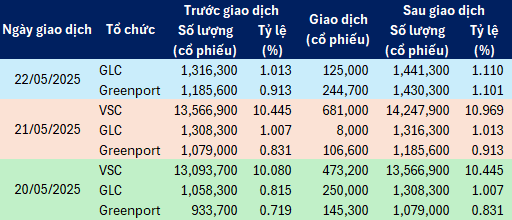

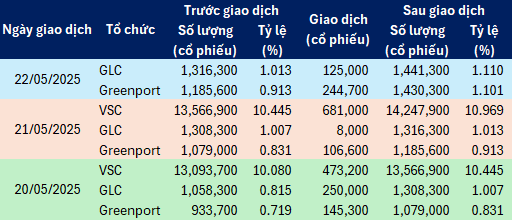

In particular, VSC purchased nearly 1.2 million HAH shares, increasing its holdings from nearly 13.1 million shares (a share ratio of 10.08%) to over 14.2 million shares (a share ratio of 10.7%). In addition, two of VSC‘s subsidiaries, Green Logistics Center Joint Stock Company (GLC) and Greenport Joint Stock Company, also bought HAH shares.

Specifically, GLC acquired a total of 383,000 shares, raising its ownership from nearly 1.1 million shares (0.8% ratio) to over 1.4 million shares (1.1% ratio); while GreenPort purchased nearly 497,000 shares, increasing its holdings from nearly 934,000 shares (a ratio of 0.7%) to over 1.4 million shares (1.1%).

Thus, in just three days, the VSC group of shareholders bought a total of more than 2 million HAH shares, increasing their ownership from nearly 15.1 million shares (a ratio of 11.6%) to over 17.1 million shares (a ratio of 13.2%), continuing the trend of increasing their stake in the recent period, ahead of the upcoming HAH annual general meeting of shareholders expected to take place in late June.

|

VSC Group Increases Ownership in HAH from 05/20 to 05/22

Source: VietstockFinance

|

More notably, HAH shares have been on a strong upward trend since April. As of the latest trading session (May 23), HAH was priced at 79,000 VND per share, up more than 60% from the beginning of 2025. Based on the closing prices of the above trading sessions, the VSC group is estimated to have spent more than 149 billion VND.

At the 2025 Annual General Meeting of VSC shareholders, the Company’s management stated that they had sought opportunities and invested in businesses in the same industry to complement their logistics business capabilities, while emphasizing that HAH and Vinaship Joint Stock Company (VNA) are important links in completing the supply chain.

VSC Management Shares with Shareholders at the 2025 Annual General Meeting

|

With a fleet of 17 vessels with a total capacity of 28,200 TEU, Hai An currently accounts for about 68% of the total capacity of Vietnam’s entire container fleet, according to information from a post on the Enterprise website. Earlier this month, the company, along with a member company, signed a contract to build two 3,000 TEU container ships in China.

Meanwhile, Viconship is the leader in the port industry in Hai Phong, with ports in the system such as Xanh Vip, Nam Hai Dinh Vu, VIMC Dinh Vu, and Cang Xanh.

Shipping company Hai An’s shares surge amid ownership control race

– 13:28 05/26/2025

Investment Fund Transactions: The Overwhelming Buying Power

In the first week of December (02-06/12) and the second week (09-13/12), the investment fund displayed a clear appetite for equity purchases, with buying activity outpacing selling.