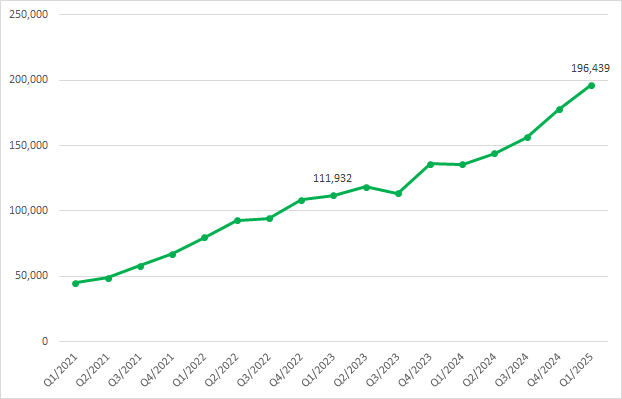

The scale of proprietary trading, reflected in the balance of financial assets recognized through profit and loss (FVTPL) of securities companies, has continuously grown in recent years. According to VietstockFinance data, as of Q1 2025, the FVTPL asset balance exceeded VND 196 trillion, a 10% increase from the beginning of the year. Within just two years, since Q4 2022, the FVTPL asset block held by securities companies has nearly doubled. This is a record high in the history of securities companies’ operations.

|

FVTPL asset balance of securities companies as of the end of Q1/2025

Unit: Billion VND

Source: VietstockFinance

|

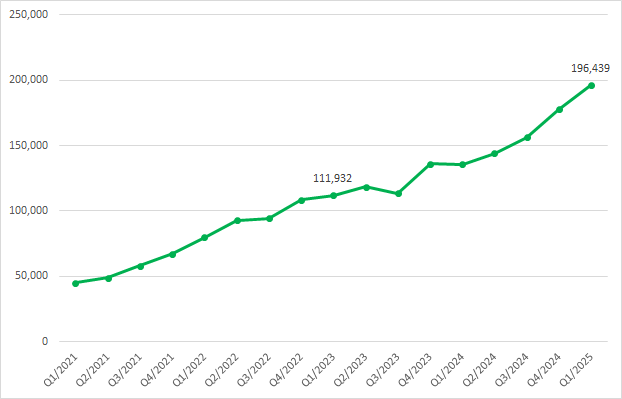

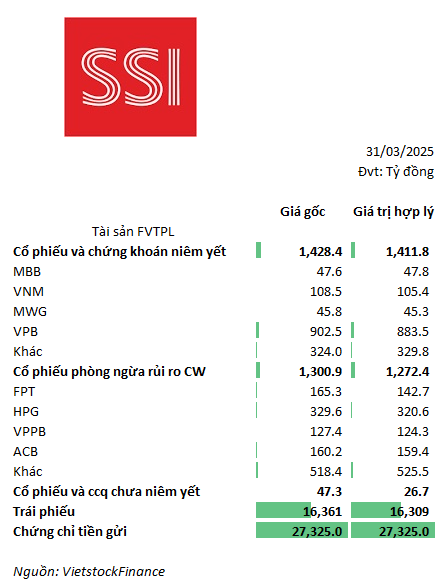

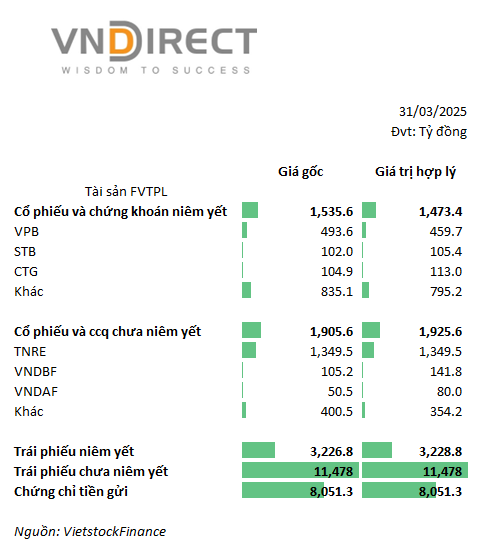

Among them, SSI Securities Company led in scale with an FVTPL asset balance of VND 46.3 trillion as of Q1. Following was VNDirect Securities Company (VND) with a portfolio valued at VND 26.1 trillion.

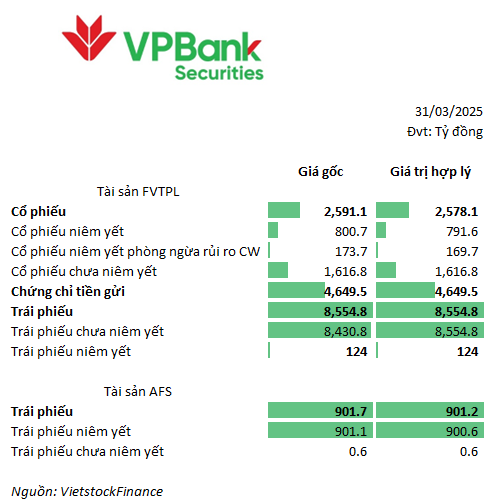

The remaining three companies in the top five were VPBank Securities Joint Stock Company (VPBankS), VIX Securities Joint Stock Company (VIX), and VPS Securities Joint Stock Company (VPS), all with portfolios exceeding VND 10 trillion, at VND 15.7 trillion, VND 12.6 trillion, and VND 10.2 trillion, respectively.

|

Top 20 securities companies with the largest FVTPL balance at the end of Q1/2025

Unit: Billion VND

Source: VietstockFinance

|

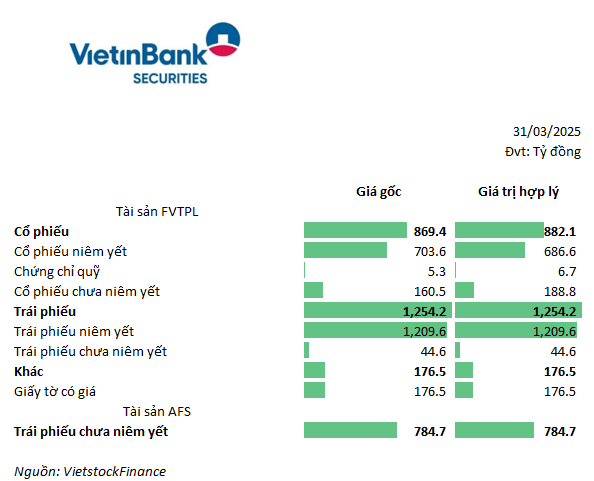

By observing the leading group in terms of FVTPL asset scale, we can identify the portfolio allocation trends of securities companies.

As the leader in FVTPL asset scale, SSI held over VND 1,400 billion in listed stocks and securities, and VND 1,300 billion in CW risk hedging stocks. The majority of the company’s FVTPL assets were in VND 27.4 trillion of deposit certificates and VND 16.3 trillion in bonds.

VND held a portfolio of unlisted bonds worth nearly VND 11.5 trillion. The second-largest allocation was in deposit certificates, valued at over VND 8 trillion. The company held VND 3.4 trillion in stocks and fund certificates, focusing on VPB, STB, and CTG stocks.

In its FVTPL portfolio, VPBankS also focused on unlisted bonds (VND 8.4 trillion) and deposit certificates (VND 4.6 trillion). On the other hand, the company held VND 1.6 trillion in unlisted stocks, accounting for over 60% of the stock portfolio. VPBankS recorded an AFS asset portfolio of over VND 900 billion in listed bonds.

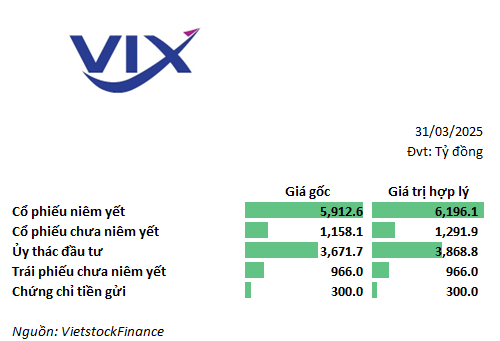

VIX Securities Company had a portfolio concentrated in listed stocks (nearly VND 6 trillion) and VND 3.7 trillion in investment trusts. The company also held VND 1.1 trillion in unlisted stocks.

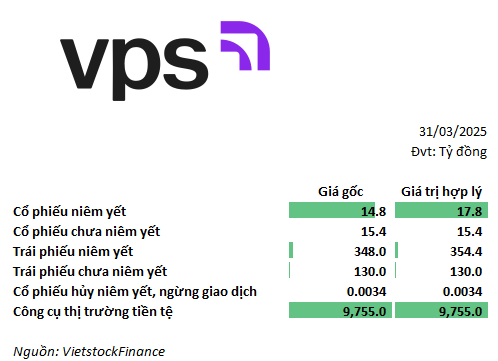

Meanwhile, VPS’s portfolio consisted mostly of money market instruments, valued at VND 9.7 trillion, or 95% of the total portfolio.

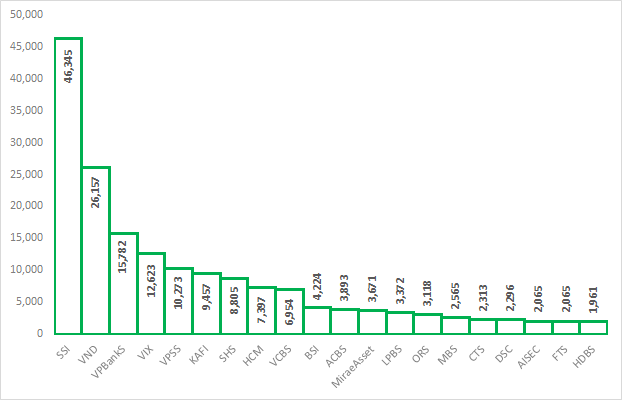

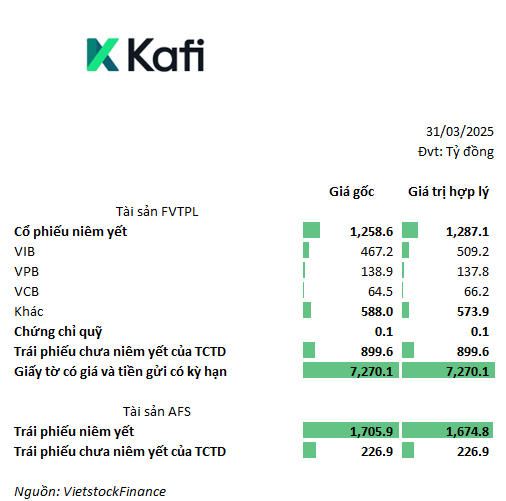

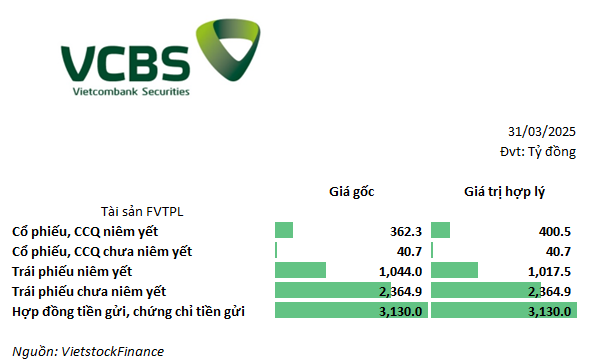

Similar to SSI and VPS, some securities companies followed a strategy of focusing on low-risk asset classes such as deposits and securities. Kafi Securities Company held VND 7.3 trillion in securities and term deposits, equivalent to nearly 80% of the FVTPL portfolio. VCBS Securities Company held VND 3.1 trillion in deposit contracts and certificates, accounting for 45% of its portfolio.

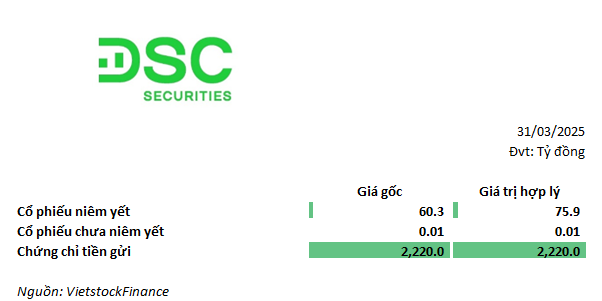

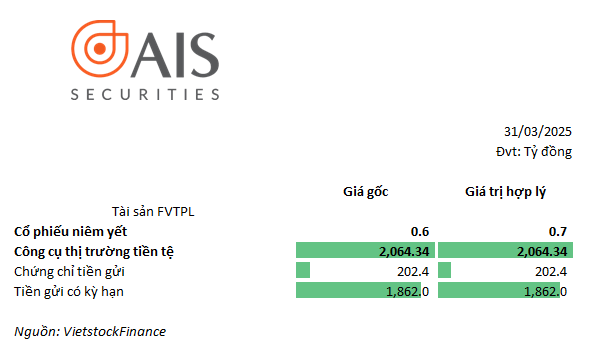

Likewise, nearly 97% of DSC Securities Company’s FVTPL portfolio value of VND 2.2 trillion was in deposit certificates. AIS Securities Company also held over VND 2 trillion in money market instruments, including deposit certificates and term deposits.

|

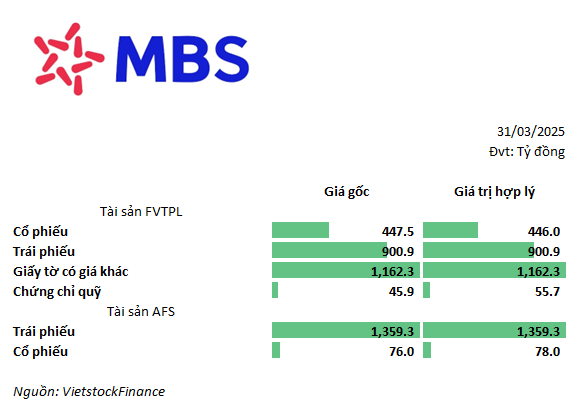

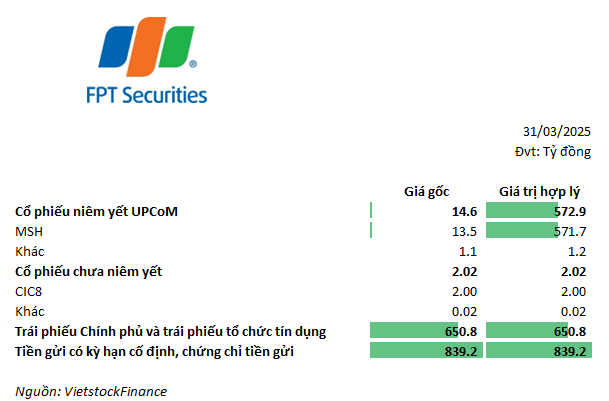

Group of securities companies with a strong allocation to low-risk assets

|

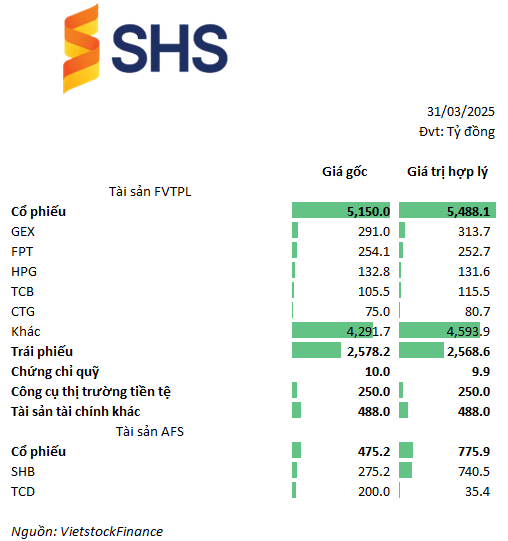

Some securities companies had different strategies, with a strong focus on stocks. SHS Securities Company’s FVTPL asset portfolio was mostly concentrated in stocks. The company provided detailed explanations for some notable investments such as GEX, FPT, HPG, TCB, and CTG. In addition, there were nearly VND 4.3 trillion in other stocks.

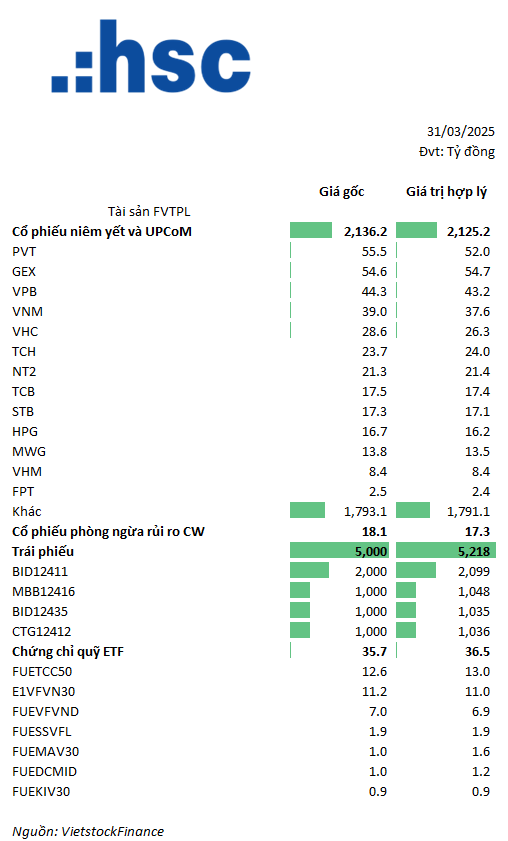

The portfolio of HSC Securities Company was focused on stocks (over VND 2.1 trillion) and bonds (VND 5 trillion). Some notable stocks included PVT, GEX, VPB, VNM, and VHC… As for bonds, the company focused on bank bonds, including BID, MBB, and CTG.

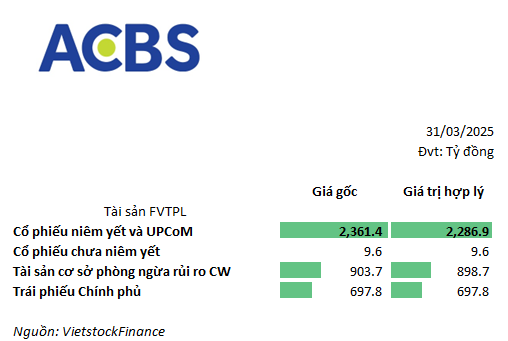

ACB Securities Company (ACBS) had a stock portfolio valued at over VND 2.3 trillion. In addition, the company also held over VND 900 billion in base stocks for CW risk hedging.

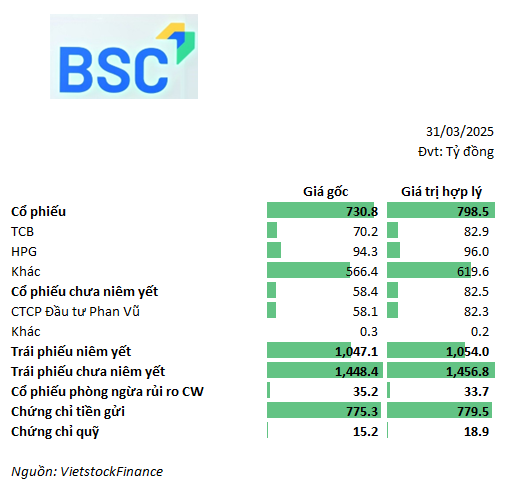

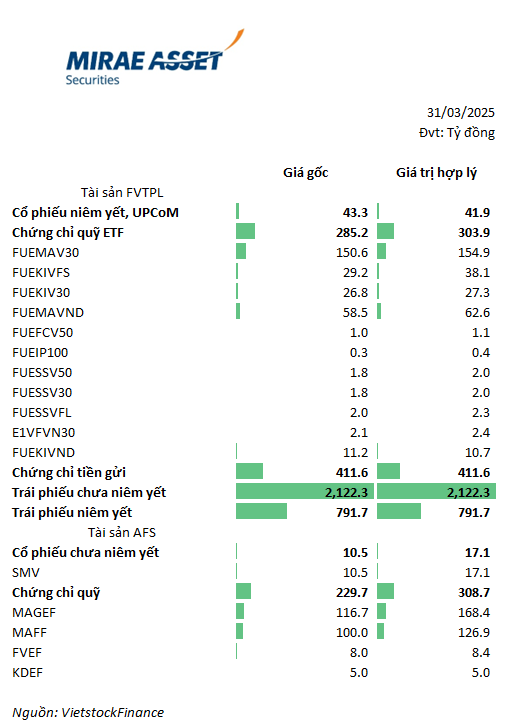

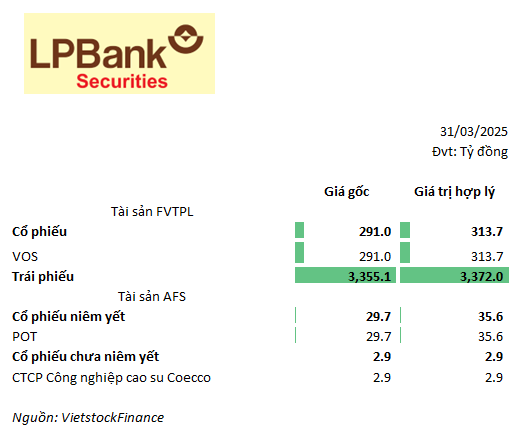

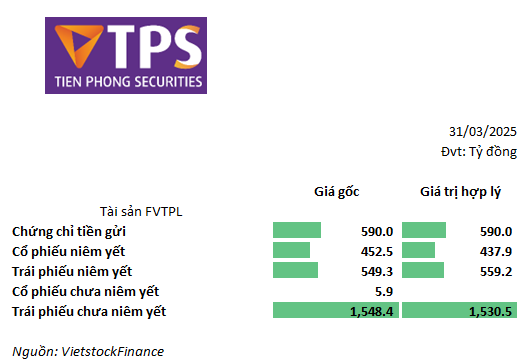

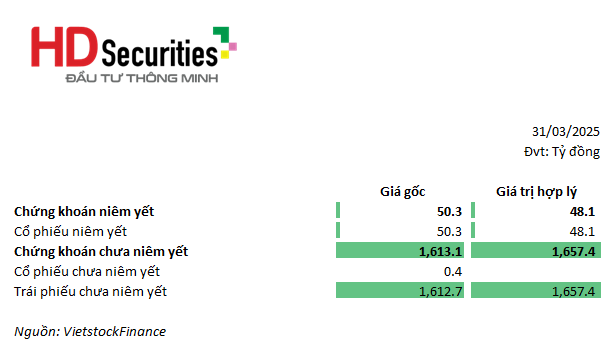

Another notable portfolio allocation strategy among securities companies was a focus on bonds. BIDV Securities Company (BSC) held VND 2.5 trillion in bonds (listed and unlisted), accounting for 60% of its portfolio value. Mirae Asset Securities Company held a bond portfolio valued at over VND 2.9 trillion, or 80% of its FVTPL portfolio. LPBS Securities Company held over VND 3.3 trillion in bonds. TPS Securities Company recorded VND 1.5 trillion in unlisted bonds, accounting for nearly 50% of its portfolio. Similarly, HD Securities Company held VND 1.6 trillion in bonds, equivalent to 97% of its portfolio.

– 12:00 27/05/2025

The Stock Code: Unveiling the Sudden Sell-Off by Proprietary Trading Firms

The HoSE witnessed a notable development as proprietary securities firms recorded net sales of VND 243 billion. This significant activity underscores the dynamic nature of Vietnam’s securities market and highlights the pivotal role played by these firms in shaping the landscape of capital markets in the country.

The Race for Brokerage Market Share: A Competitive Landscape

The stock brokerage industry is an intensely competitive landscape, with a fierce battle for market share always raging. In recent years, the zero-fee trend has only intensified this competition. As we move into 2025, which brokerage firms are poised to make a breakthrough and climb the market share rankings?