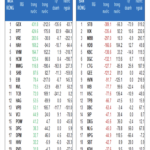

Last week, the VN-Index rose a total of 13.07 points to 1,314.46. In contrast, the HNX-Index fell 2.37 points to 216.32.

On the HoSE, foreign investors sold a net of 4.22 million units, with a net value of over VND 568 billion. On the HNX, foreign investors also sold a net of nearly 9.1 million units, with a net value of over VND 180 billion.

In the Upcom market, foreign investors sold a net of 1.67 million units but were net buyers with a total value of more than VND 26 billion. Thus, in the trading week from May 19-23, foreign investors net sold nearly 15 million units on the entire market, with a corresponding net sale value of over VND 722 billion.

Billions to buy shares

Mr. Nguyen Trong Minh, CEO of Ha Do Group Joint Stock Company (stock code: HDG), registered to buy 4 million HDG shares to increase ownership to 1.4% of charter capital. The transaction is expected to be implemented from May 27 to June 25.

Mr. Nguyen Trong Minh, CEO of Ha Do Group Joint Stock Company. Photo: Mekong Asean.

If calculated at the market price on May 22 of VND 25,900 per share, it is estimated that Nguyen Trong Minh will have to spend about VND 104 billion to buy 4 million HDG shares.

Mr. Minh is the son of Mr. Nguyen Trong Thong, who has just resigned from the position of Chairman of the Board of Directors of HDG since October 3, 2024. Mr. Thong is 72 years old this year and has been the founder and leader of Ha Do Group since the 1990s. Mr. Thong has three children: Nguyen Trong Minh, Nguyen Trong Thuy Van, and Nguyen Trong Van Ha.

In his resignation letter, Mr. Thong stated that due to his age and health, and to ensure compliance with the law on related persons, he wished to resign from the position of Chairman of the Board of Directors and not participate in the Board of Directors of the company. However, Mr. Thong will continue to support and advise the Board of Directors afterward, in his role as Founding Chairman.

Mr. Le Viet Hieu, Vice Chairman of the Board of Directors and Deputy General Director of Hoa Binh Construction Group Joint Stock Company (stock code: HBC), registered to buy 500,000 HBC shares to increase ownership to 1.71 million shares (equivalent to 0.49% of charter capital). The transaction is expected to take place from May 22 to June 20.

If calculated at the market price on May 20 of VND 6,100 per share, it is estimated that Mr. Hieu will spend about VND 3 billion to buy 500,000 HBC shares. From February 19 to May 20, HBC’s market price decreased by nearly 20% from VND 7,600 to VND 6,100 per share. It is known that Mr. Hieu is the son of Mr. Le Viet Hai, Chairman of the Board of Directors of HBC.

Mr. Le Viet Hieu will spend VND 3 billion to buy 500,000 HBC shares.

From April 16 to May 15, Mr. Vo Phi Nhat Huy, Chairman of the Board of Directors of Big Invest Group Joint Stock Company (stock code: BIG), only bought 100,000 BIG shares in the registered purchase of 1 million shares, achieving 10% of the registered volume. After the transaction, Mr. Huy raised his ownership to 17.24% of charter capital.

Explaining the reason for not buying all the registered shares, Mr. Huy said that it was due to unfavorable market conditions. After that, from May 22 to June 20, Mr. Huy continued to register to buy 900,000 shares to increase ownership to 23.2% of charter capital. From December 26, 2024, to May 20, BIG shares decreased by more than 32% from VND 7,400 to VND 5,000 per share.

Increasing ownership

CII Trading and Investment One-Member Limited Company (CII Invest) has just bought an additional 1.83 million NBB shares of Nam Bay Bay Seven Seven Investment Joint Stock Company to increase its ownership to 48.47% of charter capital. The transaction was made from May 20 to 23.

Thus, the group of shareholders, including CII Invest, Ho Chi Minh City Technical Infrastructure Investment Joint Stock Company (stock code: CII), and shareholder Nguyen Quynh Huong, has raised its ownership to 74.92% of NBB’s charter capital.

On May 20 and 21, Vietnam Container Shipping Joint Stock Company (Viconship, stock code: VSC) bought an additional 1,154,200 HAH shares of Hai An Transport and Stevedoring Joint Stock Company to increase its ownership to 10.97% of charter capital.

In addition, from May 20 to 22, Green Port Service One-Member Limited Company bought an additional 496,600 HAH shares to increase its ownership to 1.1% of charter capital. Also, from May 20 to 22, Green Logistics Center One-Member Limited Company bought a total of 383,000 HAH shares to increase its ownership to 1.11% of charter capital.

The CII Group holds 74.92% of NBB’s charter capital.

After the transaction of the 3 companies, Viconship, Green Port Service One-Member Limited Company, and Green Logistics Center One-Member Limited Company, held a total of more than 17.1 million HAH shares, equivalent to 13.18% of charter capital.

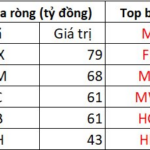

Livzon Pharmaceutical Group Inc. (China) announced the transaction to buy 64.81% of the shares of Imexpharm Pharmaceutical Joint Stock Company (stock code: IMP) through the transfer from 3 units.

The indirect subsidiary of Livzon Pharmaceutical Group and the seller signed an agreement to buy and sell a total of 99,839,990 IMP shares, holding 64.81% of the capital at Imexpharm. Of which, 73,457,880 IMP shares belong to SK Investment, 15,026,784 IMP shares belong to Binh Minh Kim Investment Joint Stock Company, and 11,355,326 IMP shares belong to KBA Investment Joint Stock Company.

The deal value is nearly VND 5,731 billion, equivalent to an average price of VND 57,400 per share. In which, Livzon paid SK Investment more than VND 4,216 billion, Binh Minh Kim nearly VND 863 billion, and KBA Investment nearly VND 652 billion.

After the transaction, Livzon Pharmaceutical Group became the largest shareholder of Imexpharm.

“VN-Index: What’s in Store for the Week Ahead?”

The stock market is heating up, and with it, the pressure on the VN-Index to adjust. In light of this, leading securities companies are advising investors to refrain from buying into the hype and engaging in short-term stock speculation.

The Flow of Funds: Is the Market Still Poised for a Breakthrough at the Old Peak?

The experts’ cautious sentiment was evident as the leading stock group showed signs of fatigue. Indeed, the VN-Index last week was heavily influenced by the pair of stocks VIC and VHM, which rose 12.4% and 10.8%, respectively. These two stocks alone contributed a significant 34.9 points to the index’s total weekly gain of 13.07 points.