The stock market has seen a slight upward trend since the beginning of the year, but most stocks have underperformed the VN-Index. Many investors find it challenging to profit from the market as the upward momentum is concentrated on a few groups of stocks. This situation is expected to test investors’ patience in the short term.

On the other hand, the market’s polarization presents an opportunity to accumulate stocks with high dividend yields (cash dividends/market price), catering to long-term investment needs. Vietnam’s stock market boasts numerous stocks with a history of high dividend payouts, ranging from tens to even hundreds of percent, coupled with superior dividend yields compared to bank deposit interest rates (around 5%).

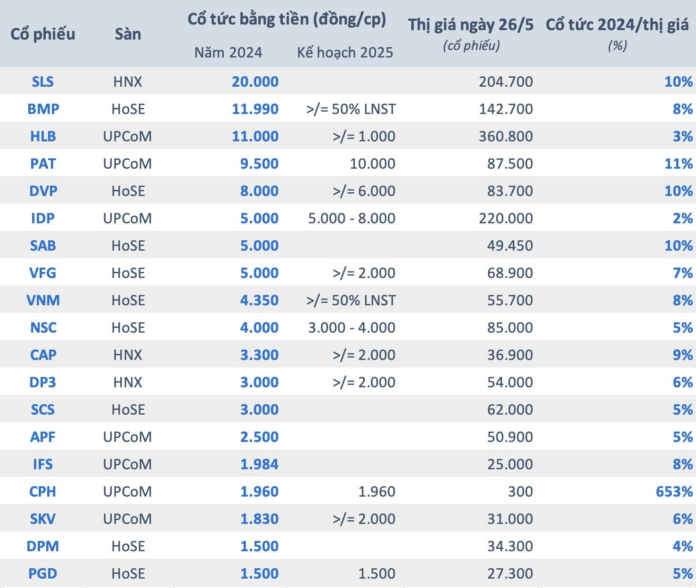

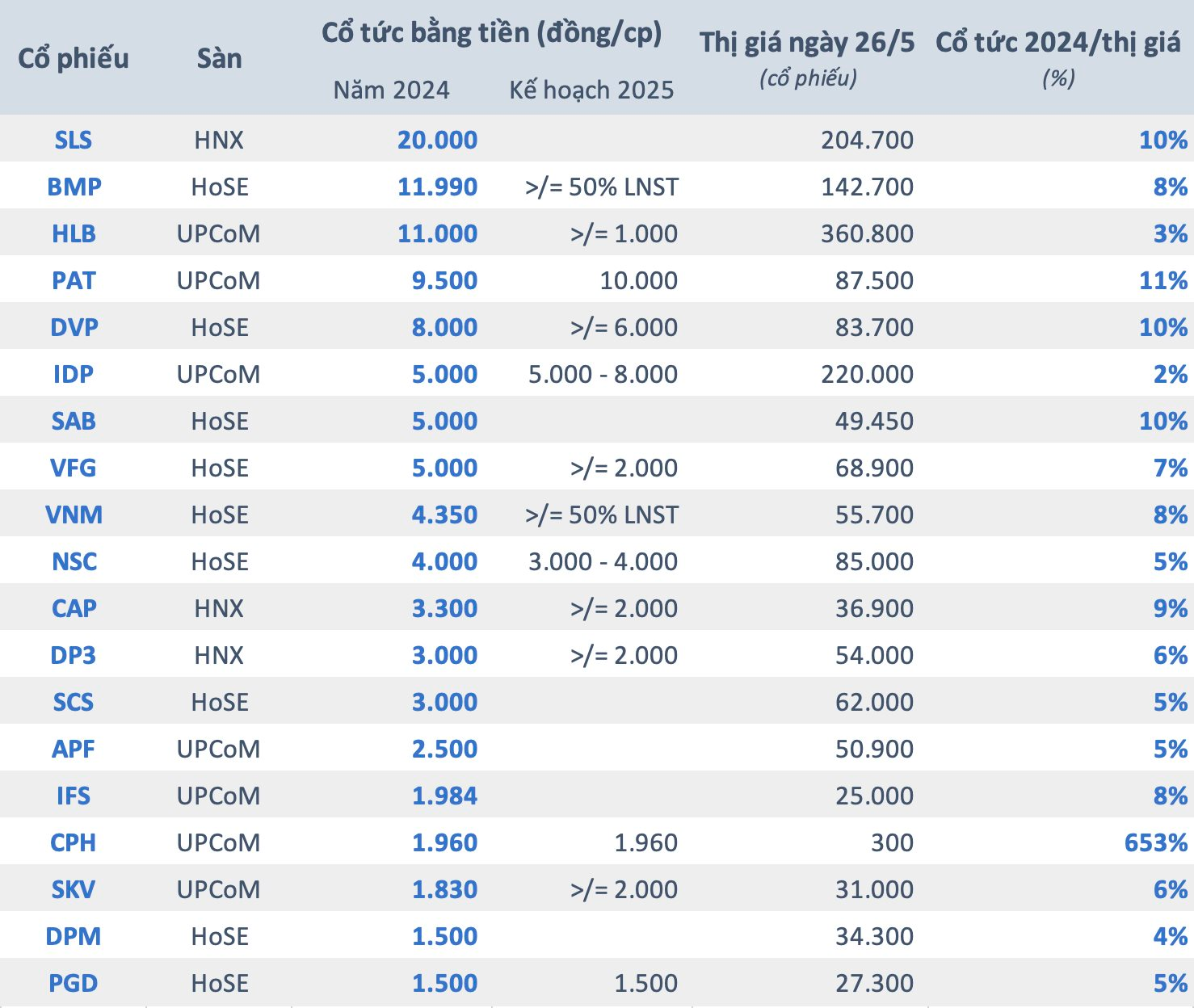

A preliminary analysis based on cash dividends for 2024 and current market prices reveals numerous stocks with dividend yields above 5%, including SLS, BMP, PAT, DVP, SAB, VNM, CAP, and IFS. Notably, a few cases, such as CPH, have dividend yields exceeding 650% due to high cash dividend payout ratios over the years, resulting in a market price adjustment to 300 VND.

When a stock pays dividends, its market price is adjusted downward, and the investor’s cost basis is reduced accordingly. For stocks with a history of high annual cash dividend payouts, long-term shareholders may even have a cost basis approaching zero. The annual cash dividends become a passive income stream that investors can use for their expenses or reinvest for compound returns.

Moreover, consistently high cash dividends are indicative of a company’s financial health. The dividend policy is maintained on the foundation of a robust and profitable business. Stable or growing profits will eventually drive the stock price upward, creating a double benefit for investors.

In reality, companies with a history of consistently high annual cash dividends are mostly in the manufacturing sector. These enterprises typically maintain stable profits, and some even experience growth, setting the stage for generous dividend policies. Furthermore, many of these companies are state-owned, and high dividend payouts are almost mandatory.

It is essential to note that the “safe and steady” approach of focusing on dividends is more suitable for long-term investors as dividend payouts hold less significance in the short term. Chasing dividend trends can sometimes lead to a “trapped” position in the short run. With a speculative mindset, investors may lack the patience to hold on, missing out on attractive long-term profit opportunities.

In the context of a volatile stock market, the dividend-focused investment strategy becomes even more effective. It is no coincidence that many large investment funds in the market have embraced this approach. The latest entrant is the KIM Growth Dividend Stock Fund (KDEF) – the first domestic open-ended fund in the KIM Vietnam ecosystem.

Prior to KIM Vietnam, prominent organizations such as Dragon Capital, VinaCapital, VCBF, and UOBAM have also launched open-ended funds with a dividend focus. While each fund has its investment strategy, their portfolios generally target leading enterprises with attractive dividend yields, robust cash flows, and long-term growth potential.

A Shipping Stock Surges Despite HoSE’s Warning

The VOS stock surge came immediately after the Ho Chi Minh City Stock Exchange (HoSE) issued a warning about the delayed disclosure of the board resolution on May 22.

The Expert’s Take: Only 154 Stocks Out of the 10% Losers Trailing VN-Index, Opportunities in Mid-Cap Space

The HoSE boasts an impressive performance with 42 stocks surging over 30%, and a further 215 stocks experiencing gains of between 10% and 30%. The remaining 154 stocks still managed a rise of under 10%. With over two-thirds of the market gaining under 30% and half of the HoSE’s stocks outperforming the VN-Index, it showcases a robust and diverse market.

How Do Investor Groups Trade During Unexpected Volatile Sessions?

The market experienced a highly volatile session, with an intensity that didn’t quite match the previous session on April 22nd. The opening index plummeted by almost 20 points, but this downward trend quickly reversed, and the index gradually climbed upwards. Fueled by investors’ expectations regarding trade negotiation outcomes, the index closed with an 18.05-point gain, surging towards the 1,332.51 price level.

The Great Exodus: Capital Fleeing Steel Stocks and Industrial Real Estate

Market liquidity took a hit last week. The steel and industrial real estate sectors witnessed prominent outflows, making them the most notable victims of this downturn.