The stock of VOS, owned by Vietnam Maritime Transport Joint Stock Company (Vosco), surged to its daily limit, closing at VND 14,800 per share on May 26, 2025, the highest in two months, following the recovery of the overall market.

Previously, after a sharp decline due to the tax shock in early April 2025, VOS mostly traded sideways around the price of VND 14,000 per share.

The surge in VOS’s stock price came immediately after the Ho Chi Minh City Stock Exchange (HoSE) issued a reminder regarding the delayed disclosure of the resolution of the Board of Directors’ meeting on May 22, 2025.

According to this document, on May 9, 2025, HoSE received Document No. 225/VOSCO-KHTH dated May 9, 2025, from Vosco, explaining its information disclosure obligations. Specifically, the company has issued resolutions of the Board of Directors regarding transactions valued at more than 10% or higher of the company’s total assets in the latest audited annual financial statements or reviewed semi-annual financial statements, based on consolidated financial statements, but has not yet disclosed this information.

HoSE stated that Vosco failed to disclose Resolutions No. 27/NQ-HĐQT dated February 5, 2024, No. 58/NQ-HĐQT dated October 7, 2024, No. 60/NQ-HĐQT dated November 1, 2024, and No. 64/NQ-HĐQT dated November 26, 2024, within the prescribed time frame.

Therefore, HoSE reminded and requested Vosco to additionally disclose the aforementioned Board of Directors’ resolutions and strictly comply with the legal regulations on the stock market to protect shareholders’ rights.

Business Performance: According to the consolidated financial statements for the first quarter of 2025, the shipping company’s revenue reached VND 462 billion, a decrease of 58% compared to the same period last year. The main reason for this decline is that last year, Vosco recorded over VND 521 billion in revenue from the cargo trading segment, which did not recur this year.

As the company operated below the breakeven point, VOS incurred a gross loss of VND 35 billion. After deducting other expenses, Vosco reported a post-tax loss of nearly VND 54 billion, marking the third consecutive quarter of losses for the company.

In their explanatory note, Vosco attributed these results to the challenging market conditions for dry cargo ships in the first quarter of the year. Freight rates plummeted due to oversupply. At some points, the daily charter rate for Supramax vessels dropped to as low as $2,500–$3,000, the lowest level since the pandemic’s outbreak.

Small vessels like the Small Handy also faced intense competition due to scarce cargo volumes. Additionally, the volatile oil tanker market, especially during the holidays and the end of March, contributed to a decline in revenue from the tanker fleet.

Furthermore, Vosco had to accelerate depreciation to generate cash flow for investment, resulting in losses. The company stated that if regular depreciation had been applied, they would have been profitable in the first quarter. Several large vessels, such as Vosco Sky, Vosco Unity, and Vosco Starlight, were also temporarily out of operation for periodic maintenance, leading to a loss of revenue during this period.

The Expert’s Take: Only 154 Stocks Out of the 10% Losers Trailing VN-Index, Opportunities in Mid-Cap Space

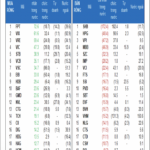

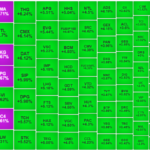

The HoSE boasts an impressive performance with 42 stocks surging over 30%, and a further 215 stocks experiencing gains of between 10% and 30%. The remaining 154 stocks still managed a rise of under 10%. With over two-thirds of the market gaining under 30% and half of the HoSE’s stocks outperforming the VN-Index, it showcases a robust and diverse market.

How Do Investor Groups Trade During Unexpected Volatile Sessions?

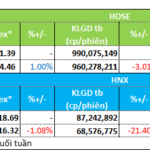

The market experienced a highly volatile session, with an intensity that didn’t quite match the previous session on April 22nd. The opening index plummeted by almost 20 points, but this downward trend quickly reversed, and the index gradually climbed upwards. Fueled by investors’ expectations regarding trade negotiation outcomes, the index closed with an 18.05-point gain, surging towards the 1,332.51 price level.

The Bottom Fishers: Small and Mid-Cap Stocks See a Flood of Inbound Cash.

The market witnessed a wild swing on Monday as the VN-Index plummeted by almost 26 points before staging a remarkable recovery to gain 18.05 points. This was the biggest intraday swing since April 22, and the impact of bottom-fishing funds was notable.

Stock Market Blog: Flash Crash Stimulates Bottom-Fishing?

Today’s market movement was characterized by a swift crash that occurred within a 2-minute window around 9:30 am in the derivatives market. It took the underlying market a good 5 minutes to react strongly to this development. Over 11,200 contracts changed hands during this intense 2-minute period, marking a significant turning point in the day’s events.