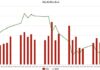

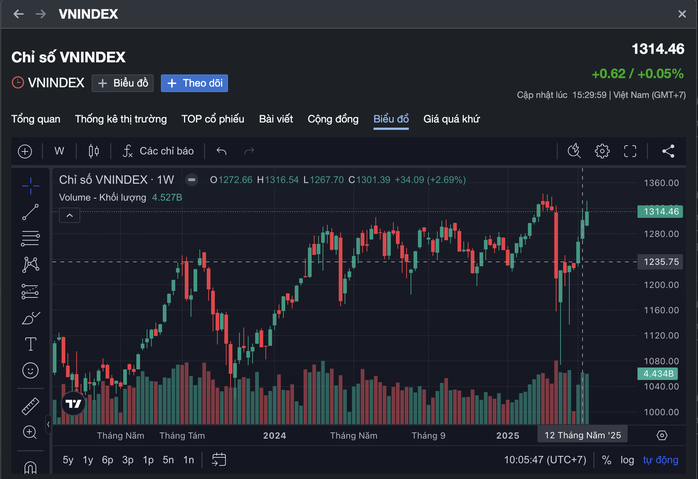

For three consecutive weeks, the VN-Index maintained its upward trajectory and closed the week at 1,314 points, a gain of approximately 13 points from the previous week and nearly 90 points from three weeks ago. As the market nears its highest peak since early 2025, it raises both expectations and questions about its potential for a breakthrough in the coming period.

Mr. Dinh Quang Hinh, Head of Macroeconomics and Market Strategy at VNDIRECT Securities Company, attributed the market’s rise to a series of positive factors, including progress in trade negotiations with the US and momentum from the Vingroup stock universe.

In particular, news such as the Prime Minister’s instruction to relevant agencies to study Vinspeed’s proposal for a high-speed railway and the inauguration of the Tu Lien Bridge project—which improves infrastructure connectivity for the Vin Global Gate Co Loa project—have contributed to the positive market sentiment.

However, Mr. Hinh also cautioned that the 1,320–1,340-point range would present a significant challenge. As the market enters a period of information scarcity after the first-quarter earnings season and the annual general meetings, the index may trade sideways within the 1,290–1,340-point range to absorb profit-taking pressure while awaiting new developments from the Vietnam-US trade negotiations scheduled for early June.

Many securities companies suggest that short-term investors should exercise caution and maintain a reasonable stock proportion.

Pinetree Securities also offered a cautious perspective. According to their analysis, while the VN-Index continued to rise, capital flows were noticeably polarized and concentrated in certain groups, such as the Vingroup, GEX, and a few midcap stocks. As a result, many individual investment portfolios failed to keep pace with the index’s gains and even recorded slight losses. Some large investors have started to take profits, indicating a cautious stance towards short-term risks.

Additionally, Pinetree noted that international news influenced investor sentiment. US President Donald Trump’s announcement to reimpose tariffs on EU goods and Apple products not manufactured in the US is considered a negative factor that could trigger a market correction as early as next week.

Consequently, Pinetree recommended that investors refrain from making new purchases and avoid a wholesale sell-off of their portfolios. A corrective phase after three consecutive weeks of gains is necessary for the market to sustain its upward trend.

VN-Index rises for the third consecutive week, staying above the 1,300-point mark.

SHS Securities shared a similar outlook. In their assessment, the 1,320–1,340-point range is not an attractive buying zone, especially considering the increasing likelihood of a correction. SHS advised investors to maintain a reasonable stock proportion and focus on stocks with solid fundamentals, belonging to strategic industries, and offering genuine growth potential.

Meanwhile, experts from CSI Securities opined that the likelihood of the VN-Index making a significant breakthrough is relatively low. As the index approaches the peak level of 2025, profit-taking pressure is expected to mount, according to CSI analysts.

Despite the positive market trend, a cautious approach is recommended by several securities companies. The current phase requires investors to remain vigilant, carefully select stocks, and avoid those that have risen too rapidly or become overheated. The VN-Index may need more time to adjust and establish a solid foundation before advancing towards higher milestones.

The Capital is Calling: Over $73 Million Raised Last Week

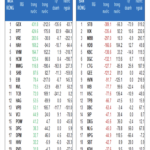

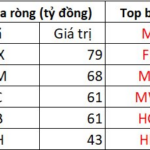

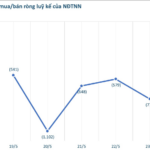

The domestic institutional investors went on a buying spree, netting a purchase of 1,777.6 billion VND, with a remarkable 1,060.5 billion VND in matched orders alone.

The Flow of Funds: Is the Market Still Poised for a Breakthrough at the Old Peak?

The experts’ cautious sentiment was evident as the leading stock group showed signs of fatigue. Indeed, the VN-Index last week was heavily influenced by the pair of stocks VIC and VHM, which rose 12.4% and 10.8%, respectively. These two stocks alone contributed a significant 34.9 points to the index’s total weekly gain of 13.07 points.

The Stock Code Surprise: Brokers’ Proprietary Trading Desk “Accumulating” Heavily on Friday

The proprietary trading arms of securities companies were net buyers to the tune of VND188 billion on the Ho Chi Minh Stock Exchange (HoSE).