TCSC plans to conduct the offering in 2025, with all the offered shares being unrestricted transfer shares.

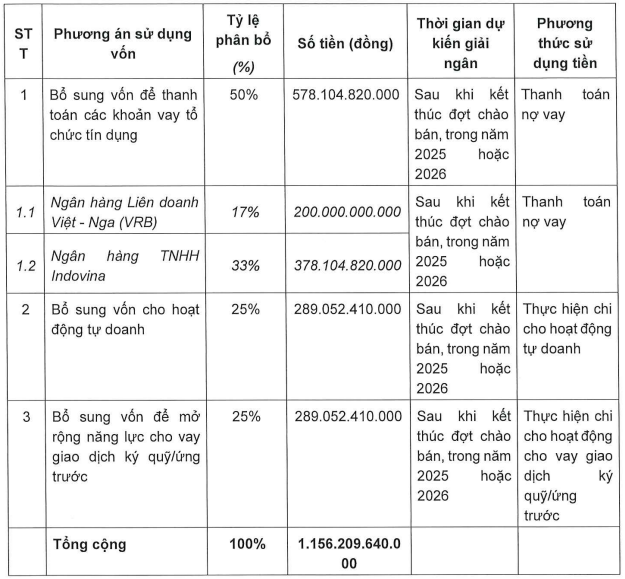

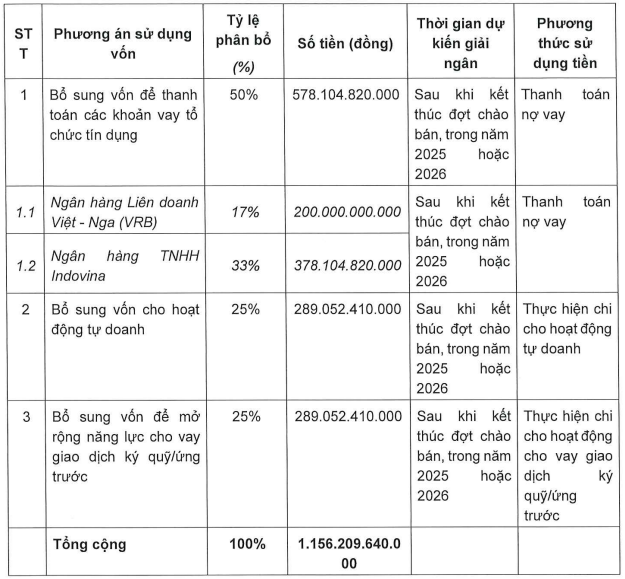

At a price of 10,000 VND per share, TCSC expects to raise over VND 1,156 billion, half of which will be used to repay loans at the Vietnam-Russia Joint Stock Bank (VRB) and Indovina Bank Limited, and the rest will be split evenly between proprietary trading and lending for margin trading/pre-contract lending.

|

TCSC’s capital usage plan

Source: TCSC

|

The share offering plan is one of the important contents that was approved at the company’s 2025 Annual General Meeting of Shareholders. In addition, the company also plans to privately offer 70 million shares to Pavo Capital Hong Kong Limited, a strategic investor, in 2025, raising VND 700 billion.

Regarding this year’s business plan, the general meeting approved a revenue target of nearly VND 277 billion, pre-tax profit of VND 125 billion, and after-tax profit of VND 100 billion – a 76% increase compared to 2024 and the highest in the past four years.

To optimize operational efficiency, the company will transfer 100% of its capital in Fund Management Success (TCAM) to its parent company, SG3 Group (SGI), at a price not lower than the book value at the time of transfer.

The 2025 business plan is not based on a capital increase scenario

At the meeting, TCSC representatives emphasized that the 2025 revenue and after-tax profit targets are based on a scenario that does not include a capital increase, as the timing of the completion of the capital increase is unknown.

“Assuming that the capital increase is completed as expected by the end of Q3 2025 and the capital is actually utilized in Q4 2025, the approximately VND 1,850 billion in proceeds is expected to contribute 2-3% to profit in the last quarter. This expectation is based on the fact that 50% of the proceeds will be used to repay loans, helping the company save on interest expenses, and 25% will be used for margin lending, which will also generate good profits” – TCSC representative

The remaining 25% will be allocated to proprietary trading activities, however, TCSC’s management did not elaborate further as it is difficult to predict.

TCSC’s management sharing at the 2025 Annual General Meeting of Shareholders

|

In fact, after the end of Q1 2025, the company earned nearly VND 24 billion in after-tax profit, up 11% over the same period last year, equivalent to nearly 24% of the yearly plan.

| TCSC’s after-tax profit in recent quarters |

– 15:28 26/05/2025

“Thủy Tiên Faces Multi-Million Dollar Loss Two Months After Becoming a Major Shareholder in Vietravel”

Our company is proud to announce that we are offering an exclusive opportunity to our valued shareholders. We are releasing nearly 28.7 million shares, priced at VND 12,000 per share, presenting a potential windfall of up to VND 344 billion. This is your chance to be a part of our thriving business and share in our success. Don’t miss out on this exclusive opportunity to invest in our future ventures and growth strategies.

“City Auto’s Shareholder Meeting: Foraying into Electric Vehicles, Electing Chairman’s Son to the Board”

At the 2025 Annual General Meeting held on the morning of May 20, City Auto Joint Stock Company (HOSE: CTF) unveiled several new strategic orientations. Notably, the company announced its plans to expand into the electric vehicle sector and its ambition to move deeper into the automotive value chain, aiming to transcend its traditional role as a mere distributor.

Revolutionizing Travel Experiences: Vietravel’s Strategic Fundraising Endeavor to Settle Outstanding Debts

On May 7, Vietravel, a leading travel and transportation marketing company in Vietnam, announced its plans to offer nearly 28.7 million shares to the public. The company, traded on the UPCoM exchange under the ticker symbol VTR, aims to raise approximately VND 344 billion to repay its bank loans.