Vietnam Stock Market: A Tale of Contrasting Fortunes

The stock market witnessed a relatively volatile trading session on Monday, May 26th, with the VN-Index closing up over 18 points to reach 1,332.51. In this context, foreign investors continued their net selling spree, offloading nearly VND 59 billion worth of shares across the market.

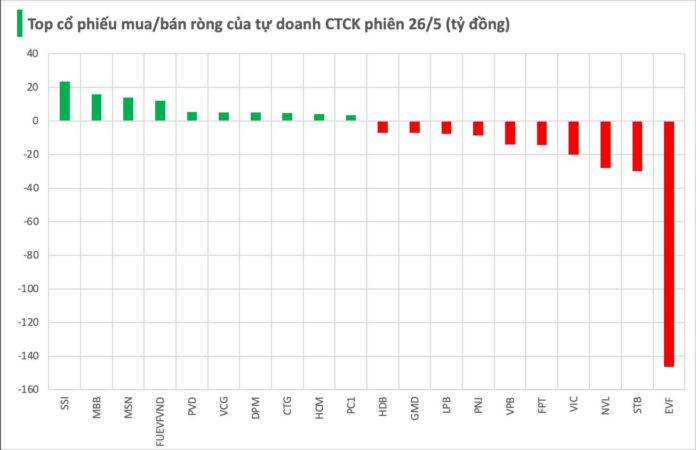

Securities companies recorded a net sell-off of VND 243 billion on the HoSE.

.png)

Figure 1: Net buying and selling activities of foreign investors on May 26th

A deep dive into the data reveals that securities companies offloaded stocks en masse, with EVF bearing the brunt of their selling frenzy at a whopping VND 146 billion. STB and NVL followed suit, witnessing net sell-offs of VND 30 billion and VND 28 billion, respectively. Other stocks that faced net selling pressure included heavyweights like VIC, FPT, PNJ, and VPB.

On the flip side, securities companies displayed a penchant for SSI and MBB, snapping up shares worth VND 23 billion and VND 16 billion, respectively. MSN also caught their fancy, with net purchases totaling VND 14 billion. FUEVFVND, PVD, VCG, and DPM were among the other stocks that enjoyed net buying interest.

The Cash Flow “Ditches” Blue-Chips: Small-Cap Stocks Surge Ahead

The lackluster performance of leading large-cap stocks is weighing heavily on the VN-Index, while the broader market continues to show resilience. This marks a reversal from previous weeks, when the index was propelled by these very same stalwarts, but investors saw limited gains as most stocks lagged.

Unlocking Vietnam’s Stock Market Potential: Unraveling Key Constraints for a Higher Ranking

In the base case scenario, BSC Research forecasts that the Vietnamese stock market could be considered for inclusion in the MSCI Watch List as soon as June 2025, with a potential upgrade announcement from FTSE Russell expected in September this year.