On May 26, CSM’s Board of Directors resolved to distribute a dividend for 2024 at a rate of 3% (VND 300/share), equivalent to over VND 31 billion. The ex-dividend date is June 5, and payment will be made on June 20.

In terms of ownership structure, the Vietnam National Chemical Group (Vinachem) is CSM’s largest shareholder and parent company, directly holding 51% of the shares, entitling it to receive nearly VND 16 billion in dividends.

In fact, this dividend plan was approved at the 2025 Annual General Meeting of Shareholders held on April 18.

Regarding business performance, in the first quarter of 2025, CSM recorded over VND 1,021 billion in net revenue, an 11% decrease compared to the same period last year. After deducting cost of goods sold, the Company’s gross profit was nearly VND 121 billion, an 18% drop, while the gross profit margin decreased from 12.9% to 11.8%.

Despite a five-fold increase in financial income due to a gain of nearly VND 7.6 billion in foreign exchange differences, along with efforts to cut various expenses such as interest expenses and transportation costs, CSM’s pre-tax profit decreased by 26%, reaching nearly VND 17.5 billion, equivalent to 19% of the yearly plan. Notably, the Company recognized only VND 1.4 billion in other income, an 84% decline compared to the previous year.

However, a significant reduction in corporate income tax expenses, related to the foreign exchange gain of nearly VND 7.6 billion, resulted in a net profit of over VND 19.4 billion, representing a slight decrease of approximately 1% compared to the previous year.

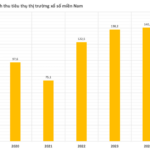

| CSM’s Financial Results for Recent Quarters |

For the full year 2025, the Company set a pre-tax profit target of VND 94 billion, a 6% increase compared to 2024. With over VND 17 billion in pre-tax profit in the first quarter, CSM has achieved about 19% of its annual plan.

At the 2025 Annual General Meeting of Shareholders, General Director Nguyen Dinh Khoat mentioned that the Company has been impacted by tax-related issues. He further emphasized that Vinachem is aiming for an 8% growth rate as directed by the Prime Minister, and therefore, CSM must undertake various measures to meet this target.

Shareholders also raised several questions regarding “hot” topics, such as the progress of tax refunds and the restructuring of the Bien Hoa factory, but CSM stated that detailed results are not yet available.

General Director Nguyen Dinh Khoat shares at the meeting – Photo: Huy Khai

|

Huy Khai

– 21:24 05/26/2025

“Traphaco Confirms Date for 2024 Second Dividend Payment”

Traphaco has announced that June 16th is the last day for shareholders to register to receive the second round of cash dividends for 2024, with a payout ratio of 20%. This round of dividends will cost the company approximately VND 82.9 billion.

“VIX Brokerage Aims for 1.8X Profit Growth in 2025”

On May 23, 2025, the Annual General Meeting of Shareholders of VIX Securities Joint Stock Company (VIX) approved an ambitious profit target, aiming for an 180% increase compared to the previous year’s performance. VIX attributes this bold growth strategy to its focus on high-quality human resources and cutting-edge technology as the key pillars for success in the coming year.

The International Passenger Boost: Soaring Success for the Aviation Industry, Quarter after Quarter.

The Vietnamese aviation industry soared to new heights in the first quarter of 2025, building on the impressive recovery witnessed in 2024. This quarter marked a positive start for the industry, with the majority of businesses reporting significant growth and continuing the upward trajectory.