According to the documents presented at the Conference, the CKG leadership forecasts that in 2025, the economic situation may continue to experience significant fluctuations, influenced by various macroeconomic factors, government policies, and consumer trends. The real estate market still faces many challenges.

Specifically, the financial health of real estate businesses has not fully recovered, borrowing rates are high, and capital sources are unstable, hindering growth. Additionally, while streamlining the state management apparatus is a positive long-term policy, it may impact the real estate market sentiment in the short term.

However, important laws such as the Land Law, Housing Law, and Real Estate Business Law have been amended to remove legal obstacles and facilitate projects. Government policies continue to support and promote affordable housing and social housing projects, providing low-income earners access to housing and offering preferential loan programs for young buyers.

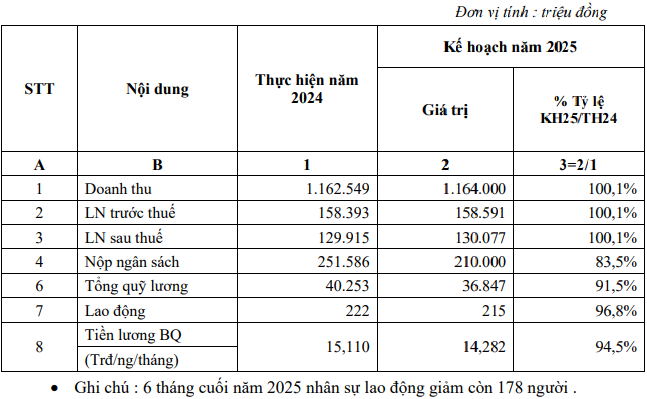

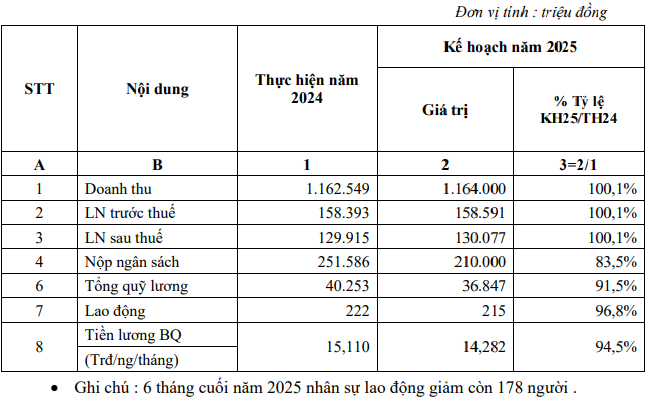

Based on these observations, the management proposes a business plan for 2025, aiming for a revenue of VND 1,164 billion and a post-tax profit of VND 130 billion, similar to the 2024 figures.

|

2025 Business Plan of CKG

Source: CKG

|

In 2025, the CKG management will focus on intensifying marketing and sales, brokerage activities, and increasing sales commissions to clear inventory and recover capital. They will also reduce maintenance costs and other expenses to ensure the completion of the planned revenue and profit targets.

Early Handover of Two Projects: CIC Boulevard and Rivera Villas

Regarding project implementation, the Company will accelerate the construction of technical infrastructure, sales, and construction to facilitate the early handover of the Urban Route 2 project (commercially known as CIC Boulevard) and the Phu Quoc Riverside Villas (Rivera Villas) project in Phu Quoc City.

In addition to ongoing projects, in 2025, CKG intends to commence operations for projects that have substantially completed their investment preparation procedures, including the Rach Gia Central Agricultural, Marine, and Commercial Market Residential Area project; the Bac Vinh Quang Residential Area project in Vinh Quang Ward, Rach Gia City (phase 1 and 2); and the sales launch of the Bung Goi luxury villa project in Cuu Duong Commune, Phu Quoc City.

Notable projects in CKG‘s investment pipeline for the 2025-2030 period include the 4.3-hectare Ba Keo Phu Quoc project, the 34.3-hectare Bai Vong project, and the E3 shophouse complex. The Company will ensure a balanced cash flow and protect shareholders’ interests during the Enterprise’s development phase in the coming years.

Regarding subsidiary companies, CKG plans to restructure two entities: CIC Education Company Limited and CIC Kien Giang Trading and Service Company Limited. They will also transfer their capital contribution in the project and equity contribution at Phu Quoc Infrastructure Development Joint Stock Company and dissolve CIC Real Estate Joint Stock Company.

CKG will not pay dividends for 2024 and plans to propose a dividend payout of up to 10% for 2025.

Notably, at the upcoming Conference, the CKG leadership will propose to the Annual General Meeting of Shareholders to consider changing the Company’s name from Kien Giang Construction Investment Consulting Group Joint Stock Company to CIC Group Joint Stock Company, abbreviated as CIC Group. This change aims to facilitate smoother connections with partners and customers during transactions and work towards the Company’s development orientation. It also helps establish a clearer, more professional, and consistent brand image for “CIC Group” in the market, expanding collaboration and investment opportunities and fostering long-term sustainable development.

– 16:28 05/26/2025

Van Phu – Invest Announces Q2/2024 Financial Statements: Focus on Handing Over The Terra – Bac Giang Project and Accelerating the Implementation of the Vlasta – Thuy Nguyen Project

With a steady revenue stream from its accommodation services and a significant boost in cash flow following the recovery of loan receivables, Van Phu – Invest Joint Stock Company (VPI) has demonstrated resilience in the face of economic and real estate market challenges.