Struggling to Offload Investments

Nguyen Thi My, a real estate investor in Hanoi, shared that in late February 2025, she and a group of investors decided to invest in land in Nam Sach district, Hai Duong province, anticipating a potential merger with Hai Phong which would lead to rising land prices.

My’s group invested in approximately five land plots in the area, each costing VND 2 billion. They have paid VND 5 billion for these plots so far and are due to pay the remaining VND 5 billion by the end of May 2025.

At the time of their investment, land in provinces with potential merger plans was in high demand, and My believed that land in Hai Duong was still affordable and offered potential for price increases. However, the market started cooling down in early April, putting My’s group in a difficult situation as they approach the deadline for full payment.

” We’ve been trying to find buyers for these plots in the past few weeks, but to no avail. If we can’t sell them this week, we’ll have to accept a significant loss to raise funds for the remaining plots “, My said.

Many investors who bought land anticipating provincial mergers are now facing disappointment. (Illustrative image)

Similarly, Nguyen Tuan Linh, a Hanoi-based land investor, shared that at the beginning of March, when merger rumors surfaced, he and his group decided to invest nearly VND 1 billion in two land plots in Phu Tho province, with VND 3 billion borrowed.

” We expected prices to rise quickly and planned to exit within 2-3 months. However, by mid-April, the land fever started to cool down. While prices have remained stable, liquidity has plummeted, leaving us unsure whether to hold on and continue paying interest or cut our losses and sell “, Linh shared.

Market research data also indicates a slowdown in real estate transactions following the provincial merger hype. According to PropertyGuru Vietnam, the real estate market in April 2025 adjusted after a booming March. Specifically, there was an 18% decrease in market interest and a 6% drop in listings.

Land plots saw an 18% decrease, apartments a 20% drop, detached houses a 14% fall, and shophouses a 14% decline. Listings across segments also decreased: land plots by 6%, detached houses by 5%, apartments by 9%, and shophouses by 7%.

In terms of location, Hanoi saw a 18% decrease in property search interest, Ho Chi Minh City a 19% drop, while other provinces across the country recorded an average decrease of 16-20%. Notably, apartments and land plots experienced the sharpest declines, with Hanoi seeing a 23% drop and Ho Chi Minh City a 21% fall.

Investors at Risk of Disappointment

Dinh Minh Tuan, Southern Region Director of PropertyGuru Vietnam, commented that the news of provincial mergers had led to high expectations for infrastructure and economic development, triggering a rush to buy land despite rising prices.

Investors are advised to be cautious as the market cools down. (Illustrative image)

However, following official warnings, investors have become more cautious, awaiting clearer information on legal and administrative planning post-merger. This has resulted in a downward adjustment in transactions and land prices.

Additionally, some investors who misjudged market trends and rushed to offload their investments have contributed to a wave of contract cancellations, negatively impacting the market.

Echoing this sentiment, Pham Duc Toan, CEO of EZ Property, warned that investors who follow rumors may end up buying high and selling low, facing liquidity issues or even having their capital tied up for years.

” Herd mentality and unrealistic expectations can lead to short-term price inflation in the real estate market, but it may take years to recover. Some areas that were expected to benefit from new administrative centers have had to offer deep discounts to improve liquidity. Financial leverage can become a double-edged sword when market trends suddenly shift “, Toan stated.

Vu Cuong Quyet, CEO of Dat Xanh Northern Region, noted that the belief that being close to administrative centers guarantees higher land prices is not always accurate. In reality, these areas mainly cater to civil servants who prioritize tranquility and a solemn atmosphere, which may not attract a large population or boost economic activity. Meanwhile, real estate prices surge in areas with robust economic development, dense population, and convenient transportation.

Looking back at history, Quyet mentioned the case of Ha Tay and Me Linh being merged into Hanoi in 2008. At that time, many expected land prices in Ha Dong, Son Tay, and Me Linh to soar immediately after the merger. However, it took a decade for prices to rise, and the primary drivers were infrastructure development and economic growth.

” Therefore, investors should not have high expectations solely based on administrative mergers. Real estate prices are influenced by economic and infrastructure factors, not just proximity to administrative centers “, Quyet advised.

Assessing the impact of provincial mergers on the real estate market, Tran Quang Trung, Business Development Director of OneHousing, stated that merger news acted as a local market booster. It was a strong “catalyst” that drove investors to rush to buy land. However, without caution, investors could easily get stuck with long-term investments as prices have already exceeded their actual value.

” Focus on liquidity and control financial leverage. Investors should ask themselves: Who will buy? Who will rent? Who will live there? “, Trung recommended.

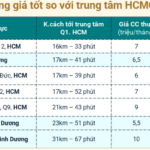

Is There a Post-Merger Exodus to the Outskirts of Ho Chi Minh City?

The merger of Binh Duong with Ho Chi Minh City and Ba Ria – Vung Tau presents a golden opportunity, a pivotal moment in history. This move is expected to spark a wave of robust growth in the real estate sector. Post-merger, a surge in population decongestion towards the outskirts of Ho Chi Minh City is anticipated.

Neglecting Urban Planning Leads to a Two-Decade Wait for Homeowners to Receive Their Property Papers

Introducing the Riva Park 504 Nguyen Tat Thanh, the Tien Hung residential project, and the 9B4 – 9B8 residential project in Binh Hung: once slated for resettlement purposes, these projects have since been released to the market by the developers. However, buyers are still awaiting their pink booklets, which are yet to be issued.

Unveiling the Five-Star Property Experience: A Grand Office Opening and Brand Launch

On May 21, 2025, Five Star Property, a leading real estate company, inaugurated its head office at Home City, 177 Trung Kinh, Cau Giay, Hanoi. This momentous occasion marked the official launch of the Five Star brand and the beginning of its journey to becoming a trusted real estate development and project distribution consultant.

The Soaring Prices of Provincial Land: A Mystifying Phenomenon

Within a span of two months, land prices in Phu My, Ba Ria-Vung Tau province, surged from VND 2.35 billion to VND 2.6 billion, with transactions concluding at VND 2.95 billion per plot.