Ms. Dang My Linh, Vice Chairman of the Board of Century Fiber, has recently registered to purchase 7 million STK shares from June 1st to 30th, aiming to increase her ownership from 14.47% to 21.72%, equivalent to nearly 21 million shares. Based on the market price of VND 25,800/share, Ms. Linh needs to spend nearly VND 181 billion for this transaction.

If the purchase is successful, Ms. Linh will become the largest shareholder in STK, surpassing Investment Consulting Company

The transaction takes place after the strong recovery of STK share price by 37% from the bottom of below VND 19,000/share in early April, following a period of adjustment due to the impact of information related to US tariffs. However, compared to the peak of over VND 27,000/share in mid-March, the market price of STK still decreased by 5% and lost 14% in the past year.

| STK share price movement in the past year |

Earlier, in early April, STK had a notable change in senior personnel. Mr. Dang Trieu Hoa left his two positions as Vice Chairman and General Director to become the Chairman of the Board, replacing Ms. Dang My Linh. Mr. Hoa is currently the Chairman and legal representative, while Ms. Linh assumes the role of Vice Chairman. The position of General Director has not yet been announced by STK.

Ms. Dang My Linh and Mr. Dang Trieu Hoa. Photo: STK

|

In terms of business results, in the first quarter of 2025, STK recorded a net profit of nearly VND 36 billion, 50 times higher than the same period last year. Revenue increased by 42% to VND 376 billion, thanks to the addition of 13 new customers and improved selling prices. Gross profit margin surged from 8.6% to 20.8%. In addition, financial revenue also increased by 77% thanks to exchange rate gains, while selling expenses decreased by 61%, supporting profit surge.

STK sets a business plan for 2025 with revenue of VND 3,270 billion, 2.7 times higher than the previous year. Expected net profit reaches VND 310 billion, more than 25 times higher. After the first quarter, the Company achieved 11% of revenue plan and 12% of profit plan for the year.

| STK’s business results in the last 5 quarters |

– 16:43 05/26/2025

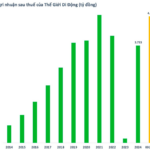

“Rapid Retail Expansion: MWG’s Impressive Growth with 359 New Stores in 4 Months, Achieving 32% of Revenue Target”

In April 2025, the combined revenue of TGDĐ and ĐMX reached an impressive VND 8.3 trillion, marking a 13% increase from the previous month and a 3% growth compared to the same period last year.

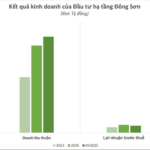

East Mountain Infrastructure Plans for 2025 Revenue of Approximately VND 700 Billion, Wins Billion-Dollar Transportation Contract in Hanoi

In 2025, Dong Son Infrastructure Investment remains committed to the timely execution of its ongoing five projects, honoring its pledges to investors. The company actively seeks out investment opportunities in industrial real estate and social housing projects, reinforcing its position in the market.

A Local Beer Brand Lists on UPCoM, Offering 6 Million Shares After Two Decades of Brewing Excellence

” Hanoi Beer Trading Joint Stock Company – Hung Yen 89, with a capacity of 35 million liters per year and an extensive distribution network in the North, will be trading on UPCoM under the ticker BHH. Despite a loss in the first quarter of 2025, the company aims for a 13% growth in net profit for the full year, coupled with a commitment to continue paying cash dividends.”