Thuduc House JSC (Thuduc House, Stock Code: TDH, HoSE) has recently disclosed information regarding an administrative decision on tax management through the suspension of invoice usage by Area II Tax Department.

The reason for this enforcement is due to Thuduc House having tax arrears exceeding 90 days from the due date as per regulations, with the enforced amount totaling over 88.9 billion VND. The enforcement was implemented on April 22, 2025, at 11:35 AM (applicable to cases where the taxpayer uses electronic invoices).

Illustrative image

Previously, on February 26, 2025, Thuduc House also announced receiving a decision from Ho Chi Minh City Tax Department (now Area II Tax Department) on enforcing administrative decisions on tax management by deducting over 90.6 billion VND from the company’s account.

In another development, Thuduc House has recently published the documents for its upcoming 2025 Annual General Meeting of Shareholders, scheduled to be held on June 27, 2025, at Ben Thanh (REX) Hotel, 141 Nguyen Hue, District 1, Ho Chi Minh City.

At the meeting, the company plans to present to the shareholders reports from the Board of Directors, General Director, and Audit Committee, as well as seek approval for the 2025 business plan and profit distribution plan. The meeting will also address the approval of remuneration paid in 2024 and the 2025 remuneration plan for the Board of Directors and Audit Committee, election of the Board of Directors for the term 2025 – 2030, and other arising issues if any.

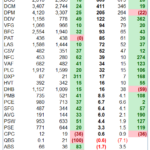

Regarding business performance, according to the consolidated financial statements for the first quarter of 2025, Thuduc House recorded net revenue of nearly 8 billion VND, a decrease of 21.2% compared to the same period last year. Thanks to other income of nearly 7.7 billion VND, the company reported a net profit of nearly 5.7 billion VND in the first quarter of 2025, while there was a net loss of nearly 1.7 billion VND in the same period last year.

As of March 31, 2025, the company’s total assets decreased by 5.5 billion VND compared to the beginning of the year, amounting to nearly 680.2 billion VND. Inventories accounted for 33.7% of total assets, totaling over 229.3 billion VND.

On the liability side of the balance sheet, total liabilities stood at nearly 604 billion VND, a decrease of 11.2 billion VND from the beginning of the year. Advance payments from customers accounted for 42.6% of total liabilities, totaling over 257.3 billion VND, while short-term payables to suppliers accounted for 23.2%, totaling over 140.1 billion VND.

Two Hòa Bình Construction Leaders Register HBC Stock Trading

The Vice Chairman of the Board of Directors and Standing Deputy General Director of Hoa Binh Construction, Le Viet Hieu, intends to purchase 500,000 HBC shares. In a contrasting move, CEO Le Van Nam plans to offload the same number of shares during this period.

The Dynamic Duo of BCG and TCD: Restricted Trading and Stock “Plummeting”

On May 20, the Ho Chi Minh City Stock Exchange (HOSE) announced that it would transfer BCG from control to restricted trading from May 27, due to a delay in submitting its audited financial statements for 2024, exceeding the regulatory deadline by 45 days. On the same day, another stock belonging to the Bamboo Capital family, TCD, faced similar punitive action from HOSE for the same infraction.