On March 18, 2025, the Vietnamese government issued Decree No. 69/2025, amending and supplementing a number of articles of Decree No. 01/2014 dated January 3, 2014, regarding foreign investors’ purchases of shares in Vietnamese credit institutions.

Effective May 19, 2025, commercial banks participating in the State Bank of Vietnam’s weak credit institution restructuring plan will be allowed to increase their foreign ownership ratio to a maximum of 49%, up from the current 30% applicable to commercial banks in general.

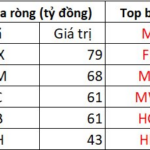

Three out of the four banks receiving the transfers will have their foreign ownership limit increased to 49%.

Specifically, three private joint-stock commercial banks, HDBank, MBBank, and VPBank, have been permitted to raise their foreign ownership ceiling to a maximum of 49%. These institutions are part of the State Bank’s weak credit institution restructuring plan and, as such, benefit from special arrangements regarding credit growth limits, mandatory reserve requirements, and liquidity support.

However, Vietcombank is the only bank in this group that does not fall under the category of banks eligible for increased foreign ownership. According to the new regulations, Vietcombank does not qualify for a foreign ownership limit increase to 49% because the state holds more than 50% of its capital.

Analysts from ACB Securities Company (ACBS) believe that the new decree facilitates capital raising for banks by allowing them to issue shares to foreign investors if they need to inject more capital into weak banks. This, in turn, expedites the restructuring process.

For instance, MB plans to contribute a maximum of VND 5,000 billion to MBV Bank during the restructuring phase. Other banks are likely to have similar plans as part of the weak bank restructuring proposal.

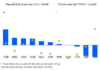

Additionally, capital raising helps bolster the capital adequacy ratio (CAR) as the banks receiving the weak banks benefit from high credit growth limits of 20-30% per year. Currently, HDBank maintains a relatively high CAR of around 14%, but it relies on Tier 2 capital bonds. Thus, they may consider increasing Tier 1 capital to reduce funding costs in the future.

Meanwhile, VPBank also boasts a healthy CAR of approximately 14% and has not utilized Tier 2 capital bonds extensively, so immediate capital raising may not be a priority. On the other hand, MB has a lower CAR of about 10% and has not leveraged Tier 2 capital either. However, ACBS points out that state ownership in MB could be a hindrance, as state-owned enterprises often resist dilution of their ownership stakes.

VIS Rating, a Vietnamese credit rating agency, anticipates that the increased foreign ownership limit will facilitate banks’ attraction of new strategic investors’ capital, fostering robust asset growth.

According to estimates, the CAR could drop by 150-300 basis points by the end of 2026 if these banks do not raise new equity capital or issue Tier 2 capital bonds. Traditionally, banks have relied on retained earnings and Tier 2 capital bond issuances to meet their capital requirements. However, the process of selecting and finalizing agreements with foreign investors can span several years.

For instance, VPBank took about two years to sell a 15% stake to Sumitomo Mitsui Banking Corporation (SMBC) in 2023. HDBank has been seeking foreign investors for the past five years, and MB has not announced any plans to attract foreign strategic investors. Therefore, retained earnings and Tier 2 capital bonds are expected to remain the primary sources of capital for these banks.

In January 2025, the State Bank of Vietnam announced the transfer of GPBank to VPBank and DongABank to HDBank. In November 2024, CBBank was transferred to Vietcombank, and Oceanbank to MBBank. These transfers were made as part of the State Bank’s restructuring program to protect creditors and restore the banks’ normal operations. Before the transfers, the four banks had been under special control by the State Bank for several years due to significant non-performing loans and accumulated losses.

The Fed is in a Bind: Walking the Tightrope of Interest Rates

From the beginning of the year to mid-April 2025, the average lending interest rates for new transactions of commercial banks decreased by 0.6 percentage points compared to the end of 2024. This move has provided a much-needed respite for businesses by alleviating the pressure of capital costs in production and trading activities, thereby fostering economic growth.

The Evolution of China’s Banking Strategy and Lessons for Vietnam

The Chinese banking system has undergone a strategic transformation over the past decade. Moving away from a model reliant on large-scale credit growth, fueled by real estate lending and state-owned enterprise loans, the industry has embraced a new paradigm. This paradigm shift involves a comprehensive approach to finance, diversifying revenue streams, and embracing digital transformation. This evolution reflects a conscious effort to adapt to the demands of risk management, improved operational efficiency, and sustained growth.