In a surprising turn of events, Vietnam’s stock market witnessed a remarkable comeback after an unexpected dip earlier in the morning session. Bottom-fishing forces entered the market strongly, helping the VN-Index to quickly recover, closing 18 points higher at 1,332.51 on May 26th. Trading liquidity improved compared to the previous week’s closing session, with a matching value of over 21,300 billion VND on HoSE.

In this context, foreign investors continued to net sell nearly 59 billion VND in this session. Specifically:

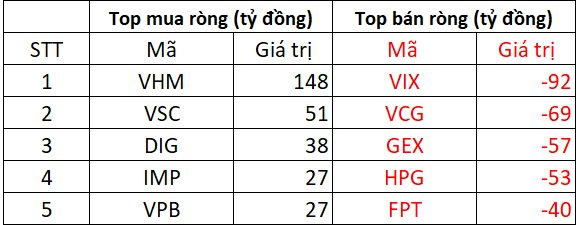

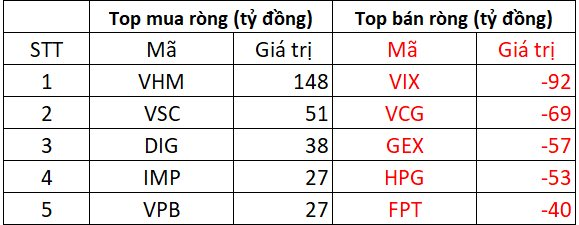

Foreign investors net sold approximately 34 billion VND on HoSE

On the selling side, securities stock VIX was heavily net sold by foreign investors with a value of 92 billion VND. VCG also witnessed net selling of 69 billion VND. Following closely, GEX, HPG, and FPT were net sold in the range of several billion VND.

Conversely, VHM saw the strongest net buying in the entire market with a value of 148 billion VND. VSC, DIG, VPB, and IMP also experienced net buying, with values ranging from 27 billion to 51 billion VND for each stock.

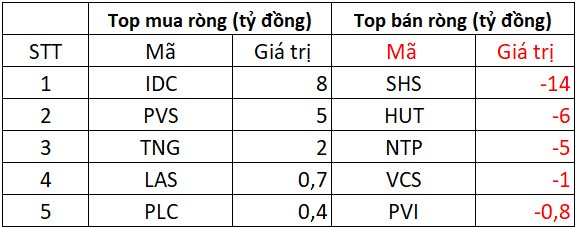

On HNX, foreign investors net sold over 14 billion VND

On the buying side, stocks on the HNX that were net bought in the range of a few billion VND included IDC (8 billion), PVS (5 billion), and TNG (2 billion). Additionally, LAS and PLC also witnessed net buying of a few hundred million VND.

Conversely, SHS experienced the strongest net selling of 14 billion VND, followed by HUT and NTP, which were net sold in the range of 5-6 billion VND. Other stocks like VCS and PVI also witnessed minor net selling.

On UPCOM, foreign investors net sold 11 billion VND

In terms of net buying, MCH stock was net bought with a value of 3 billion VND, followed by ABI, BGE, VEA, and HPD, which were net bought in the range of a few hundred million VND each.

On the opposite side, ACV and MPC experienced net selling of 8 billion and 6 billion VND, respectively. DRI, TAL, and FOC also witnessed insignificant net selling.

The Expert’s Take: Only 154 Stocks Out of the 10% Losers Trailing VN-Index, Opportunities in Mid-Cap Space

The HoSE boasts an impressive performance with 42 stocks surging over 30%, and a further 215 stocks experiencing gains of between 10% and 30%. The remaining 154 stocks still managed a rise of under 10%. With over two-thirds of the market gaining under 30% and half of the HoSE’s stocks outperforming the VN-Index, it showcases a robust and diverse market.

The Stock Code: Unveiling the Sudden Sell-Off by Proprietary Trading Firms

The HoSE witnessed a notable development as proprietary securities firms recorded net sales of VND 243 billion. This significant activity underscores the dynamic nature of Vietnam’s securities market and highlights the pivotal role played by these firms in shaping the landscape of capital markets in the country.

The Cash Flow “Ditches” Blue-Chips: Small-Cap Stocks Surge Ahead

The lackluster performance of leading large-cap stocks is weighing heavily on the VN-Index, while the broader market continues to show resilience. This marks a reversal from previous weeks, when the index was propelled by these very same stalwarts, but investors saw limited gains as most stocks lagged.

Where would the Vietnamese stock market be without the Vingroup conglomerate?

The SSI Chief Economist offered insights into the surge of large-cap stocks and the factors influencing the stock market.