The total value of corporate bond issuances in April 2025 reached VND 46.9 trillion, a 2.7-fold increase from the previous month and a 2.4-fold increase from the same period last year. This was mainly driven by the Banking group.

Banks continued to lead in terms of new issuance value in April, with a total of VND 33 trillion raised through private placements and public offerings. This accounted for 70.4% of the total market issuance, marking an increase of 182% from the previous month and 254% from the same period last year.

The value of corporate bond issuances by non-banking groups reached VND 13.9 trillion, a significant surge of 152.7% compared to March 2025 and 33.7% from the same period last year.

Despite the noticeable recovery in April, the cumulative value for the first four months of the year showed that non-banking groups have only raised a total of VND 19.7 trillion through bonds, a sharp decrease of 42% from the same period in 2024. This decline can be attributed to stricter regulations in the amended Securities Law of 2024, which came into effect on January 1, 2025, and Circular No. 76/2024/TT-BTC, effective from December 25, 2024.

A notable development in April 2025 was the return of the Real Estate group to the corporate bond market after a three-month absence. The total issuance value of the industry reached VND 12.7 trillion, a 43% increase from the same period last year, and accounted for 91.7% of the total issuance of the non-banking group for the month. The average coupon interest rate for the Real Estate group rose to 10.7%/year, significantly higher than the 8.3%/year recorded in the previous month.

This improvement was mainly driven by Vingroup (VIC), which issued bonds with a total value of VND 9 trillion, marking the first time the company has returned to the corporate bond market after a 10-month hiatus. VIC’s bonds had an average term of 2.5 years, with coupon rates ranging from 12% to 12.5%/year, on par with the rates observed in the 2023-2024 period.

According to data from FiinPro-X as of May 15, issuing organizations have made total payments of VND 42.2 trillion in corporate bond principal and interest so far in 2025, including an estimated VND 6.1 trillion paid out in the first 15 days of May.

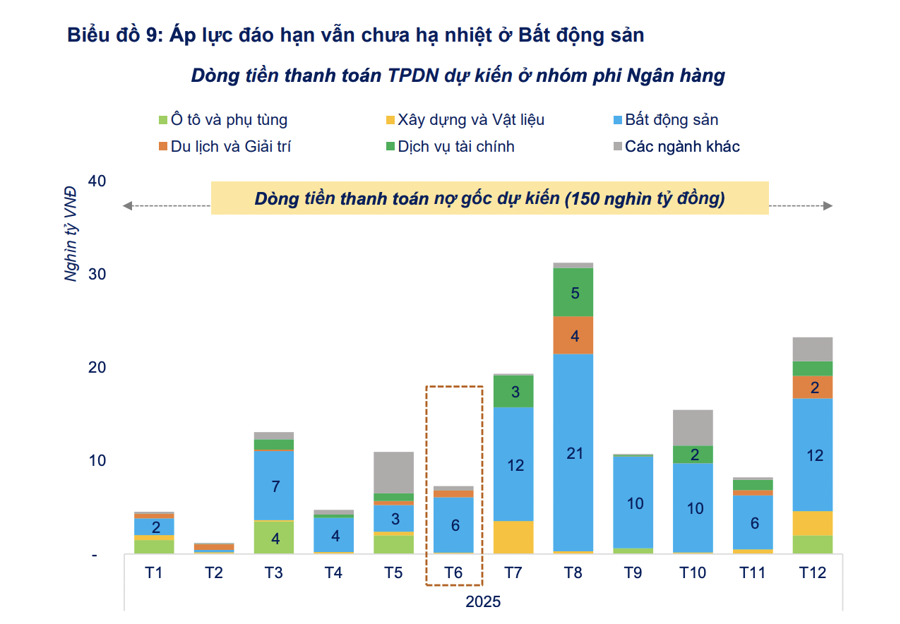

The projected amount of principal and interest payments for May is approximately VND 17.3 trillion, rising to over VND 20.7 trillion in June, bringing the total payment obligation for the second quarter of 2025 to around VND 47.5 trillion. No new cases of delayed principal or interest payments were recorded in the market during April 2025.

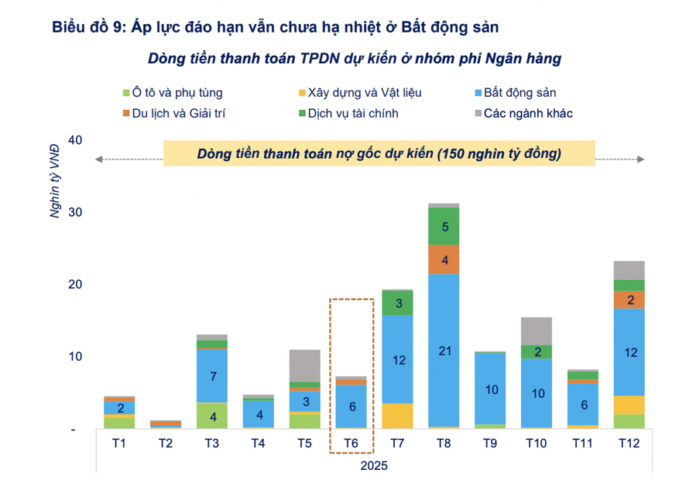

The pressure on non-banking groups to repay bond principal is expected to ease significantly in June 2025 compared to the previous month. Specifically, the total value of bond principal payments due in June 2025 for non-banking groups is estimated at VND 7.3 trillion, a decrease of 33.6% from the VND 11 trillion recorded in May but an increase of 54% from April (VND 4.7 trillion).

Real Estate continues to account for a large proportion, with approximately VND 5.9 trillion in bonds maturing in June, equivalent to 61.4% of the total market maturities for the month. This figure is also double the estimated maturities for the industry in May.

Notable issuers with bonds maturing during this period include Saigon Glory (VND 1.1 trillion), Signo Land (VND 1 trillion), and NLG (VND 660 billion).

Banks are expected to have VND 2.4 trillion in corporate bond principal payments due in June 2025, mainly attributed to Orient Commercial Joint Stock Bank (OCB) with maturities of VND 1.6 trillion. The real test for the credit institutions group will come in the last six months of 2025, with estimated maturities of corporate bonds totaling VND 42.9 trillion.

The total corporate bond principal payments due for non-banking groups in the remaining eight months of 2025 (from May to December 2025) are expected to be around VND 126.4 trillion, with the Real Estate sector accounting for approximately VND 79.4 trillion, or 63% of the total.

The interest payments on corporate bonds by non-banking groups in June 2025 are estimated to exceed VND 6.8 trillion, a 36% increase from May 2025 and the highest in the second quarter. Once again, the Real Estate sector accounts for a significant proportion, representing 31.7% of the total projected interest payments across the market.

Additionally, the Tourism and Entertainment, and Financial Services sectors also recorded significant interest payments during the month, accounting for 9.9% and 6% of the total projected interest payments, respectively.

For the remaining eight months of 2025, the total estimated interest payments on corporate bonds for non-banking groups are approximately VND 45.6 trillion. The Real Estate sector is expected to account for more than half (53%) of this amount.

The Ultimate Bond Offering: Unveiling ACBS’s 5,000 Billion “Triple No” Bond Issuance

On May 16, the Board of Directors of ACB Securities (ACBS) approved a resolution to file for a public offering of bonds in 2025 to supplement its operating capital.

April 2025 Private Placement Memorandum: Back with a Bang, But So Are Defaults.

After a subdued start to the year, the private placement of corporate bonds picked up pace in April, with issuances totaling over VND 38,000 billion—a remarkable twofold increase compared to the same period last year.