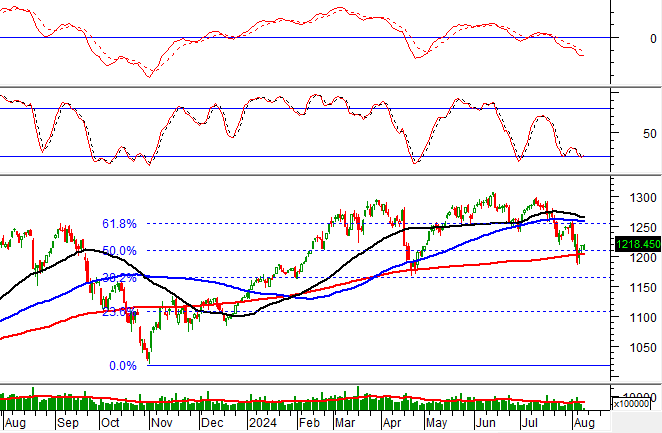

Vietnam’s stock investors underwent a classic psychological test during the May 27 session. The VN-Index plummeted in the morning session, losing up to 25 points at one point, before staging a dramatic turnaround thanks to strong bottom-fishing demand. The index eventually closed up over 18 points at 1,332.5, a year-to-date high.

Many panicked investors sold off their holdings in the morning only to regret their hasty decision in the afternoon as the market rebounded strongly.

This episode highlights that investing in the stock market is a game of discipline and strategy, not crowd sentiment. As the market climbs higher, the risk of corrections increases, and inexperienced investors are more susceptible to being blown off course.

Why is the stock market not beginner-friendly?

In reality, the stock market is a challenging and rewarding arena. Success doesn’t come overnight, and a solid foundation of knowledge, experience, and investment discipline is crucial.

Many individual investors lack basic financial and business acumen, relying instead on social media tips or “keyboard warrior” chat groups for their trading decisions. They often lack a clear strategy and discipline, which can lead to emotional trading—FOMO when the market rises and panic selling when it falls. Consequently, they may find themselves trapped in a “buy high, sell low” cycle, even though the market offers excellent recovery opportunities for those who remain patient.

Additionally, excessive use of margin trading during bullish periods can backfire when the market suddenly turns, resulting in significant losses.

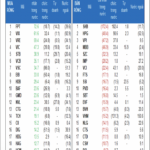

Notably, even during bullish markets, opportunities are not evenly distributed. Since the beginning of 2025, the VN-Index has risen over 5%, but nearly 60% of stocks on the HoSE have declined. This underscores the importance of stock selection and timing, in addition to following the index trend.

Successful investors, on the other hand, typically have a well-thought-out investment plan, stick to their chosen portfolio, and possess technical or fundamental analysis skills. Most importantly, they excel at controlling their emotions, a critical factor in investment success.

How can investors avoid being deceived by market volatility?

To minimize losses from sharp market swings like the one on May 27, investors need to establish a clear risk management strategy.

Firstly, margin trading should be carefully monitored and not overused during periods of high market volatility, as it can amplify losses and induce emotional decision-making.

Secondly, and more importantly, investors should thoroughly research the companies they invest in, from financial reports and business strategies to industry positioning. A deep understanding of your investments will give you the confidence to weather market storms, knowing that intrinsic value prevails over short-term fluctuations.

Another crucial aspect is setting and adhering to stop-loss limits to minimize potential losses. Cutting losses early allows for the preservation of capital and emotional fortitude, enabling a more rational portfolio restructuring.

Additionally, staying abreast of money flow trends, leading stocks, and macroeconomic factors provides a broader perspective, reducing the likelihood of impulsive reactions to market corrections.

Ultimately, maintaining a calm and disciplined mindset is essential. Avoid FOMO during market rallies, and don’t panic-sell during downturns. Emotional resilience and discipline are your strongest weapons against market turbulence.

Investing in the stock market is a journey full of potential and challenges, with “headwinds” along the way. With thorough preparation—in knowledge, strategy, and mindset—savvy investors can turn these challenges into opportunities, navigating the market’s complexities with confidence.

The Expert’s Take: Only 154 Stocks Out of the 10% Losers Trailing VN-Index, Opportunities in Mid-Cap Space

The HoSE boasts an impressive performance with 42 stocks surging over 30%, and a further 215 stocks experiencing gains of between 10% and 30%. The remaining 154 stocks still managed a rise of under 10%. With over two-thirds of the market gaining under 30% and half of the HoSE’s stocks outperforming the VN-Index, it showcases a robust and diverse market.

How Do Investor Groups Trade During Unexpected Volatile Sessions?

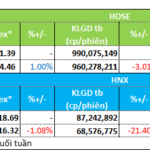

The market experienced a highly volatile session, with an intensity that didn’t quite match the previous session on April 22nd. The opening index plummeted by almost 20 points, but this downward trend quickly reversed, and the index gradually climbed upwards. Fueled by investors’ expectations regarding trade negotiation outcomes, the index closed with an 18.05-point gain, surging towards the 1,332.51 price level.

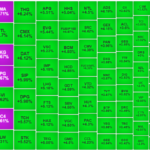

The Bottom Fishers: Small and Mid-Cap Stocks See a Flood of Inbound Cash.

The market witnessed a wild swing on Monday as the VN-Index plummeted by almost 26 points before staging a remarkable recovery to gain 18.05 points. This was the biggest intraday swing since April 22, and the impact of bottom-fishing funds was notable.