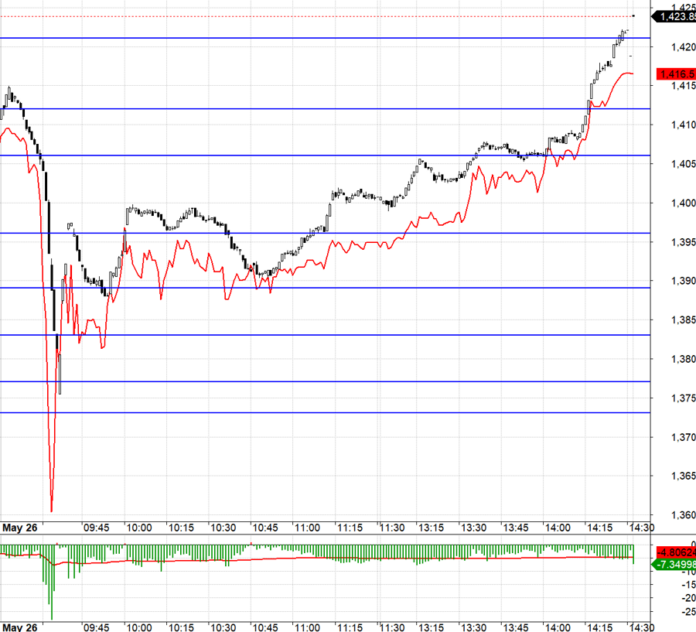

This could be the effect of a typical defensive strategy. If one intends to dump a large number of stocks and is certain that such selling will cause the index to crash, they might choose to short beforehand and then cover to compensate for the loss incurred due to the drop in stock prices. Approximately five minutes before the futures market experienced a sudden decline, F1 exhibited only a slight fluctuation of -0.24%, with 10.7k contracts traded.

Numerous large-cap stocks witnessed steep declines around this time, although they lagged by a beat compared to the fluctuations in the derivatives market. For instance, VIC also experienced selling pressure but it was delayed by about two minutes, with the lowest price dipping 6.45% from the reference price, and the bottom occurring five minutes later than the futures market. VHM’s lowest decline of 4.51% was also delayed by three minutes. TCB, VPB, and CTG likewise formed their bottoms five to six minutes later…

During this brief period of chaos, as many as 19 stocks in the VN30 basket witnessed declines exceeding 2%. The entire HSX floor saw approximately 150 tickers experiencing similar intensity declines, with their bottoms forming around the same time. This was an extremely strong movement, with VN30 plunging nearly 35 points. The HSX breadth also underwent significant fluctuations: at 9:30 AM, there were 128 gainers and 99 losers, but by 9:37 AM, this shifted to 50 gainers and 233 losers.

In general, the cause of this “flash crash” is less significant than its consequences. The market only experienced intense volatility for a brief period, as there was no sustained pressure. In reality, while stocks took slightly longer to bottom out compared to the index, they also rebounded swiftly. Within about seven minutes surrounding the bottom, HSX traded 44.8 million shares.

After the initial bottom formation around 9:35 AM, the market rebounded and then retreated to form a second bottom at 9:53 AM. Many stocks also established a second bottom—often at a higher level—during this period. This time, buying pressure was more robust, not only supporting prices but also gradually pushing them higher, resulting in a substantial increase in overall liquidity. This indicated that the sudden drop stimulated bottom-fishing funds. Even with just a single down day, prices had already discounted significantly from the previous week. Overall, HSX and HNX matched nearly VND 22,600 billion, which is impressive, especially after the unexpectedly dull session last Friday.

The pattern of declining first and then rising, while maintaining high prices until the end of the session, is positive, reflecting the buying power and price-sustaining capacity of the funds. By nature, adjustments involve shifting stock holdings and exchanging expectations, so they don’t necessarily have to be rhythmic or prolonged. Of course, a single session like today doesn’t reveal much, and liquidity wasn’t exceptionally high like the session on April 22nd. If the market continues to remain calm in terms of news, it will soon cool down again. Therefore, bottom-fishing today is fine, but there’s no need to be overly excited or experience FOMO if you missed the opportunity.

Today, the futures market witnessed substantial volatility, but the most dramatic movement occurred too swiftly to be manageable for short positions. However, it was possible to capture the long side. VN30 plunged to its lowest point of 1374.06 during the crash, very close to the anticipated support level of 1373.xx. Nonetheless, this segment was challenging due to the powerful covering force that caused basis inversion. The more stable phase for going long was the two bottoms around 1389.xx for VN30, where the basis discount was advantageous. It’s crucial to monitor the buying surplus of the pillars, guarding against a repeat of the crash scenario. A large buying surplus coupled with a slow or normal trading pace is ideal because even if there is selling pressure, it will take time for the selling side to push prices through the levels where dense buy orders are stacked.

Subsequently, the market warmed up, purportedly due to rumors about the discussed tax rates. Regardless of the authenticity of these rumors, the issue itself is insignificant. Following the dizzying shake-up, sentiments seemed to stabilize, even leaning towards excitement. The sweet spot for F1 ranged from 1398.xx to 1406.xx for VN30. Regardless of the number of long positions held, at least half of them should have been closed at 1406.xx. VHM and numerous pillars only witnessed significant upward momentum after 2 PM, but that was merely a stroke of luck rather than a predictable outcome. If one bets on uncertain scenarios, it should only be with a small portion of their capital.

VN30 closed today at 1423.85. The nearest resistances for tomorrow are 1426; 1436; 1442; 1447; 1452; 1459; 1464; 1473. Supports are at 1416; 1407; 1398; 1385; 1377.

“Stock Market Blog” reflects the personal perspective of the investor and does not represent the views of VnEconomy. The opinions and assessments expressed are solely those of the investor, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the published investment views and opinions.

“Market Movers: Navigating the Volatile Terrain”

The VN-Index staged a surprising turnaround, surging higher at the end of the trading session after a shaky start. This bullish sentiment was further validated by the trading volume, which surpassed the 20-day average, indicating a significant influx of capital.

Market Beat: Afternoon Surge, VN-Index Soars Over 18 Points

The trading session concluded on a positive note, with the VN-Index climbing 18.05 points (+1.37%) to reach 1,332.51, while the HNX-Index gained 3.09 points (+1.43%), closing at 219.41. The market breadth tilted in favor of advancers, with 509 gainers versus 216 decliners. A dominant blue hue was observed in the VN30 basket, as 21 stocks advanced, 4 retreated, and 5 remained unchanged.

The Expert’s Take: A Tactical Pause is a Prelude to the Next Wave

Short-term investors need to exercise caution and adopt a prudent stance. It is wise to maintain a sensible equity allocation and refrain from chasing stocks that have already surged.

Market Pulse for May 26: A Tale of Two Markets as Real Estate Sector Steals the Show

The market remained volatile and highly divided during the morning session. By the midday break, the VN-Index had shed 3.54 points, settling at 1,310.92. Conversely, the HNX-Index rebounded into positive territory, edging up 0.11% to 216.55. The market breadth was relatively balanced, with 314 decliners outweighing 300 advancers.