On May 18, 2025, the State Bank of Vietnam issued Circular No. 03/2025/TT-NHNN dated April 29, 2025, regulating the opening and use of Vietnamese dong accounts for foreign indirect investment activities. Circular No. 03/2025/TT-NHNN will take effect from June 16, 2025.

Thus, the Ministry of Finance has coordinated with the State Bank of Vietnam to replace Circular No. 05/2014/TT-NHNN issued on March 12, 2014, to materialize the goal of upgrading the Vietnamese stock market. Of the nine groups of solutions and roadmaps that the State Securities Commission proposed in March 2025, the authority has fulfilled seven out of nine commitments.

Specifically, seven out of nine solutions have been implemented, including the group related to Circular 68: (1) foreign room, (2) information disclosure, and NPF solutions; the group of solutions on policies: (4) establishing a dialogue group and (5) amending regulations on opening FII accounts; as well as the group of solutions on infrastructure technology: (6) deploying KRX and (7) operating the electronic transaction system between securities companies and the central depository (STP).

The remaining two solutions are the implementation of OTA and CCP. Regarding OTA, the State Securities Commission plans to deploy a master trading account, allowing fund management companies to buy and sell simultaneously for all funds without having to place orders separately for each account. This will simplify order placement and enhance convenience for fund management companies and foreign investors. The implementation is expected before August 2025.

For CCP, it is expected to be operational by 2026. Future tasks include establishing a dedicated CCP subsidiary under VSDC and perfecting the settlement process between VSDC and market members, with the State Bank becoming a clearing member.

According to BSC, the realization of Circular 03/2025/TT-NHNN and the OTA solution by the State Securities Commission will greatly facilitate foreign investors’ participation in Vietnam’s stock market.

Looking back at Saudi Arabia’s reform journey, BSC Research observes that Vietnam is gradually implementing solutions to move closer to its goal of market upgrade.

In the base scenario, BSC Research forecasts that the Vietnamese stock market could be considered by MSCI for its Watch List in June 2025 and receive an announcement of approval for upgrading by FTSE Russell in September this year.

Previously, in April, FTSE Russell announced its market classification report, maintaining Vietnam on the Watch List for potential reclassification from Frontier Markets to Secondary Emerging Markets. Vietnam has been on this Watch List since September 2018.

According to FTSE Russell’s assessment, Vietnam has not yet met the criteria for “DvP Settlement Cycle” and “Payment – Costs related to failed transactions.” Both criteria are currently rated as “Restricted.”

In November 2024, Vietnam’s market regulators introduced a Non Pre-funding (NPF) model, allowing domestic securities companies to provide appropriate capital to foreign institutional investors (FIIs) to support their securities purchases. This eliminated the pre-funding requirement for FIIs.

With this development, FTSE Russell continues to monitor the market and seek feedback from market participants on the NPF model and the handling of failed transactions.

FTSE Russell will provide an update on Vietnam’s Watch List status in its next review in September 2025.

According to BSC Securities, FTSE Russell typically announces market upgrade approvals in September – a crucial time for classification evaluation. Out of 25 announcements for 19 countries over 17 years, 21 announcements were made in September.

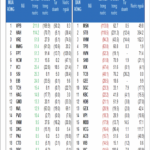

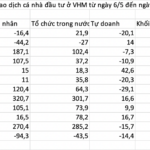

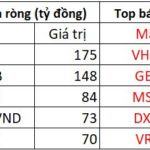

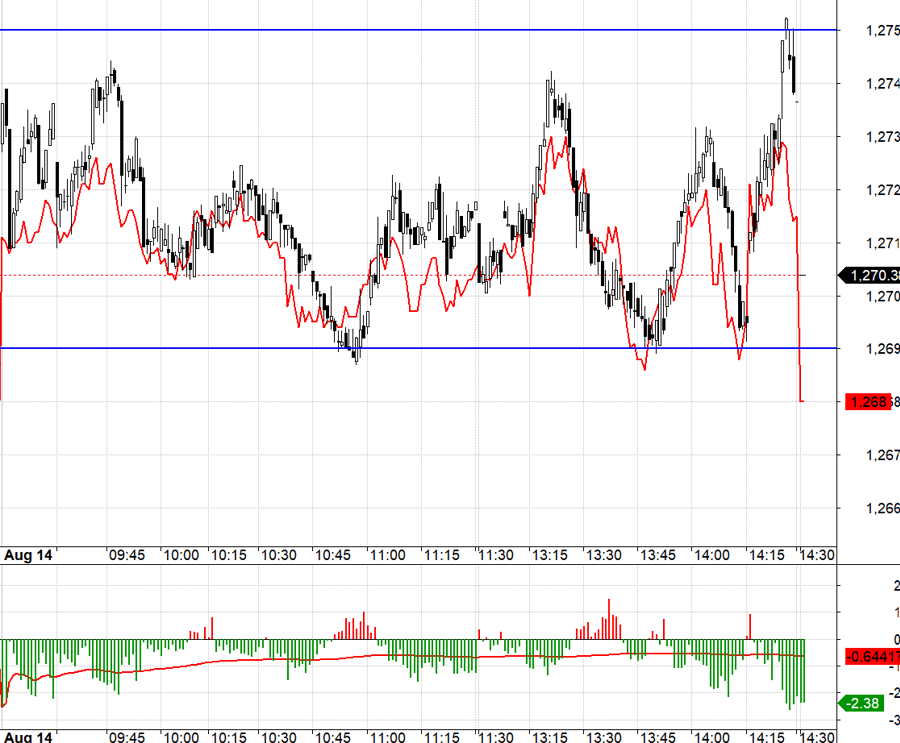

The Tax Saga: VN-Index Recovers, But Stocks Still Stranded

After almost two months since the market took a hit with the US imposing tariffs on multiple countries, with a significant 46% imposed on Vietnam, the VN-Index has recovered and returned to its previous peak. However, numerous stocks continue to struggle, with the exception of a few standouts from the Vin family.