|

Donald Trump at a bitcoin conference in Nashville last year © Bloomberg

|

The Trump family’s media empire is planning to raise $3 billion to invest in cryptocurrencies like bitcoin, betting big on the digital asset class that has gained the backing of the US president.

Trump Media and Technology Group (TMTG), the entity behind the Trump-controlled Truth Social app, aims to raise $2 billion in new equity and $1 billion through convertible debt.

TMTG’s fundraising round is expected to be announced ahead of a major gathering of crypto investors and enthusiasts in Las Vegas this week, where Vice President JD Vance, Trump’s sons Donald Jr. and Eric, and the former president’s crypto czar, David Sachs, are slated to speak.

The terms, timing, and size of the fundraising round are still subject to change. According to two sources familiar with the matter, the offering size has been increased in recent weeks due to strong demand.

This plan is the latest example of the Trump family’s growing involvement in cryptocurrencies, raising concerns about potential conflicts of interest. The president has pledged to make the US the “crypto capital of the world.”

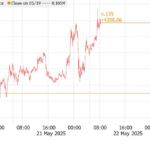

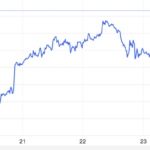

His interest in this space has spurred a wave of deals aiming to capitalize on the resurgence of the crypto market. Bitcoin prices surged to a record high of $109,000 last week.

TMTG’s capital-raising strategy mirrors that of Strategy, formerly known as MicroStrategy, an old software company that saw its market value soar to over $100 billion after using debt and equity issuance to buy tens of billions of dollars worth of bitcoin.

The secondary stock offering will be made at market prices, meaning the shares are expected to be sold close to the closing price of $25.72 on May 23. TMTG’s market value stood at nearly $6 billion as of the market close on May 23.

The Trump family’s foray into crypto includes the launch of an NFT trading card, two memecoins, and investments in the American Bitcoin mining project and the stablecoin sponsor, World Liberty Financial.

TMTG also plans to launch a crypto-focused exchange-traded fund (ETF). Last week, Trump hosted a private dinner for top investors in his memecoin at his resort outside Washington.

ClearStreet and BTIG are among the brokerage firms that could act as underwriters for the deal, according to two sources.

After reclaiming the White House last year, Trump transferred a 53% stake in TMTG, now worth about $3 billion, to a revocable trust overseen by his son, Donald Jr., who has full voting and investment power over the trust’s holdings.

In April, a special purpose acquisition company (SPAC) going public run by Brandon Lutnick, the son of Commerce Secretary Howard Lutnick, signed a deal to create a bitcoin-buying fund, with Tether and SoftBank participating in the $3.6 billion deal.

Crypto company Ripple also reached a $1.25 billion agreement last month to acquire digital asset-focused brokerage Hidden Road, betting that institutional investors will ramp up their crypto investments under the new administration.

Industry leaders predict a wave of similar crypto-focused deals, particularly among special purpose acquisition companies, in the coming weeks.

– 08:30 05/27/2025

Trump Threatens to Make Apple and Samsung ‘Uneasy’

According to the Korea Herald, President Donald Trump’s threat of a 25% tariff on Apple and Samsung Electronics has sent shockwaves through the two leading smartphone manufacturers and their partner companies. This decision could potentially disrupt supply chains and drive up phone prices in the crucial US market.

The American-Made iPhone: A Pricey Surprise

The iPhone is an iconic smartphone brand, but what would happen if its production moved back to the USA? The cost of manufacturing in the States is significantly higher than in other countries, and this would have a huge impact on the final price tag. A potential price of $3,500 per unit is not out of the question, a stark contrast to the current pricing strategy and a huge barrier for consumers.

The Ultimate Cryptocurrency: Bitcoin Soars to New Heights

The crypto market is witnessing a historic milestone as Bitcoin surges past the $110,000 mark for the first time, ushering in a new era in its journey to unprecedented heights. This breakthrough event reflects the growing optimism among investors about the future of this digital currency.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)