While global sugar prices show signs of recovery, domestic prices are moving in the opposite direction with a significant drop. According to the Vietnam Sugar and Sugarcane Association (VSSA), the price of refined white sugar decreased from 19,300 VND/kg in January 2025 to 18,400 VND/kg in March. The price of refined sugar also dropped from 21,200 VND/kg to 20,400 VND/kg, and golden sugar fell from 20,300 VND/kg to 19,500 VND/kg.

The main reason for this downturn is the abundant sugar supply. As of the end of February 2025, the cumulative production reached 476,000 tons, processed from 5.08 million tons of sugarcane. However, the consumption rate couldn’t keep up, leading to a surge in inventory and subsequent price pressure.

Profit margins varied, with most companies experiencing a decline.

Listed sugar companies have released their financial statements for Q1 2025 (or Q3 of the 2024-2025 fiscal year, depending on the fiscal calendar), painting a less-than-optimistic picture of their performance.

Quang Ngai Sugar Joint Stock Company (QNS): QNS follows a fiscal year from January 1 to December 31. Their Q1 2025 net profit decreased by 26% compared to the same period last year, reaching 392 billion VND—the lowest since Q2 2023. Revenue fell by 10% to 2,269 billion VND, with the sugar segment taking the brunt of the decline, witnessing a 35% drop in revenue to 734 billion VND and a 45% plunge in gross profit. The gross profit margin for the sugar segment narrowed to 24.1% from 28.9% a year earlier.

| QNS’s Quarterly Financial Performance from 2023 to 2025 |

QNS attributed this performance to weak demand, a slight decrease in domestic sugar prices, and the impact of illegal sugar and imported liquid sugar. With a net profit target of 1,790 billion VND for 2025, a 25% decrease from 2024, QNS has only achieved 22% of its goal after the first quarter.

The company is also undertaking three significant projects with a capital investment of over 5,000 billion VND. These projects include increasing the capacity of the An Khe sugar factory to 25,000 TMN, expanding the An Khe biomass power plant to 135MW, and constructing the An Khe Ethanol factory.

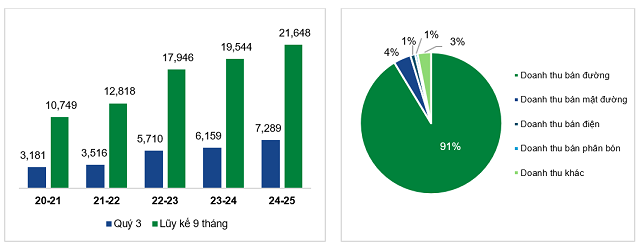

TTC AgriS (SBT): In contrast to the industry trend, TTC AgriS, the industry leader in scale, recorded an 18% increase in revenue for Q3 of the 2024-2025 fiscal year, reaching 7,289 billion VND. However, the cost of goods sold increased faster than revenue, causing the gross profit margin to narrow to 10.2%, a 2.6 percentage point decrease from the previous year. Nevertheless, through the optimization of financial expenses (down 21%) and controlled selling and management expenses, SBT managed to achieve a 6% increase in net profit, totaling 217 billion VND.

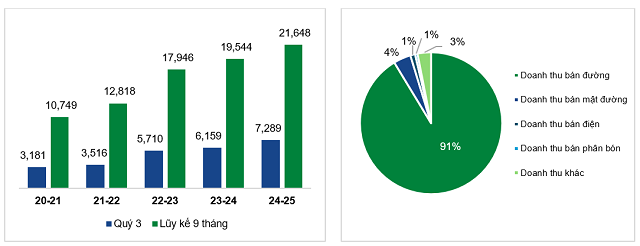

SBT’s Revenue Breakdown for Q3, 2024-2025 Fiscal Year (Source: Consolidated Financial Statements of TTC AgriS)

|

Sugar remains SBT’s core business, contributing 91% of the company’s revenue with 6,659 billion VND, while molasses accounted for approximately 4%. During this quarter, the company sold nearly 348,000 tons of sugar, a 26% increase. Domestic sales rose by 31%, and exports grew by 16%, bringing the nine-month cumulative total to over 1 million tons, a 13% increase from the previous year.

For the first nine months of the fiscal year, SBT achieved an 11% increase in revenue, totaling 21,648 billion VND, and an 18% rise in net profit, reaching 652 billion VND. The company has fulfilled 83% and 86% of its annual revenue and net profit plans, respectively.

Kon Tum Sugar Joint Stock Company (KTS): Kon Tum Sugar Joint Stock Company managed to maintain profit growth, albeit at a modest rate of 1%, resulting in a net profit of over 11.4 billion VND. While revenue decreased by 25% to 64 billion VND, the cost of goods sold declined even further, leading to a gross profit margin improvement of 6.4 percentage points to 31.6%—the highest in the industry for this quarter and the highest for the company in the last decade.

| KTS’s Gross Profit Margin from 2015 to 2025 |

Revenue primarily came from the sale of refined sugar and molasses, although both experienced decreases of 32% and 35%, respectively, compared to the previous year. Thanks to strong performance in the first half of the fiscal year, KTS achieved impressive nine-month results, with revenue surpassing 240 billion VND (a 50% increase), and a pre-tax profit of over 31 billion VND (a 179% surge), exceeding 16% of the annual plan. Net profit reached approximately 30 billion VND, marking an impressive 187% increase.

Lam Son Sugar Joint Stock Company (Lasuco, LSS): In contrast, Lam Son Sugar Joint Stock Company experienced the most significant decline this quarter. Revenue fell by 18% to over 595 billion VND, and net profit decreased by 40% to 19 billion VND. While the gross profit margin improved slightly to 13.8%, a substantial increase in financial and selling expenses significantly impacted profitability.

For the nine-month period, revenue declined by 7% to 1,664 billion VND, and pre-tax profit stood at nearly 76 billion VND (a 29% drop). With a net profit target of nearly 144 billion VND, the highest in seven years, LSS has accomplished only about 53% of its goal. Net profit reached 58.5 billion VND, a 35% decrease.

Son La Sugar Joint Stock Company (SLS): Son La Sugar Joint Stock Company reported a 13% decrease in net profit for Q3 of the fiscal year, totaling 89 billion VND, despite a 20% increase in revenue to 290 billion VND. The cost of goods sold soared by 40%, causing the gross profit margin to shrink to 30.8%, the lowest in two years. According to the company, the domestic sugar market experienced an oversupply, coupled with the impact of smuggled sugar, which led to a significant drop in selling prices.

However, thanks to exceptional results in the first half of the fiscal year, SLS exceeded 85% of its annual profit target. The nine-month net profit reached nearly 278 billion VND (a 5% decrease), while revenue achieved 72% of the annual plan. SLS is exempt from corporate income tax due to its operation in a particularly challenging area, resulting in equal pre-tax and post-tax profits.

Inventory Surge and Oversupply Pressure

A surge in inventory is a common trend across the industry this period. As of March 31, 2025, QNS’s inventory increased by 85% compared to the beginning of the year, reaching 2,450 billion VND, mainly due to a five-fold increase in finished goods inventory, which rose to over 1,920 billion VND. SBT’s inventory also grew by 10% compared to the beginning of the fiscal year (June 30, 2024), reaching 4,402 billion VND. LSS and KTS witnessed inventory increases of 79% and 55%, respectively, while SLS’s inventory rose by 43%.

The pressure of oversupply, competition from imported sugar from ASEAN countries with a 5% tariff, smuggled sugar through the southwestern border, and the increasing popularity of HFCS corn syrup, have all contributed to a decrease in the consumption of traditional sugarcane sugar. High production costs, low sugarcane yield, and limited effectiveness in managing raw material areas remain significant challenges for domestic businesses to compete effectively.

Outlook for the Sugarcane Industry

In the short term, domestic sugar prices are expected to remain under pressure due to large inventories and intense competition. However, effective trade defense measures and improvements in productivity and cost reduction by businesses could stabilize prices by the end of 2025.

In the long term, Vietnam’s sugar prices will continue to depend on global price fluctuations, international trade policies, and intrinsic competitiveness. Businesses, investors, and managers need to closely monitor the market, develop flexible response scenarios, and enhance risk management strategies to capitalize on opportunities during market fluctuations.

– 08:00 27/05/2025