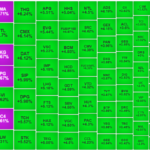

The trading session on May 26 surprised investors as the VN-Index plummeted sharply at the opening bell, losing more than 20 points and breaking below the 1,300-point threshold.

However, bottom-fishing forces and some sideline information circulating among investors propelled the entire market to a spectacular turnaround. The VN-Index closed the session with a gain of over 18 points, climbing to 1,332.51. From the intraday low, the index rebounded by as much as 40 points.

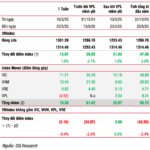

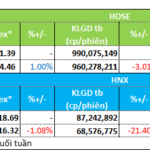

Liquidity in the market witnessed a notable improvement compared to the previous session, with the total trading value on the three exchanges surpassing VND25 trillion. On the HoSE alone, liquidity reached over VND22.1 trillion, marking an increase of more than VND5.3 trillion from the prior session.

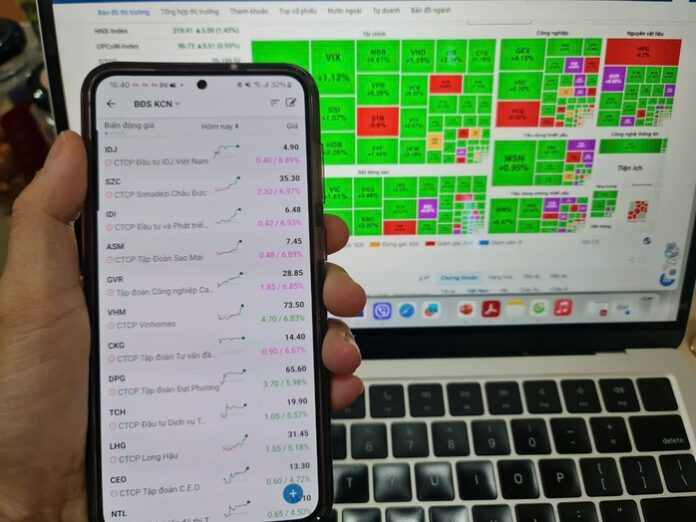

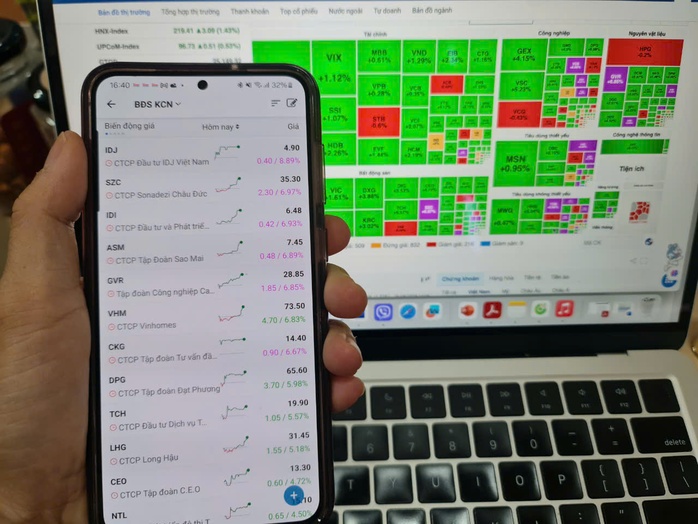

Notably, the afternoon rally witnessed the positive contribution of industrial real estate, construction, garment, seafood, and port stocks. Numerous stocks hit the daily limit-up, including GVR, CKG, IDJ, SZC, IDI, ASM, VGT, TNG, TCM, VHC, and ANV, leaving many investors surprised as these stocks had witnessed minimal volatility recently.

According to several securities companies, the session’s standout performers belonged to the garment and seafood sectors, which surged in unison following positive news on tariffs. Specifically, stocks in these sectors rallied after a statement from US President Donald Trump, who asserted that the tariff policies were not intended to support the garment industry but instead focused on boosting the domestic production of high-tech goods and military equipment. The US President stated that he did not want to focus on t-shirts or shoes but rather on chips and computers.

Many stocks closed at the ceiling price at the end of the trading session on May 26. Photo: Lam Giang

With this statement, countries with significant garment exports to the US could stand to benefit. The US is the primary export market for Vietnamese garment exports.

By maintaining the level above 1,300 points, experts believe that the year-end stock market outlook is very positive.

Speaking at a finance talk show hosted by NLD on May 26, Huynh Huu Phuoc, Director of Individual Customers and Director of Can Tho Branch of Dragon Vietnam Securities Company (VDSC), stated that the market bottom was established during the sharp decline in early April.

The VN-Index also retested the bottom for the second time, falling to around 1,130 points, before recovering swiftly in a V-shaped pattern. Therefore, from now until July 8, when official news about tariff levels post-negotiations is announced, the market will reflect this information in stock prices.

Experts shared their insights at the NLD talk show on May 26. Photo: Quang Liêm

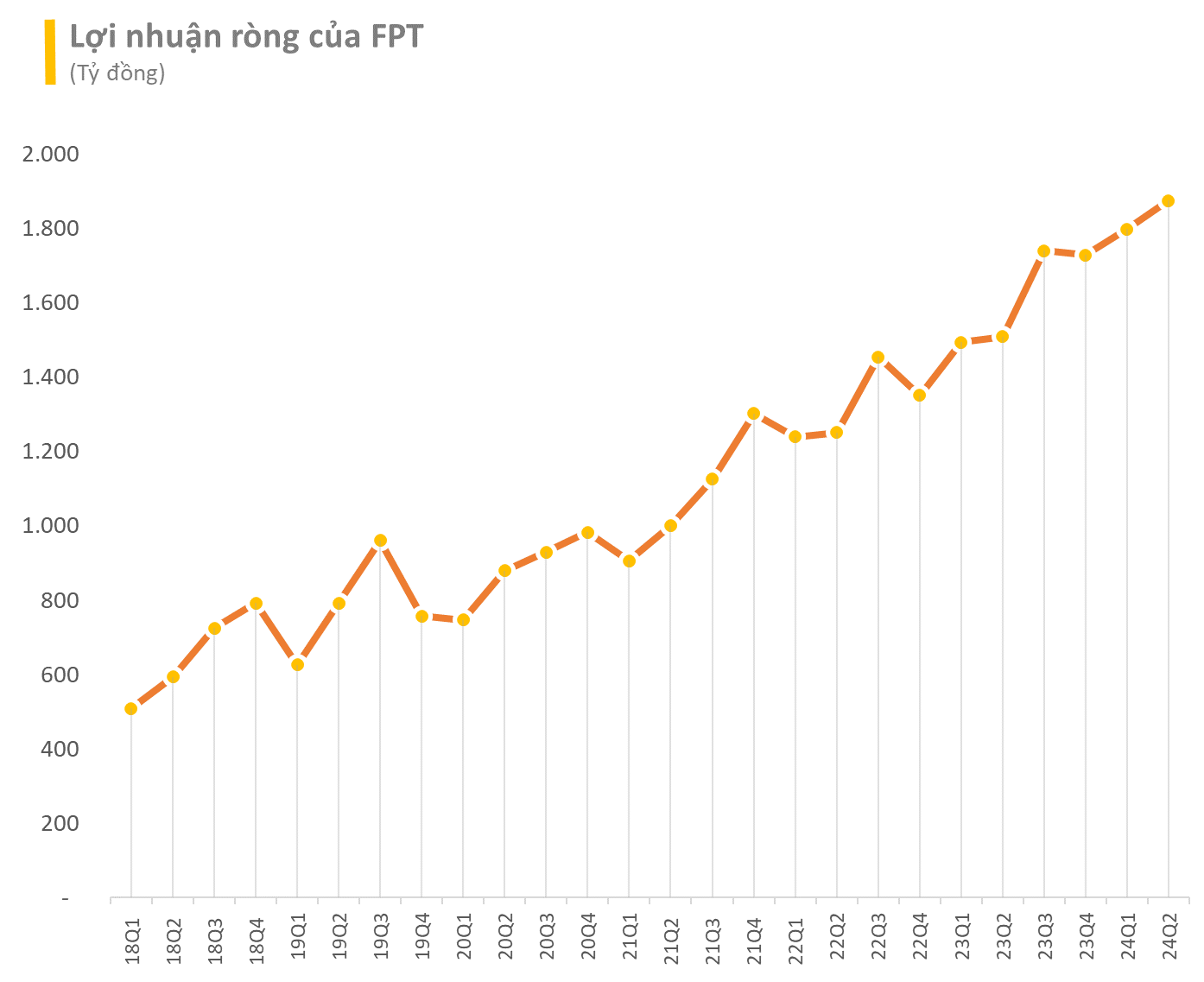

“The VN-Index is forecasted to fluctuate within the range of 1,040 – 1,380 points from now until the end of the year, and the rest depends on market reactions. With positive corporate earnings in the first quarter of 2025 and VDSC’s prediction of continued growth in the second quarter, based on low comparables from the previous year, the tariff policies, and export orders in April and May will be accelerated to take advantage of pre-tax rates. As such, the riskiest scenario has already materialized, and there is room for optimism and positive expectations.”

Dao Minh Chau, Deputy Director of the Analysis and Investment Consulting Center of SSI Securities Company, opined that after a strong recovery of over 20%, including many stocks surging by 40-50% or even doubling in value, the VN-Index needs time to consolidate. The market may experience volatility in the next 1-2 months due to uncertain information related to US tariff policies and the potential recession in some global economies.

“However, if any volatility occurs, it won’t be overly concerning, as the sharp drop in April 2025 and the tariff-related news have already been factored in, and enterprises have had time to prepare and respond,” Chau added.

The Bottom Fishers: Small and Mid-Cap Stocks See a Flood of Inbound Cash.

The market witnessed a wild swing on Monday as the VN-Index plummeted by almost 26 points before staging a remarkable recovery to gain 18.05 points. This was the biggest intraday swing since April 22, and the impact of bottom-fishing funds was notable.