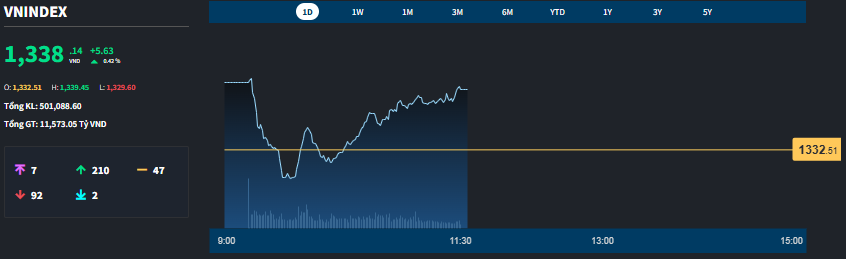

The lackluster performance of leading large-cap stocks is significantly impacting the VN-Index, while the rest of the market is faring well. This is a reversal from previous weeks, where the index was quietly pulled up by a select few major stocks, but investors did not benefit much as most stocks were left behind.

Even when the VN-Index fell sharply at 9:43 am, losing nearly 3 points, the breadth remained positive with 145 gainers and 100 losers. The VN30 basket, at its worst, had only 4 gainers and 23 losers. This indicates that money flow is detached from the index’s influence and is focusing on mid-to-small-cap stocks.

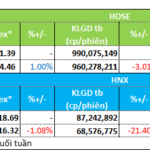

Indeed, the HoSE floor’s liquidity this morning increased slightly by 1.1% compared to yesterday morning, but trading in the VN30 basket decreased by more than 10%. The market share of this blue-chip basket fell to 41.1% of the floor’s total matching value, while it was 46.3% yesterday. In absolute terms, HoSE’s liquidity increased by 130.4 billion dong, while VN30 decreased by 543.6 billion dong. Thus, about 674 billion dong of liquidity has increased in the remaining stocks.

There are currently 37 stocks on the HoSE floor with trading value exceeding 100 billion dong, of which the VN30 group contributes 16 stocks. The Midcap basket accounts for 49.7% of the floor’s total liquidity, and the Smallcap basket accounts for about 10.7%. These are all dominant ratios in the last 3 weeks.

In the top 10 stocks by market capitalization on VN-Index, there were 5 gainers and 4 losers. The two largest stocks, VCB and VIC, decreased by 0.18% and 1.06%, respectively. Fortunately, VHM turned slightly green by 0.14% in the last few minutes of trading. CTG decreased by 0.25%, and VPL decreased by 2.44%. On the gaining side, TCB increased by 1.98%, and FPT rose impressively by 1.79%.

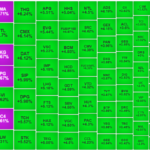

Overall, the strength of the blue-chip group is not evident. Excluding TCH and FPT, the top 10 stocks boosting the VN-Index included only 4 other stocks in the VN30 basket: GVR up 1.56%, GAS up 1.11%, VIB up 2.47%, and HPG up 0.78%. The remaining stocks were mid-cap stocks with strong performances: HVN up 4.28%, GMD up 6.82%, GEE up 4.08%, and REE up 2.36%…

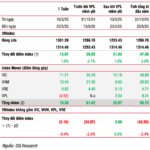

The Midcap index rose 1.28%, and the Smallcap index rose 1.08%, also significantly outperforming the VN30-Index, which rose 0.28%. The VN30 basket had 16 gainers and 10 losers, but only 5 stocks rose more than 1%. Meanwhile, the HoSE floor had 113 stocks rising more than 1%.

Mid-cap stocks are attracting money flow with notable price increases, including VND up 2.54% matching 443 billion dong; VIX up 1.79% with 357.4 billion dong; GMD up 6.82% with 257.8 billion dong; VSC up 6.7% with 235.3 billion dong; EVF up 2.83% with 208.3 billion dong; and GEX up 1.42% with 208.2 billion dong. Stocks trading around 100 billion dong with prices above 2% include DIG, HHV, HAH, TCM, FTS, and CTD.

The breadth of the HoSE floor at the end of the morning session recorded 210 gainers and 92 losers, reflecting the strength concentrated mainly in the non-blue-chip group. This has the disadvantage that the VN-Index will continue to fluctuate around the old peak of around 1340 points. The positive side is that money flow is being stimulated to move strongly in mid-and small-cap stocks, which are the groups favored and held by the majority of individual investors. This situation improves investors’ portfolios and boosts their enthusiasm.

Foreign investors recorded a sudden net sell-off of 800 billion dong on the HoSE floor, the highest in the last 30 morning sessions. Although the buying value increased by 19% compared to yesterday morning, the selling value increased by more than 49%. About 1,923 billion dong worth of stocks were sold, the highest since the morning session of April 14 (selling nearly 2,169 billion dong).

The stocks that were net sold the most were VIX -106.4 billion dong, VIC -82.9 billion dong, VHM -65.1 billion dong, HPG -60 billion dong, VCB -52.9 billion dong, DXG -50.5 billion dong, STB -50 billion dong, NVL -46.9 billion dong, VND -42.6 billion dong, and SHB -32.3 billion dong. On the net buying side, FPT bought a net +91.4 billion dong, GMD +70.2 billion dong, and CTD +28.9 billion dong.

The Relocation Revolution: Tôn Đông Á’s Grand Plans for Expansion

After a 2-year hiatus, Ton Dong A is reviving its plans to list on the HoSE stock exchange. Alongside this endeavor, the company has proposed a series of strategies to increase its charter capital in 2025.