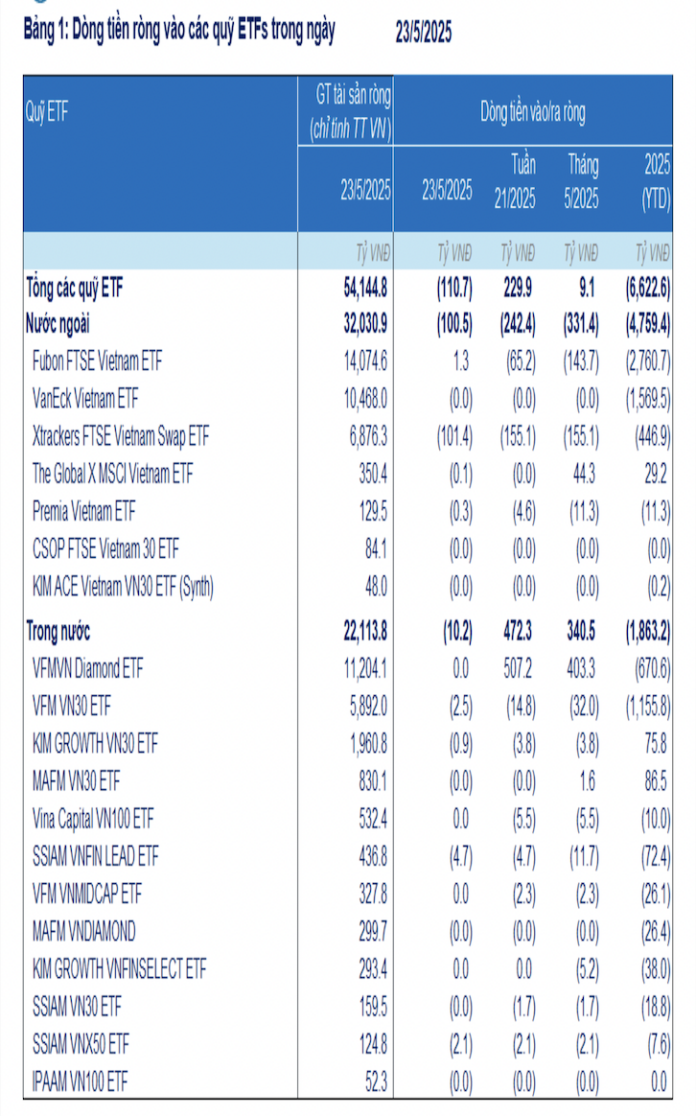

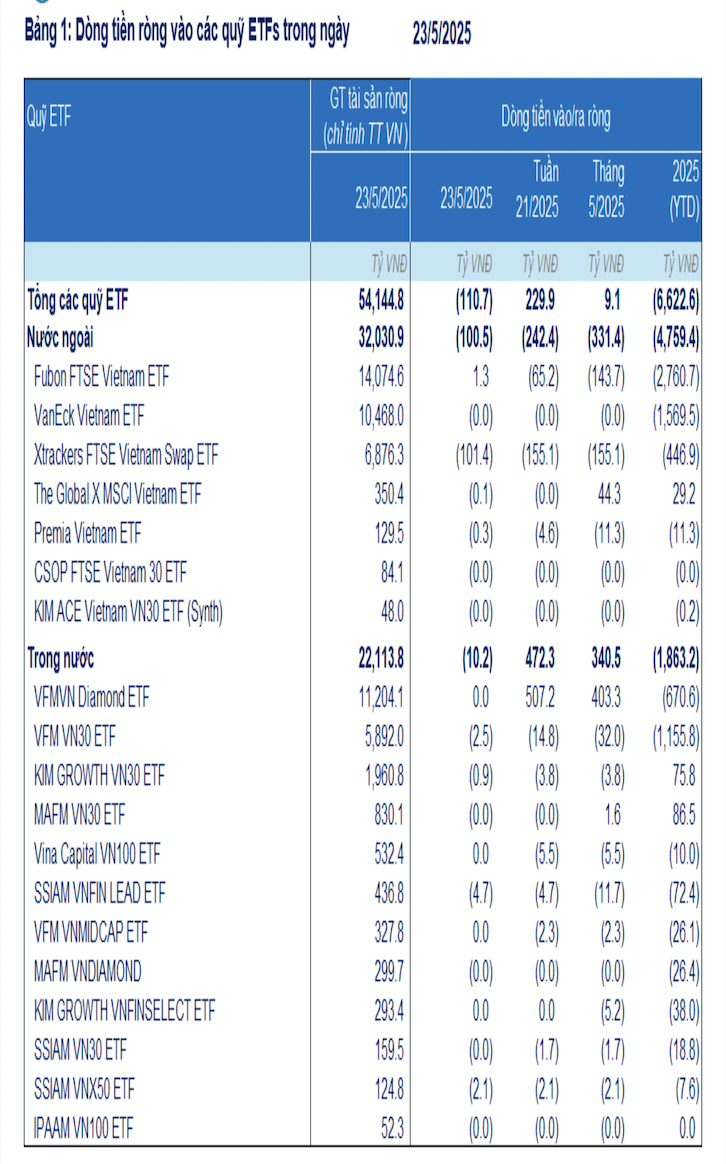

For the week of May 19-23, 2025, ETFs investing in the Vietnamese stock market recorded a net inflow for the first time since the beginning of 2025, with nearly VND 216 billion.

Of the 19 funds, 2 witnessed net inflows, mainly in the domestic VFM VNDiamond ETF. Foreign ETFs, on the other hand, experienced outflows of VND 254 billion, primarily from the Xtrackers FTSE Vietnam ETF (-VND 155.1 billion). Similarly, the Fubon FTSE Vietnam ETF saw outflows of over VND 77 billion.

In contrast, domestic ETFs witnessed strong net inflows of over VND 472 billion, entirely focused on the VFM VNDiamond ETF (+VND 507 billion). Conversely, the VEM VN30 ETF faced outflows of more than VND 14 billion. Additionally, after three weeks of stagnant cash flow, the VinaCapital VN100 ETF experienced outflows of over VND 5 billion.

Regarding Thai capital through depository certificates (DRs): Thai investors sold 500,000 DRs in the VFM VNDiamond ETF (code: FUEVFVND01), equivalent to VND 15.9 billion. Similarly, investors also offloaded 500,000 DRs in the VEM VN30 ETF (code: FUEVFVND01), valued at VND 12.2 billion.

In May 2025, ETFs recorded a net inflow of VND 9.1 billion. However, since the beginning of 2025, outflows have totaled over VND 6,600 billion, a decrease compared to 2024’s outflows of VND 21,800 billion. This indicates a slight easing of capital outflows through ETF investment funds.

As of May 23, 2025, the total net asset value of ETFs (only considering distributions in the Vietnamese market) stood at VND 54,100 billion, a 4.8% decrease compared to the end of 2024. The top stocks bought by ETFs during the week of May 19-23, 2025, included TCB, ACB, GMD, MBB, and VPB.

On May 26, 2025: The Fubon FTSE Vietnam ETF experienced outflows of over VND 12 billion and did not trade any stocks. Meanwhile, the VFM VNDiamond ETF and the VFM VN30 ETF witnessed no cash flow movements.

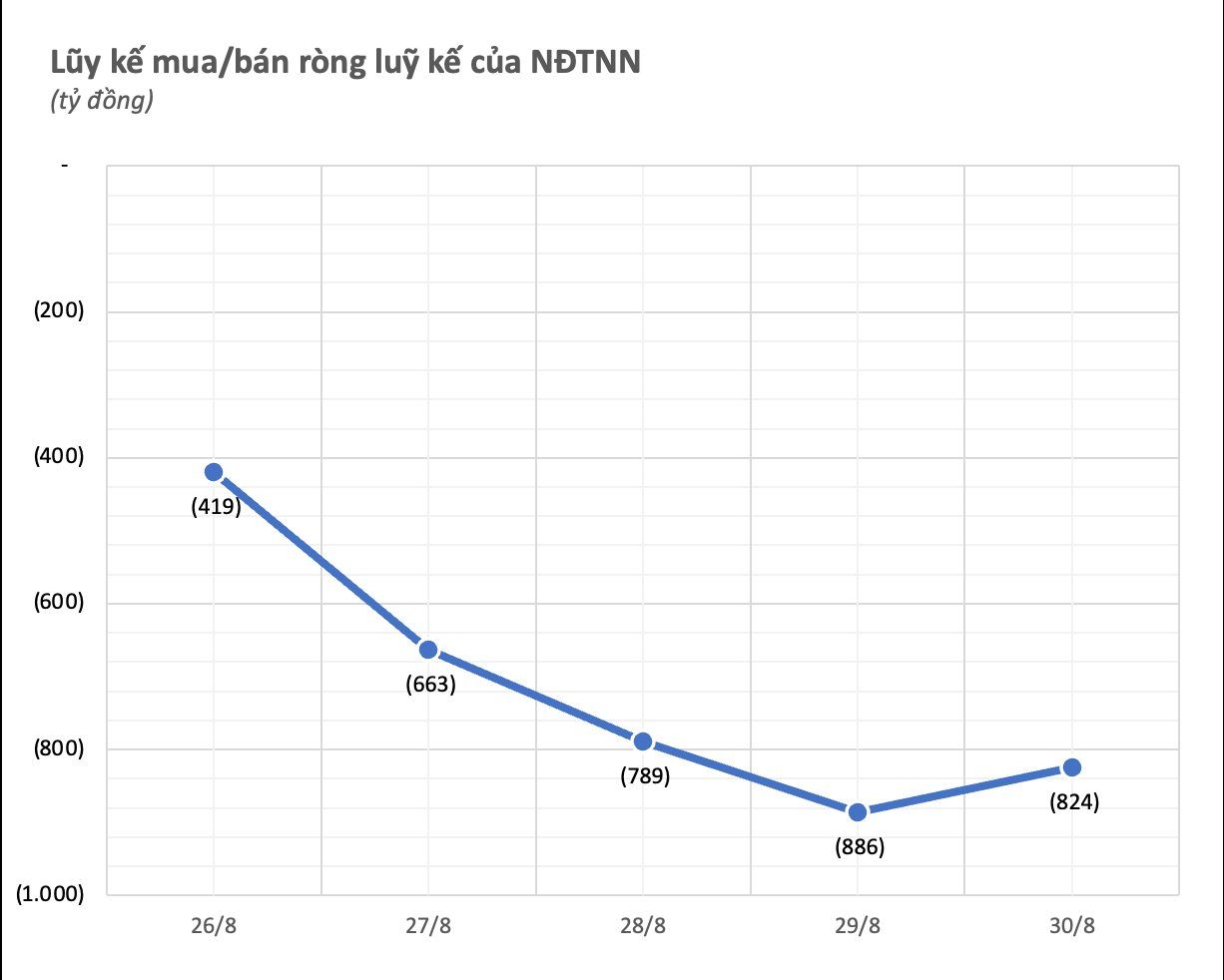

Commenting on foreign capital, Mr. Nguyen The Minh, Director of Retail Analysis at Yuanta Securities, stated that since 2024, foreign investors have maintained a net selling position. However, a positive development is the recent net buying by foreign investors.

This could be attributed to the recent outflows from the US stock market and the cooling of Vietnam’s 5-year CDS index after surging to 150 in early April 2025 due to concerns over tariff policies affecting the macroeconomy. This indicates a reduction in country risk and suggests that long-term risks have eased as negotiations progress, with expectations for positive outcomes in the coming weeks.

“Foreign capital is new money, not just Pnotes, as the net buying value is distributed across various stock groups,” emphasized Mr. Minh.

According to Yuanta’s observations, capital continues to flow out of the US stock market due to high valuations and tariff policy risks. Therefore, global capital is expected to continue diversifying into other markets, including Vietnam, which still offers attractive valuations.

“Vietnamese Billionaire Pham Nhat Vuong Hits $10 Billion in Net Worth, Joining the World’s 300 Richest People.”

As of the latest Forbes update, billionaire Pham Nhat Vuong boasts a staggering net worth of $10.2 billion. He ranks 277th globally and firmly maintains his position as Vietnam’s richest person.

Expert Opinion: Consider VN-Index’s Probability of “Giving Back Points”, Not an Attractive Price Region for Further Investment

The VN-Index is expected to fluctuate and consolidate around the 1,300-point level next week. This neutral scenario predicts a sideways movement for the index, which presents an opportunity for investors to assess their strategies and plan their next moves. With the market showing signs of uncertainty, a cautious approach is advised until a clearer trend emerges.