Record-breaking deposits, but equity investment remains more attractive

According to data released by the State Bank of Vietnam, residential deposits in credit institutions reached 7.36 million billion VND by the end of February this year, a remarkable 4% increase compared to the end of 2024.

Regarding the impact of savings growth on the economy, Mr. Duong asserted that a 4% increase is quite normal and does not raise any concerns.

Mr. Duong explained that the over 4% growth in savings is not overly worrying. In fact, a strong increase in savings is often the result of one or both of the following factors: (1) a tightening policy stance and (2) the economy’s ability to absorb capital.

A tightening policy stance could lead to rising interest rates. However, this factor can be ruled out, as there is no significant increase in deposit interest rates.

Assessing the economy’s ability to absorb capital requires a sufficiently long period and a high enough growth rate. For instance, during the last two months of 2023, deposits grew by 800 trillion VND each month, accounting for nearly 50% of the total deposit growth for the year.

Currently, neither of these factors presents a significant concern.

Mr. Dao Hong Duong – VPBank Securities’ Sector and Stock Analyst

|

One of the factors affecting the banking system’s short-term liquidity is the mismatch between deposit and credit growth. However, deposit growth is currently well-aligned with credit growth, indicating stable NIMs for the banking system and individual banks.

When asked about choosing between savings and equity investment for dividends, the VPBank Securities expert suggested a simple yet effective approach: using the market’s E/P ratio (the inverse of P/E) to calculate the investment yield on the invested capital. Investors can then compare this yield to other investment channels, such as corporate bonds or savings accounts, on an annual income basis.

Currently, the market’s E/P ratio is 1.5-2% higher than the average interest rate on 12-month term deposits, making savings less attractive. This situation was predicted three months ago, and the gap has only widened since then.

In reality, most investors use savings accounts for short-term purposes. For longer-term investments, they seek more profitable and growth-oriented opportunities.

Numerous opportunities remain after the “green on the outside, red on the inside” phase

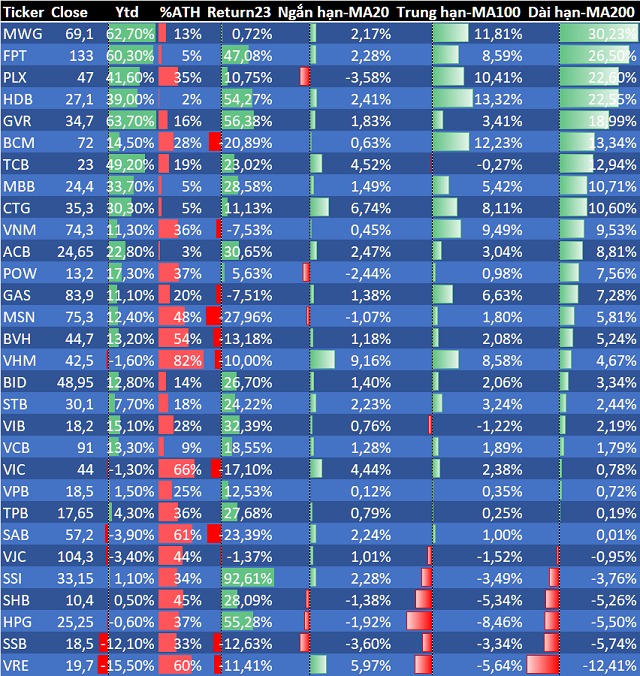

Out of all the stocks listed on the HOSE, only 42 have increased by more than 30%, 215 have risen by 10-30%, and the remaining 154 have seen gains of less than 10%. With two-thirds of the market experiencing increases of less than 30% and half of the HOSE stocks performing below the VN-Index, it’s no surprise that many investors’ portfolios have yet to recover.

According to the VPBank Securities expert, the market has witnessed a rally in a few large-cap and very large-cap stocks, pushing the index above the 1,300-point threshold. During this time, these stocks have regained much of what they lost in April, while numerous others have shown modest recoveries or have yet to return to pre-tariff crisis levels. In terms of tariffs, there are still plenty of investment opportunities in Midcap and Smallcap stocks.

The Q1 earnings reports have been released, painting a positive picture of year-over-year growth, particularly in the banking sector. The upcoming Q2 earnings reports may provide further momentum. Meanwhile, the assessment of tariffs’ impact on various industries remains speculative, as the practical effects have not yet been significant. Therefore, for industries and stock groups potentially affected by tariffs, there are still abundant investment opportunities in the next period, with relatively safe valuation levels for investment.

Mr. Duong also advised investors against chasing the market if they haven’t held on to the few stocks that have risen recently. In other words, don’t fall into the “performance chasing” trap, as this strategy entails relatively high short-term risks.

“While a fund investment faces intense pressure to perform relative to an index, an individual investment portfolio should focus on balance, safety, and overall risk management,” he added.

“Today, our portfolio may lag the market a bit, but tomorrow it could be the other way around,” Mr. Duong shared.

Huy Khai

– 11:36 27/05/2025

The Great Southern Migration: Why Hanoi’s Elite are Flocking to the South’s Property Market

“A noticeable trend has emerged in early 2025, with Hanoi-based investors making a significant shift towards the southern real estate market. This movement reflects the dynamic nature of Vietnam’s real estate landscape, indicating a potential shift in the country’s property investment trends.”

The Ultimate Guide to the NHS Gateway Bac Giang: Over 300 Transactions in Just 6 Hours!

“NHS Gateway Bac Giang, a highly anticipated development, hit the market in April, offering a strategic location adjacent to the industrial park. With all legal procedures completed and necessary qualifications met, this project quickly became the focal point for those seeking accommodation and investment opportunities in Lang Giang. The area has witnessed a surge in demand, and NHS Gateway Bac Giang is poised to cater to this rising trend.”

Unlocking the Golden Potential: Will Binh Duong Attract Another Tech Giant?

This leading global enterprise is planning to expand its investment operations in Vietnam. With a strong presence already established in the country, the company is now looking to further strengthen its position and tap into the vibrant and burgeoning Vietnamese market. This expansion underscores the company’s commitment to driving growth and creating long-term value, not just for itself but also for the local economy and community. Details of the investment plan are yet to be unveiled, but the company assures that it will bring about significant developments and exciting opportunities for all stakeholders involved.