The market continues to surge beyond investors’ expectations, with the index closing 18 points higher on May 26, approaching the 1,333 region. However, many investors’ portfolios remain stagnant or even in loss.

Commenting on this situation, Mr. Dao Hong Duong, Director of Industry and Stock Analysis at VPBank Securities Joint Stock Company (VPBankS), emphasized: With most sectors not yet achieving the performance of the VN-Index and possibly not “reaching the shore” in investors’ language. This also means that the prospects for these portfolios are still quite significant.

The market is at the 1,300-point region, but many investors’ portfolios are stagnant or even in loss. What is your assessment of this issue?

In fact, we see that only about 10 codes have increased by more than 50% in the VN50 portfolio, mainly in the Gelex group (averaging 100% increase), HAH, Vingroup, and NVL. If investors do not hold stocks in this group, it will be difficult for the portfolio to achieve the same growth as the market.

Going back to the same period last year in 2024, if an investor’s portfolio did not include FPT at that time, it would be difficult to match the growth of the VN-Index. Therefore, the performance in the first half of this year is not abnormal.

We should not chase after achievements. For a fund, the pressure to ensure performance that matches the market is very heavy. But for individual investors, we should focus on balance, safety, and overall risk management. It’s not difficult to follow the market trend when we invest in these stocks, but it’s a short-term risky way to invest.

When the mid-cap stock group is at the bottom, the market is unlikely to “collapse”. In your opinion, is it time to buy medium-sized capitalization stocks?

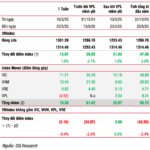

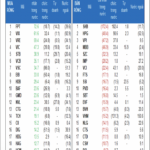

It is evident that large-cap stocks have had a significant impact on the VN-Index’s recovery trend since the post-tariff crisis phase (bottom on 4/9). From 9/4 to now, the market has seen a great differentiation in the increase of stock groups. Many stocks have increased by more than 100%, while many other groups, even many large-cap codes, have increased by less than 10%.

We have statistics that show that on HoSE, there are 42 codes that have increased by more than 30%, 215 increased by more than 10% to less than 30%, and the rest, 154 codes, increased by less than 10%. More than 2/3 of the market has increased by less than 30%, and half of the codes on HoSE have increased less than the VN-Index. This is why many investors’ portfolios have not even “reached the shore.”

In which, if we only consider VN30 or VN50, 27 codes have outperformed the VN-Index, such as the seaport group, Vingroup, NVL, and MWG. If we compare the price of this group with the pre-drop period at the beginning of 2024, the increase is about 10-15%.

Back to the mid-cap group, statistics show that most of the VN50 codes have increased at the same level as the VN-Index or lower (about 40 codes). Some names are easily explained, such as the industrial real estate group, which was affected by tariff information, the aviation and oil and gas groups (also affected by low oil prices). Some securities companies also have modest gains.

We have only seen a small part of the large-cap group with impressive gains, and this group has led the general index back to 1,300 points. Many other groups have modest gains and have not recovered from the tariff-induced decline.

In terms of tariffs, there are still quite a few mid-cap investment opportunities. We still have the cycle from the season of publishing Q1/2025 business results, in which the structure includes the banking industry, which is still positive. Information is expected from the Q2 business results, while the impact of tariffs is still just information, not the final tax figures, which could be a driving force for the market. For many industries and stock groups affected in the past period, there are still investment opportunities with relatively safe valuation levels for disbursement.

How do you assess the recent US-EU tariff tensions and how does this development affect the market?

In terms of general views, we should approach it from the perspective of what is actually happening. Has the US imposed tariffs on the EU yet? The answer is no. Second, every time tariff information is released, the market often reacts very violently, but then balances out. And after a few times, the market seems to have gotten used to reacting more cautiously.

The Vietnamese market in the last session of the previous week and the first session of this week fluctuated very limitedly when receiving US-EU tariff information. Buying and selling reactions were more cautious. This shows that the market psychology has started to be more confident in defense, reacting according to the actual situation.

In fact, we have experienced US-EU tariff tension information during the “Trade War 1.0” phase in the years 2018-2020. We understand that there is still a lot of information related to negotiation issues and related clauses. With an incomplete picture, forecasts are only for reference, and we should be cautious in observing. If the US imposes tariffs as high as President Trump has announced, the impact will be significant, especially in the context of the current weak EU growth and the ECB’s move to boost growth.

Information evaluation must be based on two factors, correctness, and completeness. Many investors who sold during the pre-4/9 period thought they were right. But just over a month later, up to now, if you don’t buy back at low prices, it doesn’t bring much value. Therefore, investors should approach the picture at a sufficient level to get a more accurate perspective.

Will investors be subjective in the face of tariff information, which is appearing more and more intensively?

I don’t think investors are “immune” to tariff information. In fact, before the Q1 business results, the market’s P/E and P/B valuations didn’t change much compared to before the deep decline due to tariffs. That is, the market did not break out impressively before the sharp decline in early April.

After the recent recovery, the VN-Index is now fluctuating slightly. So, investors are not subjective, but the market lacks momentum, and the stagnation at the current price range also coincides with the period before the tariff-related fluctuations.

The market will have a moderate sideways movement, with a differentiated structure of increases between stock groups. If the market trend increases rapidly, investors may be subjective, but not at this time.

The Stock Code: Unveiling the Sudden Sell-Off by Proprietary Trading Firms

The HoSE witnessed a notable development as proprietary securities firms recorded net sales of VND 243 billion. This significant activity underscores the dynamic nature of Vietnam’s securities market and highlights the pivotal role played by these firms in shaping the landscape of capital markets in the country.

The Cash Flow “Ditches” Blue-Chips: Small-Cap Stocks Surge Ahead

The lackluster performance of leading large-cap stocks is weighing heavily on the VN-Index, while the broader market continues to show resilience. This marks a reversal from previous weeks, when the index was propelled by these very same stalwarts, but investors saw limited gains as most stocks lagged.

Where would the Vietnamese stock market be without the Vingroup conglomerate?

The SSI Chief Economist offered insights into the surge of large-cap stocks and the factors influencing the stock market.

How Do Investor Groups Trade During Unexpected Volatile Sessions?

The market experienced a highly volatile session, with an intensity that didn’t quite match the previous session on April 22nd. The opening index plummeted by almost 20 points, but this downward trend quickly reversed, and the index gradually climbed upwards. Fueled by investors’ expectations regarding trade negotiation outcomes, the index closed with an 18.05-point gain, surging towards the 1,332.51 price level.