The market witnessed a wide range of fluctuations on Monday as the VN-Index witnessed a dramatic turnaround, recovering to gain 18.05 points after initially plunging by nearly 26 points. This was the most significant movement since April 22nd, and the impact of bottom-fishing funds was notable.

A key highlight of this impressive recovery was the breadth of participation, with mid and small-cap stocks leading the way. While the VN30-Index remained in negative territory until late in the morning session, with only 5 gainers and 25 decliners, the broader VN-Index showed more resilience, with 134 gainers versus 155 losers.

As the afternoon session progressed, the market breadth turned positive, and by 1:15 pm, the number of advancing and declining stocks had balanced out, even though the VN-Index had not yet returned to the reference level. By 2 pm, the advancers had taken the lead, with 169 gainers versus 132 decliners. Some blue chips, such as VHM and TCB, were still hovering around the reference price, while MSN and CTG remained in negative territory.

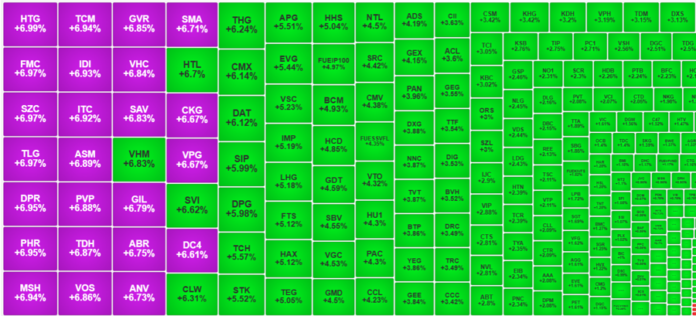

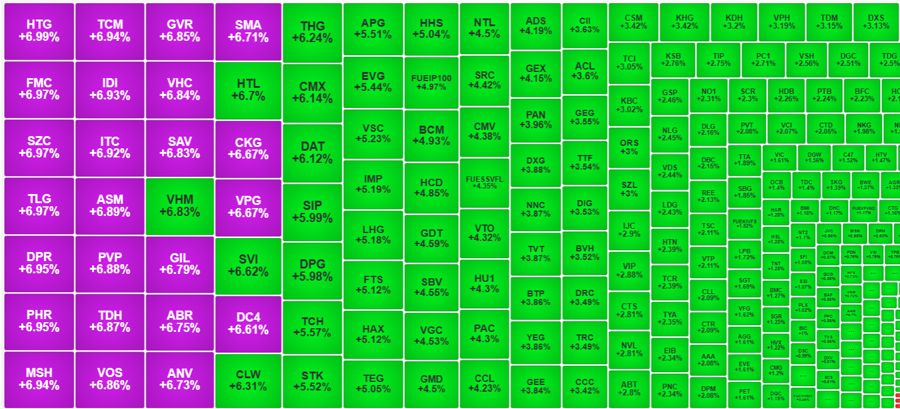

However, when the blue chips collectively reversed course and turned positive, the VN-Index’s upward momentum became truly remarkable. From 2 pm onwards, the index surged by nearly 16 points, contributing to the day’s total gain of 18.05 points. The session ended with a strong market breadth of 229 gainers versus 72 losers.

This phenomenon of market breadth leading the index highlights that the price volatility was more pronounced and rapid among mid and small-cap stocks compared to their larger counterparts. The Midcap index closed 2.06% higher, while the Smallcap index rose by 1.94%. In contrast, the VN30-Index, representing the largest stocks, gained 1.03%, and the broader VN-Index rose by 1.37%. Notably, only one stock from the VN30 index, GVR, reached the maximum daily price limit, while 24 stocks on the HoSE exchange hit their upper circuit breakers.

One of the catalysts for the market’s rebound in the afternoon was unconfirmed news about potential tariff negotiations. Although the third round of talks had not yet commenced, the speculation sparked a strong psychological boost. Many stocks in the textile and seafood industries surged to their daily price limits, including HTG, TCM, MSH, FMC, VHC, and ANV. Additionally, SZC, PHR, PDR, and VOS also witnessed strong buying interest, with their prices rising to the maximum daily limit on higher-than-average trading volumes.

The inflow of funds into mid and small-cap stocks was notable, with trading volumes in the Midcap and Smallcap baskets increasing by 43% and 69%, respectively, compared to the previous session. Out of the additional trading value on the HoSE exchange, amounting to approximately VND 6,327 billion, the VN30 basket contributed VND 2,489 billion, or roughly 39%, while the remaining volume was attributed to mid and small-cap stocks.

The buying pressure outside of the blue-chip stocks was remarkable, with 130 stocks on the HoSE exchange rising by more than 2% during this session. In comparison, only five stocks in the VN30 index showed similar gains. However, only three of these stocks, VHM, HDB, and GVR, exhibited high trading volumes. In contrast, dozens of stocks in the other two categories recorded trading values of hundreds of billions of VND each, including GEX, CII, VSC, NVL, DXG, EIB, KBC, and DIG, all surpassing VND 300 billion. The trading volume of these stocks, which rose by more than 2%, accounted for 46.2% of the total HoSE exchange volume, excluding nearly 50 other stocks that rose within the 1-2% range.

While the mid and small-cap stocks benefited from the VN-Index’s upward momentum, the blue chips were the true architects of the sharp climb towards the session’s close. VHM, for instance, hovered around the reference price until 2:12 pm before breaking out. Within just over 15 minutes, VHM soared from VND 69,000 to VND 73,000 and eventually closed at VND 73,500, a 6.83% increase from the reference price, just one step away from the maximum daily limit. VHM alone contributed 4.5 points to the VN-Index and 6.7 points to the VN30-Index.

Many other blue chips also staged impressive recoveries during the latter half of the afternoon session. The VN30 index, which ended the morning session with only 5 gainers and 25 losers, saw all but ACB turn positive by the close, with 10 stocks rising by more than 1% compared to the reference price. Notably, BCM jumped by 4.58%, closing 4.93% higher. GVR hit the daily limit, rising by 3.22%. MSN reversed earlier losses to climb 2.08%, while PLX ended 1.02% higher. VIC also displayed strength, reversing a 2.27% loss to close 1.61% higher.

Another positive signal was the rebound in overall trading volume across the two exchanges, which increased by 41% compared to the previous Friday’s session, reaching VND 22,577 billion excluding block trades. This swift recovery in trading volume followed a sudden drop in the previous session.

Foreign investors also reversed their net selling position in the afternoon session, buying a net of VND 307.4 billion worth of stocks after net selling VND 341.4 billion in the morning. As a result, their net position for the day was not significant. Notable stocks that attracted net buying included VHM (VND 148.3 billion), VSC (VND 51.5 billion), DIG (VND 38.4 billion), IMP (VND 27.2 billion), VPB (VND 26.7 billion), KBC (VND 23.6 billion), GVR (VND 23.3 billion), and NLG (VND 22.4 billion). On the net selling side, VIX (-VND 92.4 billion), VCG (-VND 69.3 billion), GEX (-VND 56.8 billion), HPG (-VND 52.7 billion), FPT (-VND 39.7 billion), VRE (-VND 33.9 billion), TDM (-VND 33.9 billion), and NVL (-VND 33.7 billion) saw outflows.

Stock Market Blog: Flash Crash Stimulates Bottom-Fishing?

Today’s market movement was characterized by a swift crash that occurred within a 2-minute window around 9:30 am in the derivatives market. It took the underlying market a good 5 minutes to react strongly to this development. Over 11,200 contracts changed hands during this intense 2-minute period, marking a significant turning point in the day’s events.

“Market Movers: Navigating the Volatile Terrain”

The VN-Index staged a surprising turnaround, surging higher at the end of the trading session after a shaky start. This bullish sentiment was further validated by the trading volume, which surpassed the 20-day average, indicating a significant influx of capital.

Market Beat: Afternoon Surge, VN-Index Soars Over 18 Points

The trading session concluded on a positive note, with the VN-Index climbing 18.05 points (+1.37%) to reach 1,332.51, while the HNX-Index gained 3.09 points (+1.43%), closing at 219.41. The market breadth tilted in favor of advancers, with 509 gainers versus 216 decliners. A dominant blue hue was observed in the VN30 basket, as 21 stocks advanced, 4 retreated, and 5 remained unchanged.

What’s Capturing the Attention of Stock Investors?

The VN-Index is inching closer to its 2025 peak after three consecutive weeks of gains. The looming profit-taking pressure could trigger short-term market volatility. Next week, investors’ eyes will be glued to news of potential tariff negotiation support between Vietnam and the US, which could provide a fresh impetus for the market.