From May 1–7, Decree 94/2025/ND-CP on the regulatory sandbox mechanism in the banking sector, including peer-to-peer (P2P) lending activities, will officially take effect. This is considered a significant milestone in bringing online lending activities within a legal framework in Vietnam.

Following the reflection of Báo Người Lao Động on the urgent need to control the online lending sector as per Decree 94, our reporters continue to capture insights from international experts to find effective solutions for implementing the P2P lending model.

Mr. Heng Lee, Head of Government Affairs and Public Policy for the Asia Pacific region at Kaspersky, a global cybersecurity company, opined that bringing the P2P lending model within a regulatory sandbox will enhance financial inclusion. Individuals with no credit history or difficulty accessing loans from traditional banks will have improved financial opportunities, thus fostering financial comprehensiveness.

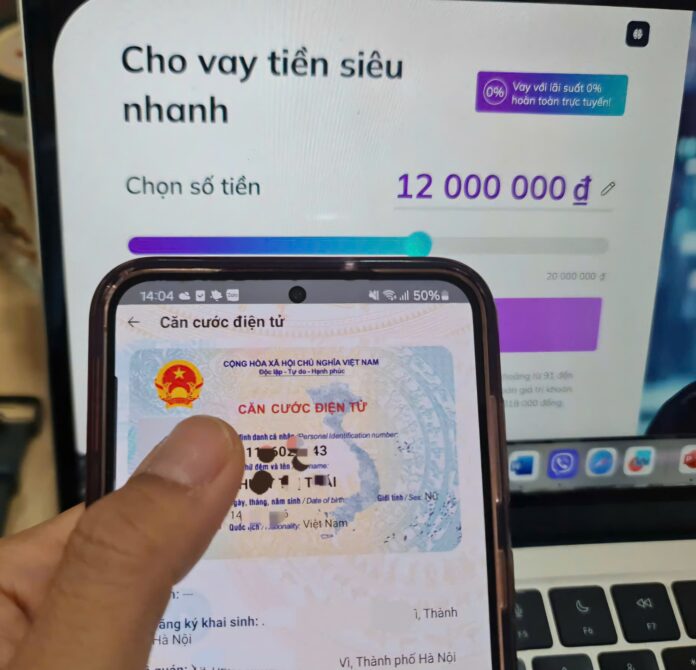

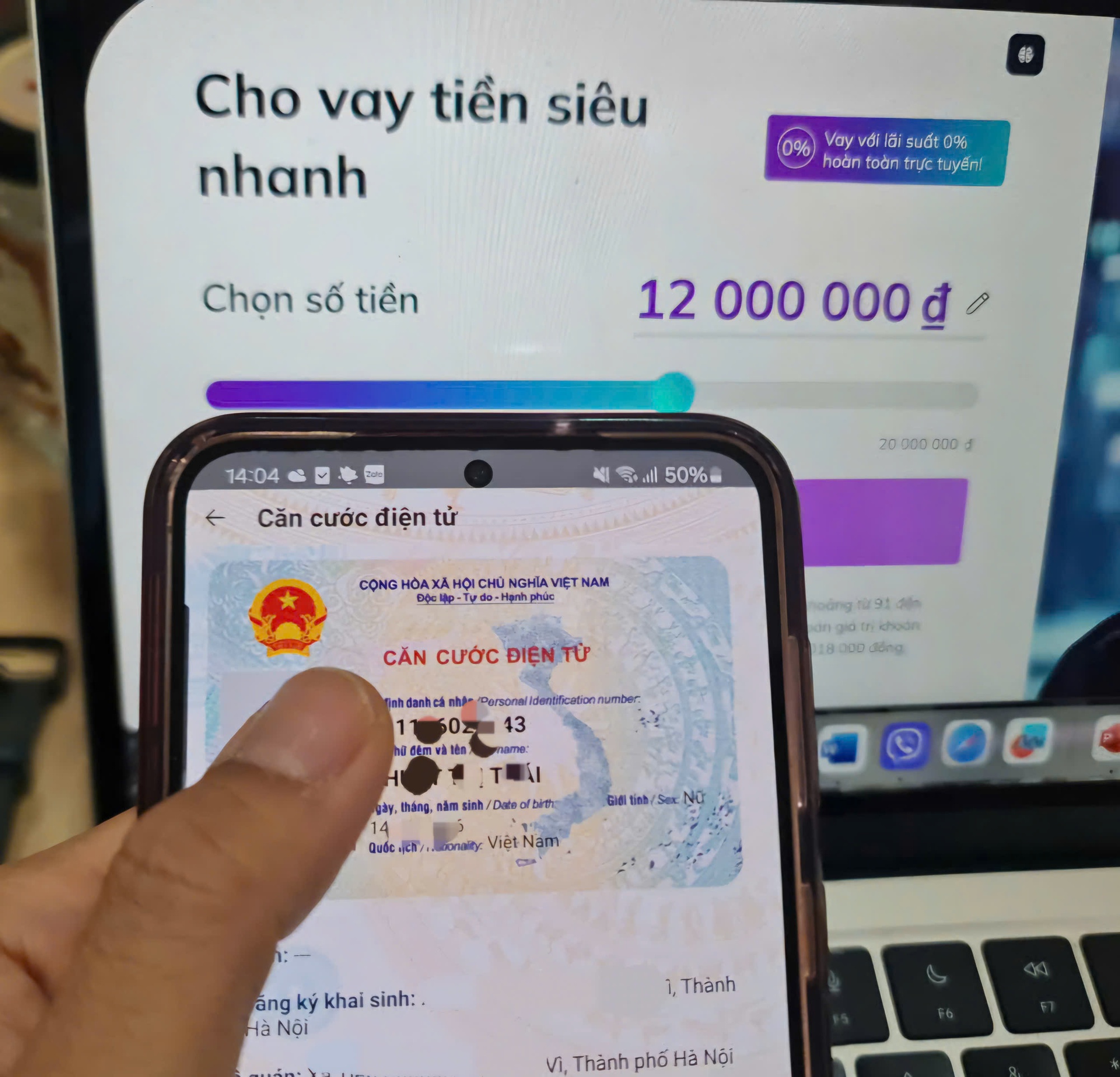

Online lending emerged in Vietnam from 2018 to 2019 and then exploded during the COVID-19 pandemic. A plethora of simple lending apps with exorbitant interest rates have caused numerous negative consequences.

According to Mr. Hang Lee, Vietnam’s P2P lending market started to emerge during 2018–2019 and exploded during the COVID-19 pandemic. However, along with its rapid growth came a slew of negative consequences as numerous lending apps with simple procedures but usurious interest rates proliferated. Many companies lacked adequate investment in critical departments like finance, accounting, legal, and cybersecurity, leading to serious risks for borrowers.

Therefore, Decree 94 is a notable step forward in establishing a legal framework and paving the way for modern financial technology solutions, particularly P2P lending activities. However, he also cautioned about concerning issues in this model, notably debt collection practices and user data handling.

In reality, many lending platforms collect data not only from borrowers but also from their personal connections. This increases the risk of sensitive data leakage, leading to harassment, privacy invasion, and public discontent. The regulatory sandbox phase under Decree 94 will provide the government with an opportunity to assess actual risks and establish a robust legal framework that matches the pace of digital finance development.

Although the P2P lending model in Vietnam allows borrowers and lenders to transact directly through a technological platform, it is not yet recognized as a formal financial institution. Companies operating in this field function under a separate mechanism, distinct from the traditional banking system, despite supervision from the State Bank.

From an enterprise perspective, Mr. Tran The Vinh, CEO of Tima – one of the first platforms in Vietnam to operate under the P2P lending model – believes that to ensure the healthy development of this model and prevent it from becoming a cover for loan sharks, enhanced supervision and tighter management are necessary.

According to him, authorities should establish regular inspection mechanisms, especially regarding interest rates, credit assessment procedures, and the protection of users’ personal information.

In the opinion of experts and enterprises, Vietnam’s first legal framework for testing P2P lending activities will provide an essential foundation for businesses to confidently invest and deploy products within a legal safe zone. It will also contribute to the purification of the rapidly growing consumer finance market.

Peer-to-Peer Lending: Navigating the Risks

The government has recently introduced a new decree, 94/2025/ND-CP, which outlines a controlled experimentation framework for the banking sector, coming into force on July 1st, 2025. Peer-to-peer lending, or P2P lending, is one of the key areas that will undergo this innovative regulatory sandbox approach.

Crafting Bankers with Heart, Vision, and a Nation’s Aspirations

Over half a century ago, President Ho Chi Minh, with his visionary foresight, laid down not just professional standards but also fundamental ethical principles for the banking sector. His teachings serve not only as a reminder but also as a guiding light for the industry as it strives to build a humane, efficient, and people-centric financial system.

Unlocking the Power of Cashless Transactions: Accelerating Financial Inclusion

Cashless payments are an integral part of the financial inclusion agenda. When effectively implemented and scaled, this initiative can serve as a powerful catalyst for the robust development of financial inclusion, aligning with the overarching policy goals.