The Vietnamese beer industry faced challenges in the first quarter of 2025, amid the pandemic and restrictive regulations. According to Mirae Asset Securities, citing Euromonitor report, the market is dominated by four major players: Heineken, Sabeco (SAB), Carlsberg, and Habeco (BHN), collectively holding over 90% market share. Among them, SAB and BHN are listed on the Vietnamese stock exchange.

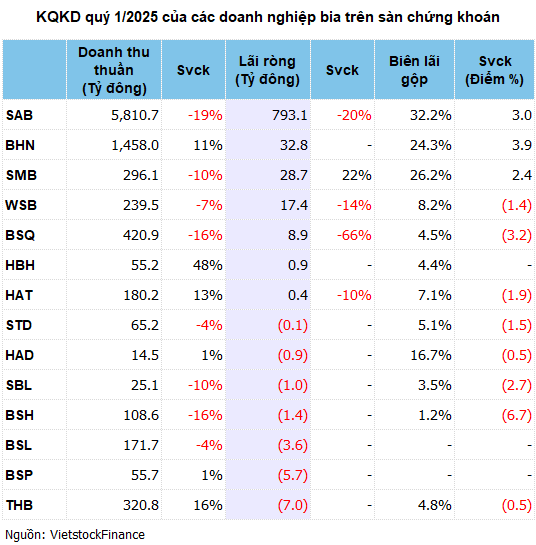

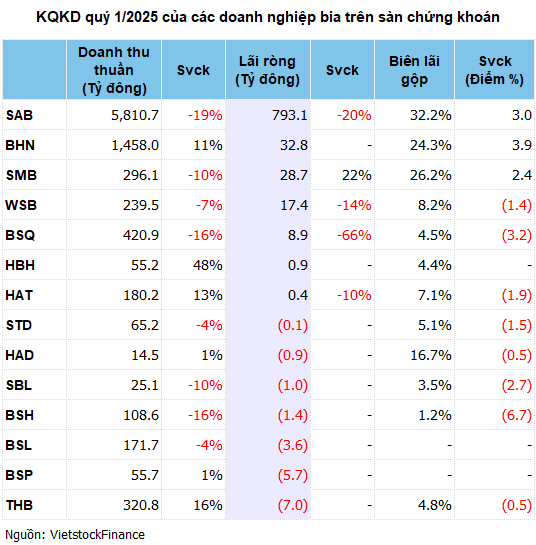

Data from VietstockFinance revealed a noticeable dichotomy in the financial performance of 14 listed beer companies during this period, with a widespread decline in profits. The group’s total revenue exceeded VND 9,200 billion, a 12% drop from the previous year. Despite a 1.5-percentage-point increase in the average gross profit margin to 25.8%, the industry’s net profit fell by 18%, amounting to VND 862.5 billion. This reflects intensifying competition and challenges in cost management.

Contrasting performances of southern and northern leaders

The dichotomy in financial results was most evident between the southern and northern representatives, Sabeco and Habeco. Sabeco (SAB) maintained its industry leadership, contributing 53% to the group’s total revenue on the stock exchange, with VND 5,811 billion in the first quarter of 2025, a 19% decrease year-over-year. Net profit reached VND 793 billion, accounting for 92% of the group’s total profit, despite a 20% drop—the lowest in 14 quarters since the fourth quarter of 2021. Nonetheless, Sabeco’s gross profit margin improved to 32.2%, the highest in the past ten quarters.

| Sabeco’s Quarterly Financial Results from 2022 to 2025 |

The company attributed the decline in performance to heightened competition, the impact of Decree No. 168/2024/ND-CP, and changes in special consumption tax calculations following the successful consolidation of Sabibeco as a subsidiary from January 3, 2025. Additionally, income from interest on deposits decreased, while financial and management expenses rose due to the Sabibeco acquisition. After three months, SAB has achieved only 13% of its annual revenue target and 17% of its profit target.

On the other hand, Habeco (BHN) experienced growth in both revenue and profit. BHN’s revenue increased by 11% to VND 1,458 billion, and its net profit reached VND 33 billion, reversing a loss of VND 5.2 billion in the previous year. The gross profit margin also improved from 20.4% to 24.3%. However, compared to the previous quarter, both revenue and profit have declined for the third consecutive quarter, resulting in the lowest performance in the past four quarters. The company has accomplished 20% of its revenue target and 11% of its profit target for the year.

| Habeco’s Revenue and Profit for the Last Five Quarters |

Small businesses show mixed results

Among smaller businesses, results continued to vary. Bia Saigon – Central (SMB), a subsidiary of Sabeco, was one of the few companies that witnessed profit growth, with a 22% increase to nearly VND 29 billion, despite a 10% drop in revenue to VND 296 billion. A significant reduction in cost of goods sold improved the gross profit margin to 26.2%, thanks to efficient management of raw materials and adjustments in product mix. Nonetheless, this remains the lowest quarterly profit for SMB in the last four quarters.

Habeco Haiphong (HBH), a subsidiary of BHN, escaped losses by avoiding selling below cost. Increased production and sales volumes, along with financial income, further contributed to their improved performance.

However, most other small businesses reported concerning results. BSQ experienced a 66% plunge in profits, reaching just under VND 9 billion, while WSB decreased by 14%, landing at VND 17 billion. HAT barely broke even with a profit of VND 384 million, a 10% decline. Notably, 7 out of 14 businesses incurred losses in the first quarter, including THB with a loss of VND 7 billion, BSP with a loss of VND 5.7 billion, and SBL and HAD both losing nearly VND 1 billion. Three other companies turned from profitable to loss-making: BSL (-VND 3.6 billion), BSH (-VND 1.4 billion), and STD (-VND 106 million). A common thread among this group was a significant decline in gross profit margins, indicating that cost pressures remain a significant hurdle for smaller players.

Tax pressures dampen recovery expectations

Despite positive mid-term prospects for the beer industry, underpinned by expected consumption growth of 5-6% per annum due to a young population, rising incomes, and a rebounding tourism sector, the industry confronts long-term challenges. Notably, the proposed amendments to the Law on Special Consumption Tax (SCT), expected to be passed by the National Assembly in May 2025 and take effect from January 1, 2026, include a steep tax hike.

Mirae Asset Securities analysis highlights that SCT on beer in Vietnam has been adjusted four times, rising from 45% to 65% in 2018. Each tax increase led to a 2-3 year period of stagnant consumption. However, the industry has historically recovered after a transition period due to price adjustments and cultural consumption patterns.

Shinhan Vietnam Securities (SSV) estimates a roughly 10% increase in alcohol prices in 2026, followed by additional annual increases of 2-3%. While this may negatively impact short-term demand, the long-term outlook for leading companies remains positive, with room for recovery.

Business adaptation strategies

To navigate the dynamic legal and market landscape, beer companies will need to embrace more flexible strategies. At the 2025 Annual General Meeting of Shareholders, Sabeco’s CEO, Lester Tan, emphasized their focus on a “premiumization” strategy. This approach aims not to directly compete with international brands but to enhance profit margins for each product line through gradual upgrades and alignment with emerging consumer trends.

Regarding the SCT, Sabeco is engaging in dialogue with the Vietnam Beer Alcohol Beverage Association (VBA) and the Ministry of Finance, advocating for a lower tax increase and a longer implementation period. Mr. Tan stated that the company intends to pass on the tax increase to consumers, leading to higher retail prices.

– 10:00 05/26/2025

“Revolutionizing Credit Limits: DSC Secures an Impressive 1.3 Trillion VND Margin Facility”

On May 23, the Ho Chi Minh City Stock Exchange (HOSE) announced the removal of DSC Securities Corporation’s (DSC) shares from the list of ineligible securities for margin trading. On the same day, the company disclosed two board resolutions approving the receipt of credit limits totaling over VND 1,300 billion from two banks.

A Transformational Year for PGBank: Rising to New Heights

In 2025, PGBank aims to build on its transformative progress in 2024 and forge ahead with robust, efficient, and sustainable growth. This ambitious goal will be achieved through a continued focus on process optimization, strategic expansion, vigorous brand-building, and enhancing the customer experience.