No Changes to the Portfolio Composition

Unlike previous reconstitution periods, which often involved additions and deletions of stocks, the second-quarter review of 2025 is considered a “stable” period regarding portfolio structure. Both VNM ETF and FTSE ETF maintained the same number of stocks in their portfolios.

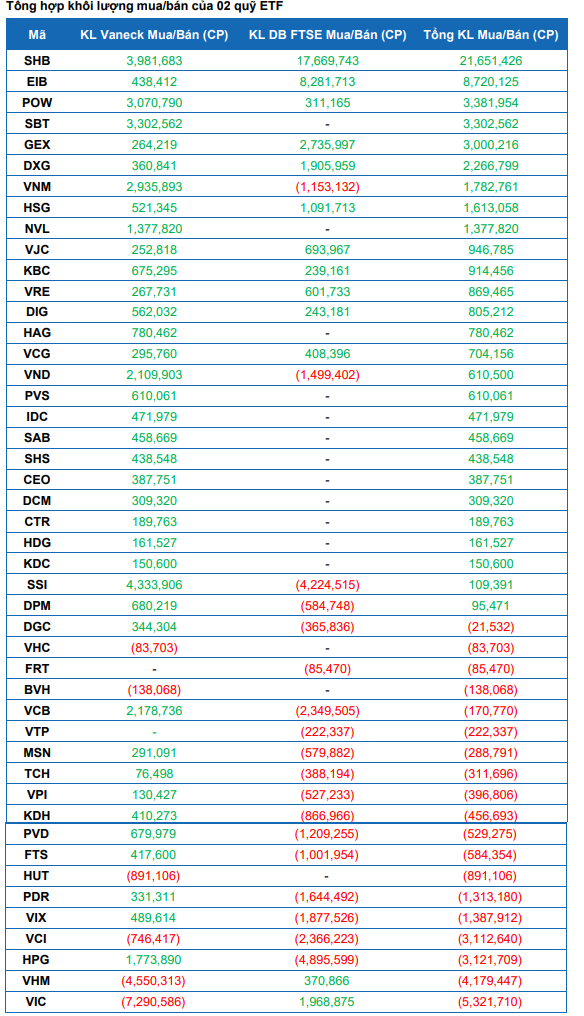

Yuanta Vietnam Securities predicts that VNM ETF will significantly increase the weight of large-cap stocks such as VNM, VCB, and SSI, while considerably reducing the weight of VIC and VHM. On the other hand, FTSE ETF focuses on increasing the weight of banks such as SHB and EIB, while decreasing the weight of HPG and VCB.

Banks Lead in Net Buying

When aggregating the expected transactions from both ETF funds, the picture reveals significant changes in capital flow. SHB will be the biggest beneficiary, with a total net purchase volume of 21.65 million shares. This number mostly comes from FTSE ETF, with 17.67 million shares, while VNM ETF contributes an additional 4 million shares.

EIB ranks second, with 8.72 million shares net bought, mainly by FTSE ETF, as the fund increases its EIB allocation from 1.63% to 4.18%. POW is also net bought at 3.38 million shares, mainly by VNM ETF. SBT and GEX are net bought at 3.30 million and 3 million shares, respectively.

Stocks Under Selling Pressure

On the opposite side, VIC will face the most significant selling pressure, with 5.32 million shares sold net. Interestingly, while FTSE ETF increases its VIC allocation and buys nearly 2 million shares, VNM ETF sells 7.29 million shares. VHM faces a similar situation, with 4.18 million shares net sold, mainly by VNM ETF.

VCI and HPG are net sold at 3.11 million and 3.12 million shares, respectively. Notably, HPG is reduced in weight by FTSE ETF from 12.91% to 11.10%, while VNM ETF slightly increases its weight. Other stocks facing considerable selling pressure include VIX with 1.39 million shares, PDR with 1.31 million shares, HUT with 891,000 shares, and FTS with 584,000 shares.

FTSE ETF is expected to announce its reconstitution portfolio on June 6, while VNM ETF will do so on June 13. The two funds will complete the reconstitution on June 20, 2025.

Source: Yuanta Vietnam Securities

|

– 11:52 27/05/2025

The Crypto King Reigns Supreme: Bitcoin Smashes Records as VN-Index Hovers at 1,300

The crypto market witnessed a historic milestone last week as Bitcoin surpassed the $110,000 mark for the first time, ushering in a new era in its journey to unprecedented heights. Meanwhile, the VN-Index conquered the 1,300-point mark once again, ending on May 23 with a 1% weekly gain to close at 1,314.46 points. But while the markets soar, individual investor portfolios may tell a different story.

“ACB to Roll Out Dividend Payout of 25% Next Week: Investors Must Buy Shares Before This Date to Claim Their Stake.”

ACB plans to dish out VND4.467 trillion in cash dividends to its shareholders, representing a 10% dividend payout ratio. In addition, the company will issue a maximum of nearly 670 million new shares as stock dividends, equivalent to a 15% dividend ratio.

Surprising Drop in Liquidity, Stocks Soar.

The liquidity in many stocks suddenly contracted, with a notable decline of 45% in the VN30 blue-chip stocks compared to yesterday’s morning session. Despite this contraction, the market didn’t perform too badly, as funds continued to flow dynamically, and today it was the turn of securities stocks to take the lead.