts remains high, forcing banks to increase loan loss provisions and eroding profits, despite any NIM gains.

Moreover, a report by SSI Research, published on May 7, 2025, forecasts two significant factors that will influence the NIM trajectory of banks. Firstly, the changing competitive landscape in the event of escalating trade tensions. Should trade tensions escalate, the FDI segment—a stronghold for state-owned commercial banks with their CASA and USD funding advantage—is expected to come under pressure. In this scenario, the capital advantage of state-owned banks may be partially affected, narrowing the funding cost gap between these banks and large joint-stock commercial banks.

Secondly, the end of promotional interest rates for home loans. A wave of promotional lending rates for home purchases started around Q3 2023 and peaked in mid-2024. These loans typically offer promotional rates for 1-3 years. As these promotional periods end, starting from late 2025, NIM could recover, especially for banks like BID, CTG, TCB, MBB, and ACB, as loans shift from fixed to floating rates.

Navigating uncertainty: Strategies for NIM improvement

While there are expectations for a gradual NIM improvement towards the end of the year, the current environment is fraught with uncertainties, and escalating trade tensions could reshape the business landscape and competitive dynamics within the industry.

Banks should focus on restructuring their credit portfolios and optimizing interest-earning assets. This involves shifting towards higher-yield segments like SME lending, retail, and consumer lending, coupled with enhanced risk management practices (improved credit scoring and AI-powered lending). Reducing exposure to low-yield assets like government bonds and reinvesting in higher-NIM assets is also advisable.

Boosting CASA (non-term deposits) through digital banking expansion, salary accounts, free transaction accounts, and convenient banking apps can help. Increasing the proportion of short-term, low-cost funding for medium to long-term lending can also improve NIM. Investing in digital banking and ecosystem services will reduce reliance on NIM as fee income rises. The “bank-as-a-platform” model will enhance customer retention, lower funding costs, and facilitate cross-selling.

Controlling operating expenses will improve the cost-to-income ratio (CIR), enhancing overall efficiency. While increasing loan loss provisions is necessary, proactive classification will prevent significant losses down the line, preserving long-term profit margins. As Mr. Huy highlights, NIM is no longer the sole determinant of bank profitability. In this new era, profits will stem from “capability margins,” driven by technology, risk management prowess, and innovative thinking.

– 08:10 26/05/2025

The Fed is in a Bind: Walking the Tightrope of Interest Rates

From the beginning of the year to mid-April 2025, the average lending interest rates for new transactions of commercial banks decreased by 0.6 percentage points compared to the end of 2024. This move has provided a much-needed respite for businesses by alleviating the pressure of capital costs in production and trading activities, thereby fostering economic growth.

The Evolution of China’s Banking Strategy and Lessons for Vietnam

The Chinese banking system has undergone a strategic transformation over the past decade. Moving away from a model reliant on large-scale credit growth, fueled by real estate lending and state-owned enterprise loans, the industry has embraced a new paradigm. This paradigm shift involves a comprehensive approach to finance, diversifying revenue streams, and embracing digital transformation. This evolution reflects a conscious effort to adapt to the demands of risk management, improved operational efficiency, and sustained growth.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)