Joint Stock Company Traphaco (code: TRA) has announced that June 16th is the last day to close the rights to pay the second dividend of 2024 in cash to shareholders. The payment ratio is 20%, or VND 2,000 per share.

With nearly 41.5 million circulating shares, Traphaco is expected to spend over VND 82.9 billion on dividends. The payment will be made on July 4, 2025.

It is known that Traphaco plans a total dividend ratio of 40% for 2024, equal to that of 2023 and in line with the plan approved by the Annual General Meeting of Shareholders. Previously, the company had paid a dividend of 20% in January 2025.

Traphaco sets the date for the second 2024 dividend payment

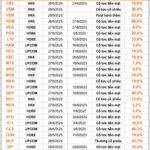

SCIC (State Capital Investment Corporation) – TRA’s largest shareholder with a 35.67% stake – will receive the largest amount, estimated at nearly VND 30 billion.

In addition, TRA has three other major shareholders: MAGBI Fund Limited, which owns 25% and is expected to receive VND 20.7 billion; Super Delta Pte. Ltd., which holds 15.12% and is expected to receive VND 12.5 billion; and Asia Top Picks, which holds 5.15% and is expected to receive nearly VND 4.3 billion.

In other news, Traphaco’s Board of Directors recently passed a resolution to establish a subsidiary, Traphaco Pharmaceutical Company Limited. The company is headquartered in Hoang Mai District, Hanoi, with a charter capital of VND 40 billion, fully contributed by TRA. Traphaco Pharmaceutical will mainly operate in the logistics sector (storage, warehousing, delivery, and collection), with all products being pharmaceuticals owned by Traphaco.

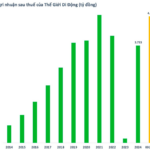

In terms of business results for the first quarter of 2025, Traphaco recorded a slight 1% increase in net revenue to VND 555 billion compared to the same period last year. Notably, cost of goods sold increased by 11% to VND 268 billion, resulting in a 6% decrease in gross profit to VND 287 billion compared to the previous year.

After deducting taxes and fees, Traphaco reported a 20% decrease in after-tax profit to VND 48 billion compared to the same period. According to the minutes of the 2025 Annual General Meeting of Shareholders, TRA targets nearly VND 2,560 billion in revenue, up 9% compared to 2024, and VND 268 billion in after-tax profit, up 4%. Thus, the company has achieved 22% of its revenue target and nearly 18% of its profit target for the year in the first three months.

“VIX Brokerage Aims for 1.8X Profit Growth in 2025”

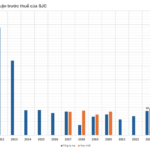

On May 23, 2025, the Annual General Meeting of Shareholders of VIX Securities Joint Stock Company (VIX) approved an ambitious profit target, aiming for an 180% increase compared to the previous year’s performance. VIX attributes this bold growth strategy to its focus on high-quality human resources and cutting-edge technology as the key pillars for success in the coming year.

“Raking in 95 Billion VND a Day: SJC’s Surprising Turnaround with Profits Quadrupling from 2023, but How Much Gold is in their Vaults?”

In 2025, SJC’s leadership aims high with a revenue target of nearly VND 34.9 trillion. However, their net profit goal stands at a modest VND 89 billion.