Over 204.8 million shares of DSC officially began trading on the HOSE on October 24, 2024, with a reference price of VND 22,500 per share. On the same day, HOSE issued a notice adding DSC to the list of stocks with restricted margin trading, due to its listing period being less than six months.

As of May 23, 2025, DSC has met the minimum listing period requirement and has been granted margin trading privileges again. With DSC‘s removal, the list of stocks with restricted margin trading on HOSE includes 67 securities.

On May 23, DSC announced two resolutions approved by the Board of Directors, authorizing the company to obtain credit limits totaling VND 1,314 billion. This includes VND 714 billion from the Vietnam Prosperity Joint-Stock Commercial Bank (PGBank) and VND 600 billion from Asia Commercial Joint Stock Bank (ACB).

The credit limit from PGBank will be used for investing and trading government bonds, including guaranteed bonds, and for proprietary trading. The credit facility has a term of 12 months from the date of the loan agreement, with interest rates specified for each drawdown.

Meanwhile, the loan from ACB will be utilized for working capital purposes, such as salary payments, utility bills, and investments in government bonds, as well as for margin trading and investments in other financial instruments. The credit facility has a term until May 11, 2026, with interest rates agreed upon with ACB for each period, and is secured by the company’s financial assets.

In terms of capital raising, on April 24, 2025, DSC‘s Board of Directors resolved to issue a maximum of 75 million new shares, including shares to be issued from equity sources and shares to be offered to existing shareholders at a price of VND 10,000 per share, all of which are freely transferable.

The issuances are planned for the 2025-2026 period or other times as approved by the State Securities Commission. With this move, the company aims to increase its charter capital from VND 2,048 billion to VND 2,800 billion. The proceeds will be used to supplement margin trading and proprietary trading activities, as well as investments in government bonds, certificates of deposit, and other financial instruments.

In terms of business results, in the first quarter of 2025, DSC reported a pre-tax profit of over VND 67 billion, a 10% decrease compared to the same period last year, mainly due to lower proprietary trading profits and heavier losses in the brokerage segment, despite a 20% growth in lending activity profits. Finally, the company posted a net profit of nearly VND 54 billion, a 9% decrease.

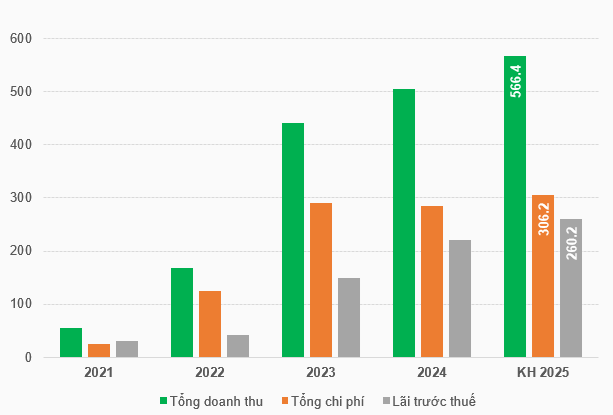

Compared to the full-year pre-tax profit target of over VND 260 billion approved at the recent Annual General Meeting of Shareholders, the company has achieved approximately 26% of the target. The business plan for this year includes unprecedented figures in the history of DSC‘s operations.

|

Financial performance over the years and 2025 plan for DSC

Unit: Billion VND

Source: VietstockFinance

|

– 10:28, May 26, 2025

“Late Disclosure: Vosco Reminded to Speed Up Information Release”

“Vosco has been issued a reminder by HoSE for its delay in disclosing information regarding the resolution of the Board of Directors on transactions valued at over 10% of the company’s total assets. The exchange urges the company to promptly announce such vital information to maintain transparency and ensure compliance with regulatory requirements.”

The Viconship Group Raises Stake to 13.18% in Port Haiphong

From May 20 to 22, Viconship and its two subsidiaries continued to purchase a significant number of HAH shares, bringing their total ownership to 17.11 million HAH shares, representing a substantial 13.18% stake in Hai An Port and Shipping Joint Stock Company.