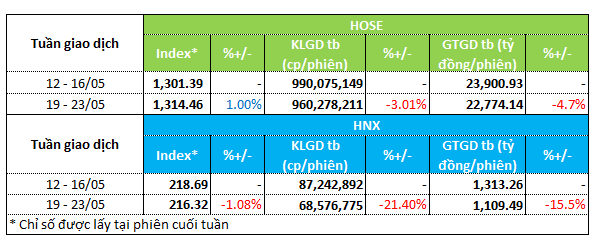

Vietnam’s stock market witnessed contrasting fortunes for its two main indices during the week of May 19-23. The VN-Index rose 1% to 1,314.46, while the HNX-Index fell 1% to 216.32.

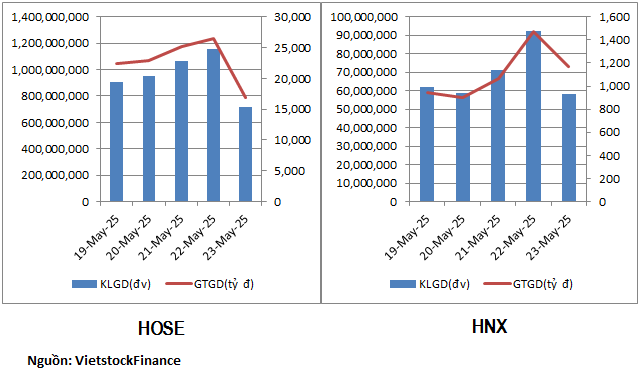

Market liquidity declined on both exchanges. On the HOSE exchange, trading volume fell 3% to 960 million units per session, while trading value dropped nearly 5% to VND22.7 trillion. On the HNX exchange, trading volume fell over 20% to 68.5 million units, and trading value decreased 15.5% to VND1.1 trillion.

|

Market Liquidity Overview for May 19-23

|

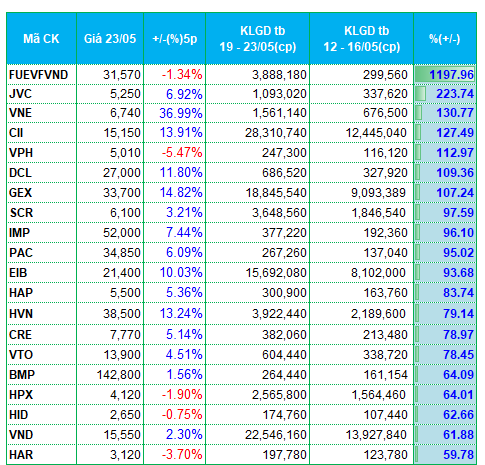

Money flow last week saw a breakthrough in the FUEVFVND fund certificate with a trading volume surge of nearly 1,200% to almost 4 million units per session. However, the market lacked many codes with such strong breakthroughs. Only 8 codes recorded an increase in trading volume of over 100% compared to the previous week.

In terms of sectors, the money flow did not show a clear trend. However, some groups still attracted attention. The real estate group had many representatives attracting money on the HOSE exchange. VPH, CRE, HPX, and HAR recorded liquidity increases ranging from 60% to 110%.

Pharmaceutical stocks, including DCL, IMP, and DVM, as well as plastic stocks such as BMP, NTP, and VTZ, were also among the top gainers in liquidity last week.

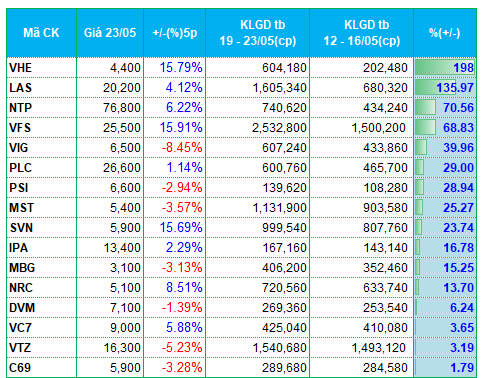

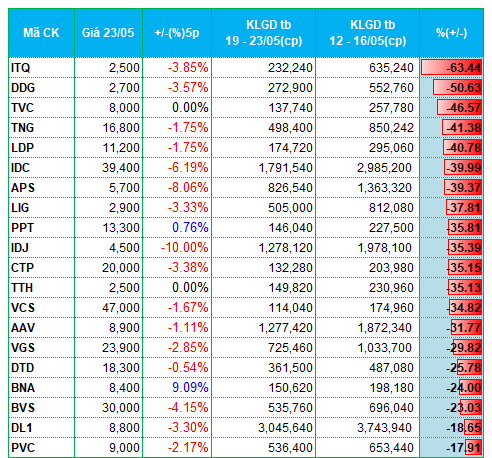

On the HNX exchange, securities stocks were slightly polarized in terms of liquidity. VFS, VIG, and PSI were among the top gainers, while TVC, APS, and BVS saw declines.

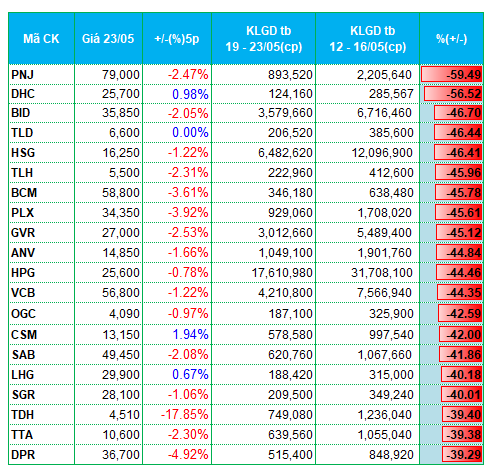

Among the stocks that witnessed a decrease in liquidity were several codes belonging to the steel and industrial real estate sectors. In the steel group, HPG, TLH, HSG, ITQ, and VGS all saw significant declines in trading volume. In the industrial real estate group, BCM, GVR, LHG, and IDC were among the top losers in liquidity.

|

Top 20 codes with the highest liquidity increase/decrease on the HOSE exchange

|

|

Top 20 codes with the highest liquidity increase/decrease on the HNX exchange

|

The list of codes with the highest and lowest liquidity increases/decreases is based on a trading volume of over 100,000 units per session.

– 19:28 26/05/2025

The Bottom Fishers: Small and Mid-Cap Stocks See a Flood of Inbound Cash.

The market witnessed a wild swing on Monday as the VN-Index plummeted by almost 26 points before staging a remarkable recovery to gain 18.05 points. This was the biggest intraday swing since April 22, and the impact of bottom-fishing funds was notable.

Stock Market Blog: Flash Crash Stimulates Bottom-Fishing?

Today’s market movement was characterized by a swift crash that occurred within a 2-minute window around 9:30 am in the derivatives market. It took the underlying market a good 5 minutes to react strongly to this development. Over 11,200 contracts changed hands during this intense 2-minute period, marking a significant turning point in the day’s events.

“VN-Index Revisits Old Peak: Is it Time to Invest or Hold Back?”

“The VN-Index has once again reached the old peak range of 1,320-1,340 points. SHS believes that this is not an attractive price range for further investment.”

Market Beat: Afternoon Surge, VN-Index Soars Over 18 Points

The trading session concluded on a positive note, with the VN-Index climbing 18.05 points (+1.37%) to reach 1,332.51, while the HNX-Index gained 3.09 points (+1.43%), closing at 219.41. The market breadth tilted in favor of advancers, with 509 gainers versus 216 decliners. A dominant blue hue was observed in the VN30 basket, as 21 stocks advanced, 4 retreated, and 5 remained unchanged.