Agribank is auctioning off bad debts from multiple companies, with a total book value of over 304.2 billion VND as of March 31, 2025. The debts are secured by land use rights and attached assets in Ha Noi and Vinh Phuc.

Agribank has recently announced the auction of bad debts from several companies, including Hoang Kim Construction Ceramic Trading and Transport Joint Stock Company, TTT Vietnam Development Investment Co., Ltd., and Tu Liem Commercial and General Services Co., Ltd. The total book value of these debts as of March 31, 2025, is approximately 304.2 billion VND, comprising 226.6 billion VND in principal and 77.6 billion VND in interest.

The collateral for these debts includes land use rights and attached assets covering an area of 32,257.90 square meters in Thach Da, Me Linh, Hanoi. The assets also encompass construction works, tunnel kiln production lines, and machinery at the factory in Thon 1, Thach Da.

Agribank has set a starting price of 246.4 billion VND for this debt package. This price excludes taxes, fees, charges, VAT (if any), and other financial obligations related to the transfer of debt ownership, which will be the responsibility of the debt purchaser.

Agribank is also offering for sale the debts of Hung Anh Co., Ltd. – Hanoi Branch, Dai Minh Construction – Trading – Service Joint Stock Company – Hanoi Branch, Nhuận Hiển Construction and Transport Co., Ltd., Tam Duong Infrastructure Investment and Development Co., Ltd., and Hong Quan Building Materials Trading Co., Ltd. The total book value of these debts as of March 31, 2025, exceeds 416.6 billion VND, including 308.5 billion VND in principal and 107.7 billion VND in interest.

The collateral for these debts includes land use rights in Hoang Lau, Tam Duong, Vinh Phuc, for Hung Anh Co., Ltd. – Hanoi Branch; land use rights in Tay Mo, Nam Tu Liem (280 square meters, certificate CP 022101, dated November 6, 2018), and Van Noi, Dong Anh, Hanoi (141.6 square meters, certificate CK 530474, dated September 12, 2017).

Additionally, the collateral comprises a tunnel kiln production line, KOMATSU and KOBELCO excavators, a SHANTUI bulldozer, a 120-ton automobile weighing station, conveyor systems, Yaskawa brick-grabbing robots, automatic strapping machines, a 22KV power line, a 2000KVA transformer, and future construction works (GPXD 17/GPXD, dated February 21, 2019)

Agribank is auctioning off the debts of Hop Thinh Phat Vinh Phuc Joint Stock Company, Thai Duong Infrastructure Investment and Development Co., Ltd., and Ha Tinh Building Materials Production Co., Ltd. The total book value of these debts as of March 31, 2025, is nearly 333.8 billion VND.

The collateral for the debts of Hop Thinh Phat Vinh Phuc JSC and Thai Duong Infrastructure Investment and Development Co., Ltd. includes land use rights in Hoang Lau, Tam Duong, Vinh Phuc (certificate AM 678686, dated September 22, 2009, Lot 2, Sheet 00), a tunnel kiln production line (electric ferry, suction fan, goong carrier), forming machines (mixer, extruder, brick cutter, air compressor), and future construction works (GPXD 06/GPXD, dated March 25, 2009).

The collateral for Ha Tinh Building Materials Production Co., Ltd. comprises land use rights and attached assets in Thach Da, Me Linh, Hanoi (32,257.9 square meters, certificate BB 916198, dated December 28, 2011), along with Yaskawa brick-grabbing robots (Japan) and finished product-grabbing robots at Hop Thinh Phat (Hoang Lau) and Hoang Kim (Thach Da) factories.

Agribank is offering for sale the debts of Nhường Hưng Co., Ltd., Ngô Thu Hà, Trần Văn Khải, and Nguyễn Thị Thúy Huyền, arising from credit contracts signed with Agribank Ha Thanh Branch (formerly known as Agribank Dong Ha Noi Branch). As of March 20, 2025, the total book value of these debts is 162.4 billion VND.

Agribank is also selling the debts of HLQ TRADING Import-Export Co., Ltd. and Mr. Ngo Xuan Ky, arising from credit contracts signed with Agribank Ha Thanh Branch (formerly known as Agribank Dong Ha Noi Branch). As of March 20, 2025, the book value of these debts exceeds 149 billion VND.

Additionally, Agribank is selling the debts of QA International Investment and Trading Co., Ltd., Thanh Cong Metal and Equipment Co., Ltd., and Phan Thi Ut, arising from credit contracts signed with Agribank Ha Thanh Branch (formerly known as Agribank Dong Ha Noi Branch). The total book value of these debts as of March 20, 2025, is 257.5 billion VND.

Agribank is offering for sale the debts of Dong Duong Trading, Service, Construction and Transport Co., Ltd., arising from credit contract number 1420-LAV-202100149, signed on April 5, 2021, with Agribank Ha Thanh Branch (formerly known as Agribank Dong Ha Noi Branch). As of March 20, 2025, the book value of this debt is 51.3 billion VND.

Agribank is selling the debts of Ha Thanh Industrial Equipment and Construction Co., Ltd., arising from credit contract number 1420-LAV-202100129, signed on March 22, 2021, with Agribank Ha Thanh Branch (formerly known as Agribank Dong Ha Noi Branch). As of March 20, 2025, the book value of this debt is 90.6 billion VND.

Agribank is also selling the debts of Thuc Lan Co., Ltd., arising from credit contract number 1420-LAV-202000504, signed on November 30, 2020, with Agribank Ha Thanh Branch (formerly known as Agribank Dong Ha Noi Branch). As of March 20, 2025, the book value of this debt is 89.8 billion VND.

Agribank is offering for sale the debts of Clean Food and Packaging Production Co., Ltd., arising from credit contract number 1420-LAV-202000276, signed on July 10, 2020, with Agribank Ha Thanh Branch (formerly known as Agribank Dong Ha Noi Branch). As of March 20, 2025, the book value of this debt is 137.1 billion VND.

Agribank is selling the debts of Dat Nhuong Co., Ltd. and Steel Tin Phat Co., Ltd., arising from credit contracts signed with Agribank Ha Thanh Branch (formerly known as Agribank Dong Ha Noi Branch). As of March 20, 2025, the total book value of these debts is 190 billion VND.

Lastly, Agribank is offering for sale the debts of Asian Materials and Equipment Co., Ltd., arising from credit contract number 1420-LAV-202100242, signed on July 5, 2021, with Agribank Ha Thanh Branch (formerly known as Agribank Dong Ha Noi Branch). As of March 20, 2025, the book value of this debt is 80.4 billion VND.

“Ho Chi Minh City Pilots Housing Project through Land Use Agreement”

The Department of Agriculture and Environment has been tasked with heading the formation of an inter-agency task force and support group to review and assess proposed land areas for the pilot project. This decision was made in consultation with the Ho Chi Minh City People’s Committee, who have entrusted the department to take the lead in this important initiative.

The Two Mandatory Fees for Obtaining a ‘Red Book’ in 2025: Be Prepared!

In 2025, the two biggest expenses when obtaining a land use right certificate (red book) in Vietnam are land use fees and registration fees, which can amount to hundreds of millions of Vietnamese Dong depending on the land area and location.

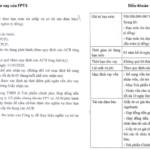

Two Securities Firms Receive a Combined Limit of VND 2,500 Billion from ACB

On May 15, the Board of Directors of FPT Securities (FPTS, HOSE: FTS) approved a short-term borrowing limit of VND 2,000 billion at Asia Commercial Joint Stock Bank (ACB). On the same day, the Board of Directors of Agribank Securities (Agriseco, HOSE: AGR) also approved a limit of VND 500 billion at ACB, with similar terms and conditions regarding purpose and collateral.

“Agribank Aims for a 3-5% Rise in Pre-Tax Profits in 2025”

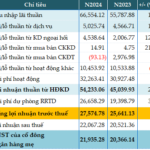

According to the 2024 Annual Report, the Vietnam Bank for Agriculture and Rural Development (Agribank) has set an ambitious target for its 2025 pre-tax profit. The bank aims to achieve a 3-5% increase compared to its 2024 performance and strives to meet or exceed the profit plan approved by the State Bank of Vietnam.

Unlocking Pink Books: A Dialogue-Driven Approach to Resolving Issues for 8 Projects in Ho Chi Minh City

“Director of the Department of Agriculture and Environment in Ho Chi Minh City, Nguyen Toan Thang, took charge of facilitating dialogue on individual projects to resolve issues pertaining to long-standing delays in the issuance of land ownership certificates. The bottleneck was attributed to investors’ sluggish response to emergent issues, consequently impeding the process of granting certificates to homebuyers.”