According to statistics from the Customs Department, Vietnam’s coffee exports in April 2025 reached 166.6 thousand tons, earning 965.82 million USD. In the first four months of 2025, coffee exports reached 665.8 thousand tons, worth 3.75 billion USD, a decrease of 9.45% in volume but a surge of 51.8% in value compared to the same period in 2024. The average export price of coffee in the first four months of 2025 reached 5646 USD/ton, a whopping 66.61% increase compared to the previous year.

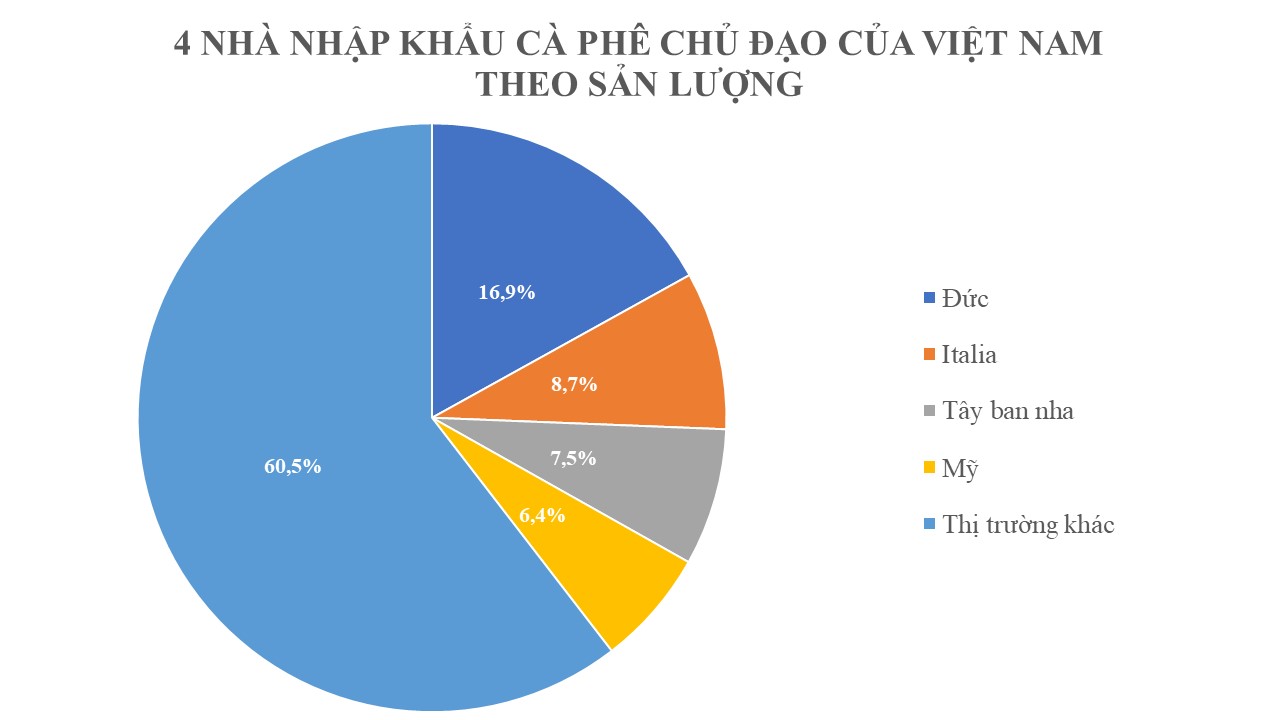

In terms of market performance, Germany, Italy, and Spain were the top three export destinations during this period.

Specifically, Germany imported over 112.8 tons of coffee, with a total value of 628.12 million USD, in the first four months of 2025, marking a nearly 17% increase in volume and a 97.62% surge in value year-on-year. The average price reached 5566 USD/ton, a nearly 67% increase compared to the same period last year.

Similarly, Italy spent more than 307.6 million USD on importing 57.7 thousand tons of coffee, a decrease of 21.7% in volume but a 33.8% increase in value compared to 2024. The average export price reached 5232 USD/ton, a 71.1% surge.

During the same period, exports to Spain reached 50.1 thousand tons, valued at over 292.54 million USD, a decrease of 9.4% in volume but a 51.3% surge in value year-on-year. The average export price reached 5834 USD/ton, a 67.1% increase.

The United States is spending more on importing coffee from Vietnam. In the first four months, the US purchased 42,568 tons of coffee from Vietnam, worth nearly 236.8 million USD, a 6.7% decrease in volume but almost a 56.8% surge in value compared to the previous year. The average export price reached 5562 USD/ton, a 68.1% increase compared to the previous year.

Notably, Mexico stood out with breakthrough growth. In the first four months, Vietnam exported 17,413 tons of coffee to this market, worth nearly 93 million USD. Compared to the same period in 2024, the export volume increased by 2971%, while the value surged by 5412%.

Vietnam is the top supplier of robusta coffee to the US. When considering all coffee types (Arabica, Culi, Cherry, Moka, etc.), Vietnam ranks third as a coffee exporter to the US, after Brazil and Colombia. Since April 9, 2025, the US has imposed a temporary tax of 10% on coffee imports from Vietnam, replacing the previous tax-free policy.

Currently, Vietnamese coffee exported to the US uses HS codes under the 0901 group, depending on the product type. Unroasted coffee beans are coded as 0901.11, roasted coffee as 0901.21, and other products, such as coffee husks, are coded as 0901.90. Proper HS code classification ensures accurate customs procedures and import tax compliance according to US regulations.

In April 2025, coffee prices in Vietnam surged to a record high in many years, ranging from 129,000 to 132,100 VND/kg. This was mainly due to severe droughts in Brazil and the Central Highlands of Vietnam, which reduced production, while production and transportation costs increased. Additionally, global trade tensions and the imposition of import taxes in the US also contributed to the sharp rise in world coffee prices.

The US Department of Agriculture (USDA) lowered its forecast for Vietnam’s coffee crop for the period from October 2024 to September 2025 to 29 million bags (60-kg bags), a 3.65% decrease from its previous estimate. However, the forecast for the 2025-2026 crop year (starting later this year) is expected to increase by 6.9% to 31 million bags, including 30 million bags of Robusta and 1 million bags of Arabica. Additionally, the estimated carryover stock for the new crop is 939,000 bags.

The Shocking Truth About Robusta Coffee Prices

The London Robusta coffee price just witnessed a tumultuous trading session, surging by nearly $300 per ton and catapulting the ‘black gold’ to unprecedented highs.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)