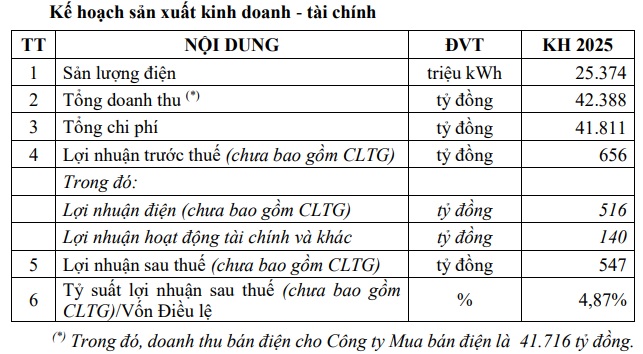

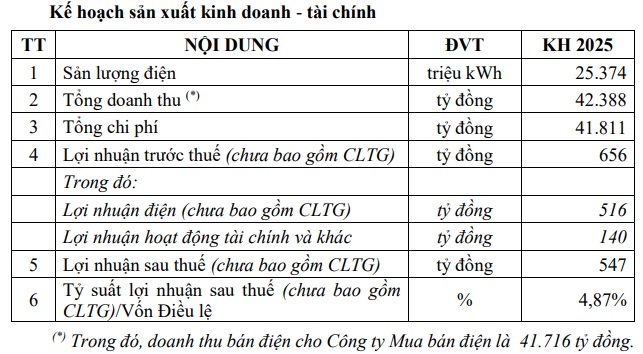

EVNGENCO3 aims for a total consolidated revenue of nearly VND 42.4 trillion, a 7% increase from the previous year. The after-tax profit plan is to achieve VND 547 billion, a 12% increase. The electricity output plan is to reach more than 25.4 billion kWh, an 8.6% increase.

However, it is important to note that this plan pertains only to the parent company, and the figures do not include foreign exchange rate losses. In 2024, EVNGENCO3 incurred an after-tax loss of VND 786 billion due to foreign exchange losses (over VND 1.3 trillion). The 12% growth target is relative to the profit excluding exchange rate losses in 2024 (VND 489 billion, nearly 150% higher than the set plan).

Source: PGV

|

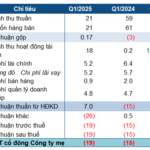

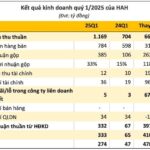

In the first quarter of 2025, PGV recorded a consolidated revenue of VND 10.6 trillion, a 10% increase compared to the same period last year; net profit of over VND 96 billion, a significant recovery from a loss of VND 655 billion in the previous year.

Regarding capital plans, the company will propose to the AGM an amount of nearly VND 5.6 trillion, including more than VND 5.3 trillion for loan principal repayment and over VND 278 billion for net investment.

To achieve these goals, PGV has outlined several strategies. In terms of electricity production, PGV will closely coordinate with PV GAS to prioritize the maximum allocation of domestic gas for power generation and receive re-gasified LNG according to signed contracts. Additionally, the company will implement plans to purchase re-gasified LNG for operation during 2025-2026 and the long term, ensuring fuel supply to increase electricity production at Phu My Power Plants and meet the rising load demands of the power system.

For coal-fired power plants, PGV will prioritize coal delivery from contracted suppliers, closely monitor electricity supply, and flexibly adjust the coal delivery plan according to the dispatch of the plants, ensuring sufficient coal for electricity production and minimum inventory as per regulations.

In terms of construction investment, PGV aims to complete the final settlement for the following projects in 2025: Thai Binh Thermal Power Plant, Vinh Tan 4 and Vinh Tan 4 Expansion; Expansion of the Vinh Tan 2 Coal Warehouse Roof Project (Phase 2).

For the Vinh Tan Central Thermal Power Center Port Project, PGV will submit to the competent authorities and follow the directions of the major shareholder, EVN, to commence construction and dredging for 100,000 DWT vessels after Binh Thuan Province approves the adjustment of the Hon Cau conservation area and hands over the sea area.

Additionally, PGV has listed 16 power projects with a total capacity of nearly 6,460 MW to be implemented from 2027 to 2031. The largest projects include the Ninh Binh 2 Flexible Thermal Power Plant (1,200 MW) and the Long Son LNG Power Plant (1,500 MW), expected to be operational in 2030 and 2030-2031, respectively.

Notably, PGV will add several business lines, including non-hazardous waste treatment and recycling of scrap to handle ash and slag at Vinh Tan 2 Thermal Power Plant. The company will also venture into commodities and securities brokerage and management consulting to facilitate the brokering, consulting, and management of direct power purchase agreements (DPPA) for renewable energy projects.

The 2025 AGM of PGV is scheduled for 8:30 am on June 10, 2025, at Lotte Hotel Saigon, Ton Duc Thang Street, Ben Nghe Ward, District 1, Ho Chi Minh City.

– 15:58 26/05/2025

A Garment Business Prioritizes Salary Expenses, Reducing Over 900 Employees After 18 Years

Once boasting a workforce of nearly 1,100 employees at its privatization, Thanh Tri Garment JSC now has fewer than 150 staff members. The company has recently adjusted its plans for the use of proceeds from a private placement, opting to allocate funds towards paying salaries for the third quarter of 2025 instead of upgrading its factory as initially intended.

“Shareholder Meeting: Considering Multiple Payment Installments to Regain the Phuoc Kien Project”

At the 2025 Annual General Meeting held on the afternoon of May 17th, JSC Quoc Cuong Gia Lai (HOSE: QCG) will propose to its shareholders a target of VND 300 billion in pre-tax profit, a figure that is second only to the years 2010 and 2017, along with a record-breaking revenue. Most surprisingly, the company is proposing to change its name after more than 30 years of operation.