The VN-Index closed the 21st trading week of 2025 at 1,314.46 points, a 13.07-point or 1% increase from the previous week, despite a slight drop in trading volume (-4.2%) during the same period.

The average matched trading value on the HOSE reached VND 20,756 billion, 15.8% higher than the 5-week average. In terms of capitalization, liquidity decreased significantly for large-cap stocks in the VN30 index, while mid-cap and small-cap stocks in the VNMID and VNSML indices continued to gain traction.

Analyzing sector performance, liquidity declined in several major sectors, including Banking, Securities, Steel, Food, Information Technology, and Personal Goods. Conversely, Real Estate, Construction, Electrical Equipment, and Aviation maintained improved liquidity, contributing to the upward momentum in these sectors.

Across the three exchanges, the average trading value for the week of 21/2025 reached VND 24,772 billion, with a matched trading value of VND 22,405 billion. This represented a 4.5% decrease from the previous week but remained 12.7% higher than the 5-week average.

In terms of investor participation, foreign investors continued to be net buyers, although the net buying value decreased significantly compared to the previous week, reaching only VND 286.5 billion (based on matched orders only). The sectors that attracted the most foreign investment during week 21 were Banking, Fund Certificates, Retail, Aviation, and Construction.

Breaking down the foreign investor activity, they sold VND 561.2 billion worth of shares but purchased VND 286.5 billion on a matched basis. Their net purchases were focused on the Banking and Financial Services sectors, with the top stocks being FUEVFVND, STB, MBB, VIC, MWG, VIX, HVN, CTG, EIB, and VND.

On the selling side, foreign investors offloaded stocks primarily in the Information Technology sector, with the top stocks being FPT, VHM, VRE, SSI, HCM, MSN, GMD, VPB, and VCB.

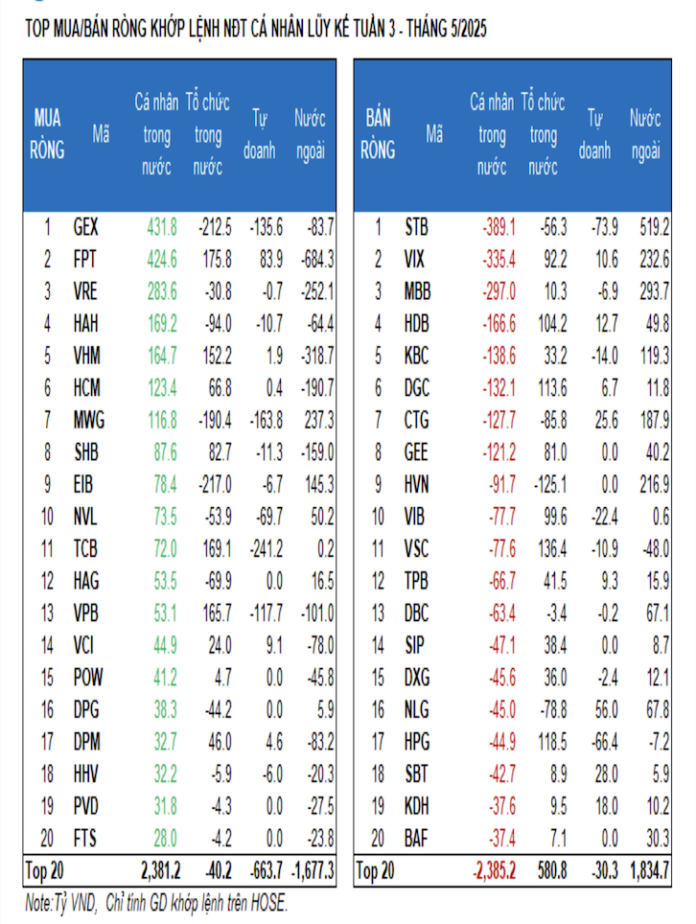

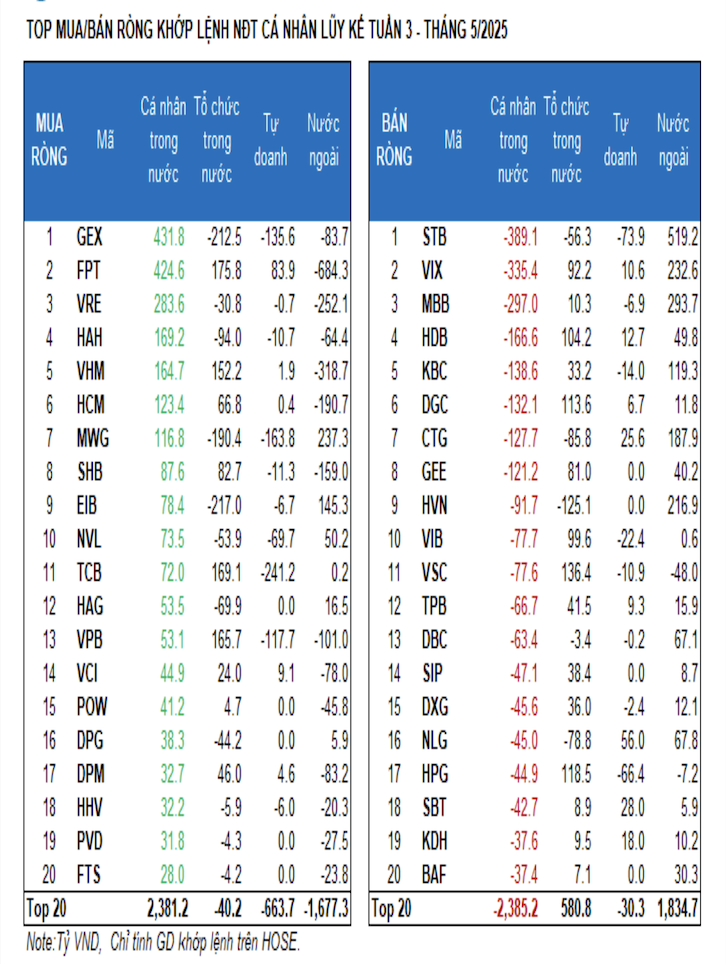

Retail investors sold a net amount of VND 100.2 billion, including VND 224.6 billion in matched transactions. When looking at matched orders only, they were net buyers in 10 out of 18 sectors, mainly in the Industrial Goods & Services sector. Their top purchases included GEX, FPT, VRE, HAH, VHM, HCM, MWG, SHB, EIB, and NVL.

On the selling side, retail investors offloaded stocks in 8 out of 18 sectors, primarily in the Banking and Financial Services sectors. The top stocks they sold included STB, VIX, MBB, HDB, KBC, DGC, GEE, HVN, and VIB.

Proprietary trading arms of securities companies (self-trading) sold a net amount of VND 1,116.3 billion, including VND 1,122.4 billion in matched transactions. Focusing on matched orders, self-trading was net buyers in 6 out of 18 sectors, with the highest net purchases in the Information Technology, Personal & Household Goods sectors. Their top purchases included FPT, PNJ, NLG, SSI, GMD, EIVFVN30, SBT, CTG, FUESSVFL, and REE.

The top stocks they sold were in the Banking sector, including FUEVFVND, TCB, MWG, GEX, VPB, STB, NVL, HPG, VNM, and VCB.

Domestic institutional investors were net buyers to the tune of VND 1,777.6 billion, with net purchases of VND 1,060.5 billion in matched transactions. When considering matched orders only, domestic institutions were net sellers in 6 out of 18 sectors, with the highest net selling value in the Retail sector. Their top sales included VIC, EIB, GEX, MWG, HVN, VND, HAH, VCG, CTG, and NLG.

In terms of net purchases, the Banking sector led the way, with the top stocks being SS1, FPT, TCB, VPB, MSN, VHM, VSC, HPG, DGC, and HDB.

Analyzing the capital flow by sector, there was an increase in capital allocation towards Real Estate, Construction, Electrical Equipment, Aviation, and Building Materials sectors, while a decrease was observed in Banking, Information Technology, Steel, and Retail sectors. The allocation remained stable in the Securities and Food sectors.

From a capitalization perspective, liquidity decreased significantly for large-cap stocks in the VN30 index, while mid-cap and small-cap stocks in the VNMID and VNSML indices witnessed improved liquidity.

Looking at the weekly capital flow by capitalization, the large-cap VN30 index accounted for 49.3% of the total matched trading value in the market, down from the 5-week high of 56.4% in week 20. Conversely, the mid-cap VNMID and small-cap VNSML indices saw their capital allocation ratios increase to 38.2% and 7.6%, respectively, thanks to improved liquidity.

In terms of trading value (based on matched orders only), the VN30 index witnessed a significant decrease of VND 1,951 billion, or 16%, compared to the previous week, due to less active trading in Banking stocks. However, the VN30 index still outperformed with a gain of 1.8%, driven by the Vingroup trio (VIC, VHM, and VRE).

Meanwhile, the mid-cap VNMID and small-cap VNSML indices experienced liquidity increases of 10% and 5.8%, respectively, but this failed to translate into price momentum during the week. The VNMID and VNSML indices recorded modest gains of 0.64% and 0.74%, respectively.

The Flow of Funds: Is the Market Still Poised for a Breakthrough at the Old Peak?

The experts’ cautious sentiment was evident as the leading stock group showed signs of fatigue. Indeed, the VN-Index last week was heavily influenced by the pair of stocks VIC and VHM, which rose 12.4% and 10.8%, respectively. These two stocks alone contributed a significant 34.9 points to the index’s total weekly gain of 13.07 points.

The Tax Cut Beneficiaries: Unveiling the Businesses Set to Thrive

As per the Balanced Scorecard (BSC), the government will accelerate the disbursement of public investment in expressway and railway projects, as well as aggressively pursue energy and oil and gas ventures. Furthermore, policies supporting consumption, tourism, and visa exemptions will be promoted to stimulate economic growth and development.

“VIX Brokerage Aims for 1.8X Profit Growth in 2025”

On May 23, 2025, the Annual General Meeting of Shareholders of VIX Securities Joint Stock Company (VIX) approved an ambitious profit target, aiming for an 180% increase compared to the previous year’s performance. VIX attributes this bold growth strategy to its focus on high-quality human resources and cutting-edge technology as the key pillars for success in the coming year.

The Stock Code Surprise: Brokers’ Proprietary Trading Desk “Accumulating” Heavily on Friday

The proprietary trading arms of securities companies were net buyers to the tune of VND188 billion on the Ho Chi Minh Stock Exchange (HoSE).