Illustrative image

Oil prices hold steady

Oil prices remained steady as eight OPEC+ countries pledged to cut voluntary oil production, with a meeting scheduled for May 31, 2025.

On May 26, Brent crude oil prices dipped by 4 US cents to 64.74 USD per barrel, while WTI oil prices remained unchanged at 61.53 USD per barrel.

Both oil types witnessed an increase at the start of the trading session after US President Donald Trump agreed to extend trade negotiations with the EU until July 9, 2025. This extension eased concerns about potential US tariffs on EU goods, which could have impacted fuel demand.

The meeting of the eight OPEC+ countries is separate from the virtual meeting of the Organization of the Petroleum Exporting Countries (OPEC) and its allies, led by Russia, scheduled for May 28. Russia’s Prime Minister, Alexander Novak, stated that OPEC+ has not discussed increasing production by 411,000 barrels per day ahead of the meeting.

OPEC’s oil production declined in April 2025, despite plans to increase output, further fueling market hesitancy.

Gold prices dip nearly 1%

Gold prices dropped by nearly 1% as US President Donald Trump retracted his threat to impose a 50% tariff on goods imported from the EU starting June 1, 2025, reducing the demand for safe-haven assets like gold.

Spot gold on the LBMA fell by 0.8% to 3,332.04 USD per ounce, while gold futures for June 2025 on the New York Mercantile Exchange dipped by 1% to 3,331.90 USD per ounce.

US and UK markets remained closed for a holiday.

In the previous week, gold prices surged, marking the strongest weekly gain in six weeks, after Trump’s tariff threats and his consideration of a 25% tariff on Apple iPhones sold in the US but manufactured elsewhere.

China’s net gold imports from Hong Kong doubled in April 2025 compared to the previous month, reaching their highest level since March 2024.

Citi raised its three-month gold price forecast to 3,500 USD per ounce from 3,150 USD per ounce, citing US tariff policies, geopolitical risks, and concerns surrounding the US budget. The bank expects gold prices to fluctuate between 3,100 USD and 3,500 USD per ounce.

Copper prices rise

Metal prices in London climbed as US President Donald Trump withdrew his threat to impose tariffs on goods imported from the EU starting June 1, 2025, boosting market sentiment.

Copper for delivery in three months on the London Metal Exchange rose by 1.19% to 9,614 USD per ton.

Shanghai copper increased by 0.57% to CNY 78,270 (USD 10,909.62) per ton.

Additionally, tight copper supply could push prices higher in the short term, according to Hexun Futures.

Copper inventories in Shanghai fell by 9% to 98,671 tons in the previous week.

The weakening US dollar also supported higher copper prices, with the dollar index falling by 0.3% to 98.813 after a 1.9% decline in the previous week.

A weaker greenback makes commodities priced in US dollars more attractive to buyers holding other currencies.

On the London Metal Exchange, aluminum prices climbed by 0.41% to 2,466 USD per ton, zinc rose by 0.56% to 2,712.50 USD per ton, lead increased by 1.22% to 1,994 USD per ton, tin gained 0.89% to 32,665 USD per ton, and nickel advanced by 0.49% to 15,570 USD per ton.

Shanghai aluminum prices slipped by 0.05% to CNY 20,155 per ton, lead rose by 0.12% to CNY 16,795 per ton, zinc fell by 0.52% to CNY 22,185 per ton, nickel dropped by 0.08% to CNY 122,780 per ton, and tin declined by 0.24% to CNY 264,050 per ton.

Dalian iron ore prices hit two-week low, steel falls

Iron ore prices on the Dalian Commodity Exchange declined due to softening steel consumption in top consumer China, while the country’s prolonged real estate sector woes also weighed on the market.

The September 2025 iron ore contract on the exchange fell by 2.21% to CNY 706.5 (USD 98.47) per ton, earlier touching CNY 704 per ton, the lowest since May 12, 2025.

Meanwhile, the June 2025 iron ore contract on the Singapore Exchange dipped by 1.09% to 97.05 USD per ton.

China’s real estate sector is expected to remain weak this year, with house prices projected to fall by nearly 5% and remain flat in 2026.

The US dollar index slipped by 0.3% to 98.813 after a 1.9% drop in the previous week.

A weaker greenback makes assets priced in US dollars more affordable for buyers holding other currencies.

On the Shanghai Futures Exchange, steel rebar dropped by 1.67%, hot-rolled coil fell by 2.03%, stainless steel declined by 0.04%, and steel wire rod slid by 2.58%.

Rubber prices in Japan dip

Rubber prices in Japan followed a downward trend, in line with falling rubber prices on the Shanghai Futures Exchange, amid concerns over the US-China trade war. The stronger JPY also encouraged selling.

The October 2025 rubber contract on the Osaka Exchange fell by 1.7 JPY, or 0.5%, to 318.3 JPY (2.20 USD) per kg. Rubber prices had risen by 2.1% in the previous week, marking the fourth consecutive weekly gain.

Meanwhile, the September 2025 rubber contract on the Shanghai Futures Exchange dropped by 330 CNY to 14,400 CNY (2,005 USD) per ton.

Rubber futures for June 2025 on the Singapore Exchange dipped by 0.4% to 168.8 US cents per kg.

The JPY was trading at 142.8 against the USD, compared to around 143.42 in the previous session.

A stronger JPY makes Japanese commodities priced in JPY cheaper for overseas buyers.

Malaysian palm oil prices edge higher

Malaysian palm oil prices fluctuated within a narrow range, influenced by weak soybean oil prices and concerns over rising production and inventories. However, higher crude oil prices provided some support to the market.

The August 2025 palm oil contract on the Bursa Malaysia Derivatives Exchange climbed by 2 ringgit, or 0.05%, to 3,829 ringgit (908.42 USD) per ton.

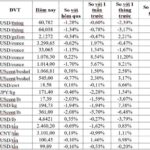

Key commodity prices on May 27, 2025

Expert Take: Stock-Picking Opportunities Wane as Cash Takes a Cautious Stance Ahead of Trade Talks Outcome

Let me know if you would like me to make any changes or modifications to this title.

The divergence among stocks may become more pronounced this week, as the lack of fresh supportive news may lead to a further distinction between strong and weak stocks. With limited positive catalysts, the ability to identify robust stocks becomes increasingly crucial, and cautious capital deployment is expected.

The Market on May 23: Oil, Natural Gas, Gold, Copper, and Coffee Prices All Decline

As of May 24, 2025, the commodities market witnessed a broad decline with oil, natural gas, gold, and coffee prices all trending downward. The drop was significant enough to push the value of certain commodities to multi-week lows: copper hit its lowest point in three weeks, lead touched a two-week trough, and Indian rice futures plunged to their weakest level in nearly two years.