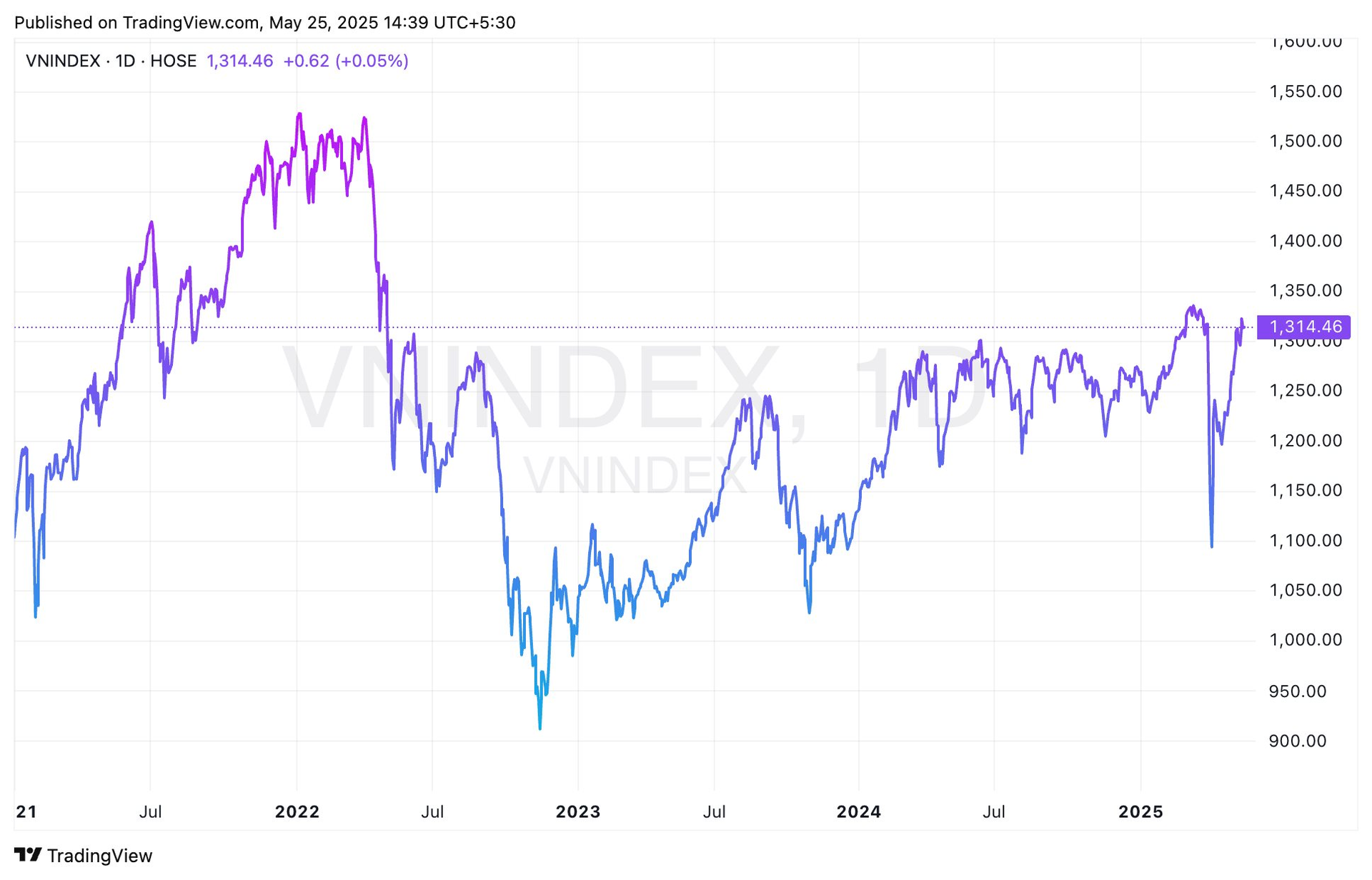

The stock market opened the week of May 19-23 with positive gains. The upward momentum cooled off in the last two sessions as profit-taking pressure returned at the 1,320-1,340 resistance level. At the week’s close, the VN-Index rose a total of 1.4% to 1,314.5. Foreign exchange trading was a downside, with a net sell-off of 779 billion VND across the market.

Most experts expressed relatively cautious views about the market. Investors are advised not to be overly negative but to refrain from new purchases during this period.

Caution is advised ahead of increased profit-taking pressure

According to Mr. Dinh Quang Hinh, Head of Macro and Market Strategy, VNDIRECT Analysis Division, after retreating to the 1,290-1,300 support zone in the second session, the VN-INDEX showed a positive recovery trend in the mid-week sessions. The recovery was led by positive signals in trade negotiations between Vietnam and the United States. As a result, at the end of the second round of talks, Vietnam and the United States made some positive progress, identifying groups of issues where consensus has been reached and groups of issues that need further discussion to reach agreement in the future. The two sides also pointed out the contents that need to be further negotiated in the third round of talks in early June. These moves raise hopes that Vietnam could reach a more favorable tax deal within the next 45 days.

Mr. Hinh said that next week, the 1,320-1,340 resistance zone remains a big challenge, as it is the peak zone since the beginning of the year. The market is entering a “blank” period of supportive information after the first-quarter business results and the 2025 shareholders’ meeting. With the Vietnam-US trade negotiations taking place in early June, the VN-Index may move sideways in the 1,290-1,340 range to absorb profit-taking pressure and wait for new signals.

Mr. Hinh advised short-term investors to switch to a “cautious” state, maintain a reasonable stock proportion, and refrain from new purchases with codes that have risen sharply. In the medium and long term, the VNDirect expert expects breakthrough policies to promote the private sector from Resolution 68-NQ/TW and Resolution 198/2025/QH15, which have just been issued, will promote comprehensive reform and significantly improve the business environment in Vietnam. This will be a great driving force for the Vietnamese stock market in the medium and long term.

A correction may occur

In the view of Mr. Nguyen Tan Phong, Analyst at Pinetree Securities, the VN-Index continued to gain for a week, fluctuating around the 1,314-point mark, returning to the level before US President Donald Trump announced the countervailing tax. However, cash flow was extremely polarized, focusing on a few groups of stocks such as the Vingroup, GEX, and some midcap stocks. Therefore, although the score continued to rise, most of the investors’ portfolios in the market were not positive and even decreased compared to the previous week.

With the news that US President Donald Trump will re-impose a 50% tax on EU products and 25% on Apple products if they are not produced in the US at the end of the week, the expert pointed out that there is a high possibility that the market will correct from the beginning of next week.

Technically, the VN-Index is following the MA9 line and is likely to hover around the 1,300-point mark next week and, if negative, could fall back to test the 127x support mark.

According to Pinetree, investors should refrain from new purchases next week but don’t need to be too negative by selling their entire portfolio. After three consecutive weeks of gains, the VN-Index needs to correct to rise sustainably. If, in the coming week, cash flow continues to pour into the VIC group, pulling the VN-Index up, it is likely that in June, when this group of stocks is adjusted, it will put immense pressure on the entire market.

Market Pulse for May 26: A Tale of Two Markets as Real Estate Sector Steals the Show

The market remained volatile and highly divided during the morning session. By the midday break, the VN-Index had shed 3.54 points, settling at 1,310.92. Conversely, the HNX-Index rebounded into positive territory, edging up 0.11% to 216.55. The market breadth was relatively balanced, with 314 decliners outweighing 300 advancers.

Market Beat: The Tug-of-War Begins as Sellers Step In.

The market steadies and shifts to a tug-of-war around the reference point after a sudden surge of selling pressure. VN-Index’s 0.65% dip indicates an impending adjustment, reflecting investor caution amidst unpredictable dynamics.

Expert Take: Stock-Picking Opportunities Wane as Cash Takes a Cautious Stance Ahead of Trade Talks Outcome

Let me know if you would like me to make any changes or modifications to this title.

The divergence among stocks may become more pronounced this week, as the lack of fresh supportive news may lead to a further distinction between strong and weak stocks. With limited positive catalysts, the ability to identify robust stocks becomes increasingly crucial, and cautious capital deployment is expected.

‘The Privileged Few’: A Tale of Stock Market Privilege

Mr. Nguyen Trong Minh, the son of former Ha Do Group’s Chairman, Nguyen Trong Thong, is planning to purchase 4 million HDG shares, amounting to over a hundred billion VND. Meanwhile, Mr. Le Viet Hieu, the son of Le Viet Hai – the Chairman of Hoa Binh Construction Group – will be investing approximately 3 billion VND to acquire 500,000 HBC shares.