Cafe với Chứng: VN-Index Rebounds as Large-Cap Stocks Surge

Source: CafeF

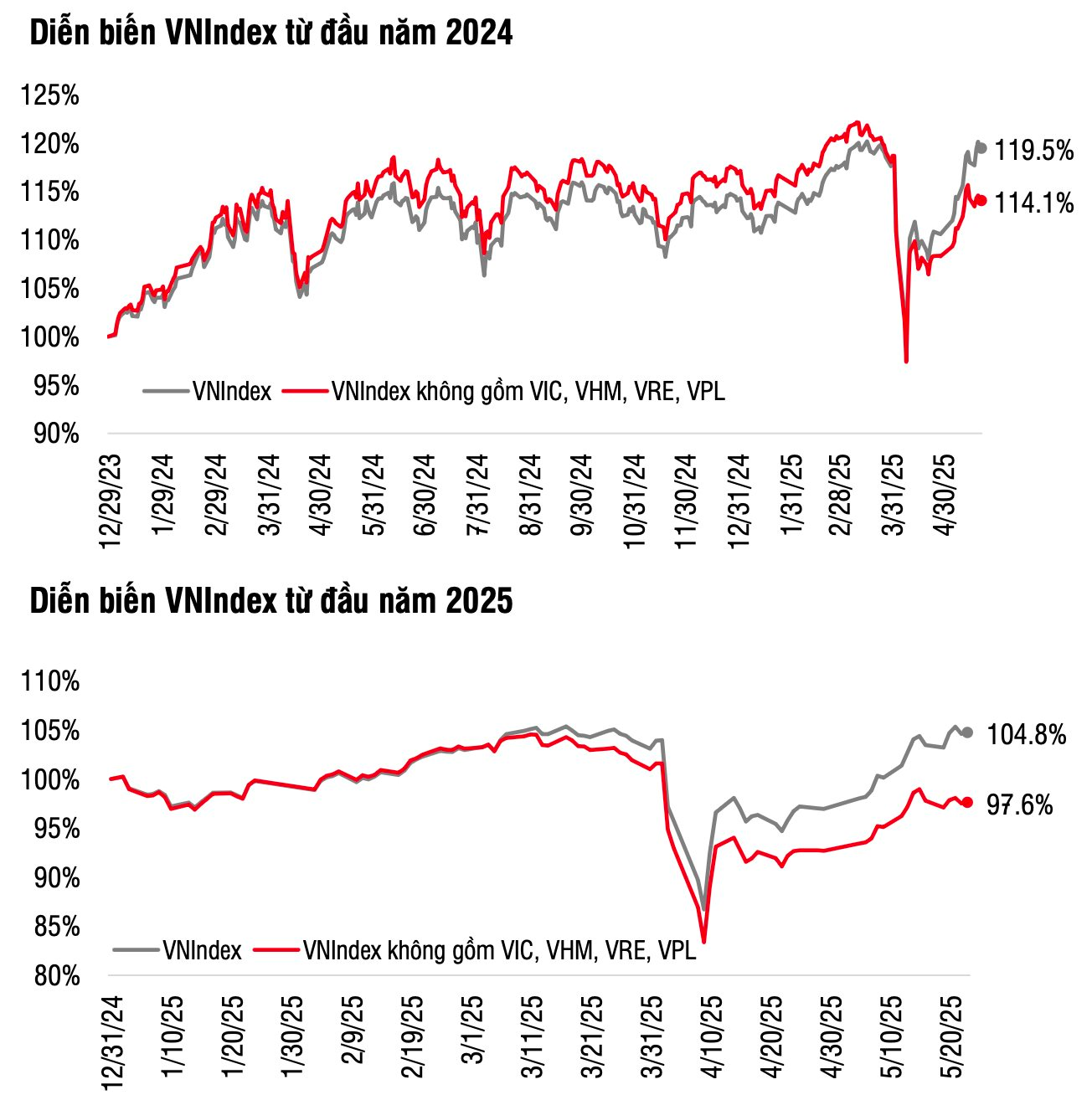

In the latest edition of Cafe với Chứng, SSI’s Chief Economist, Mr. Nguyen Luu Hung, shared a positive development: Vietnamese stocks bucked the global downward trend last week. As a result, the VN-Index has recovered its losses following the US tariff-related event.

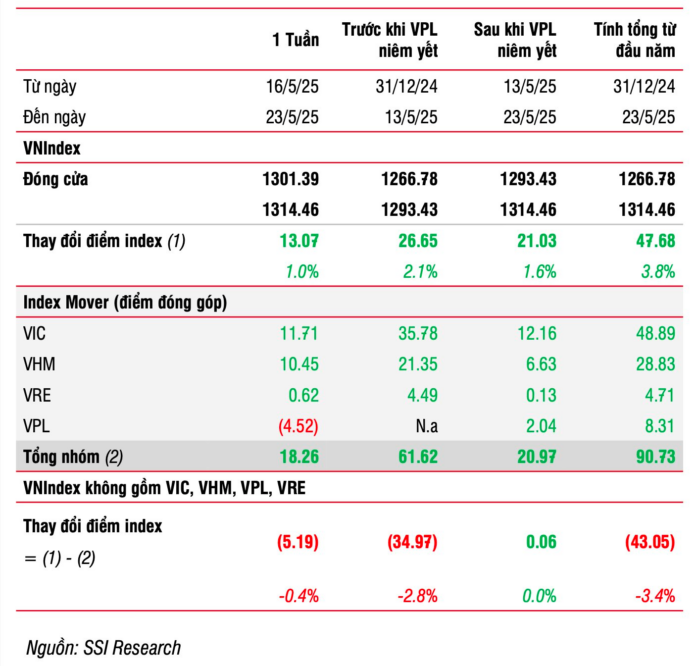

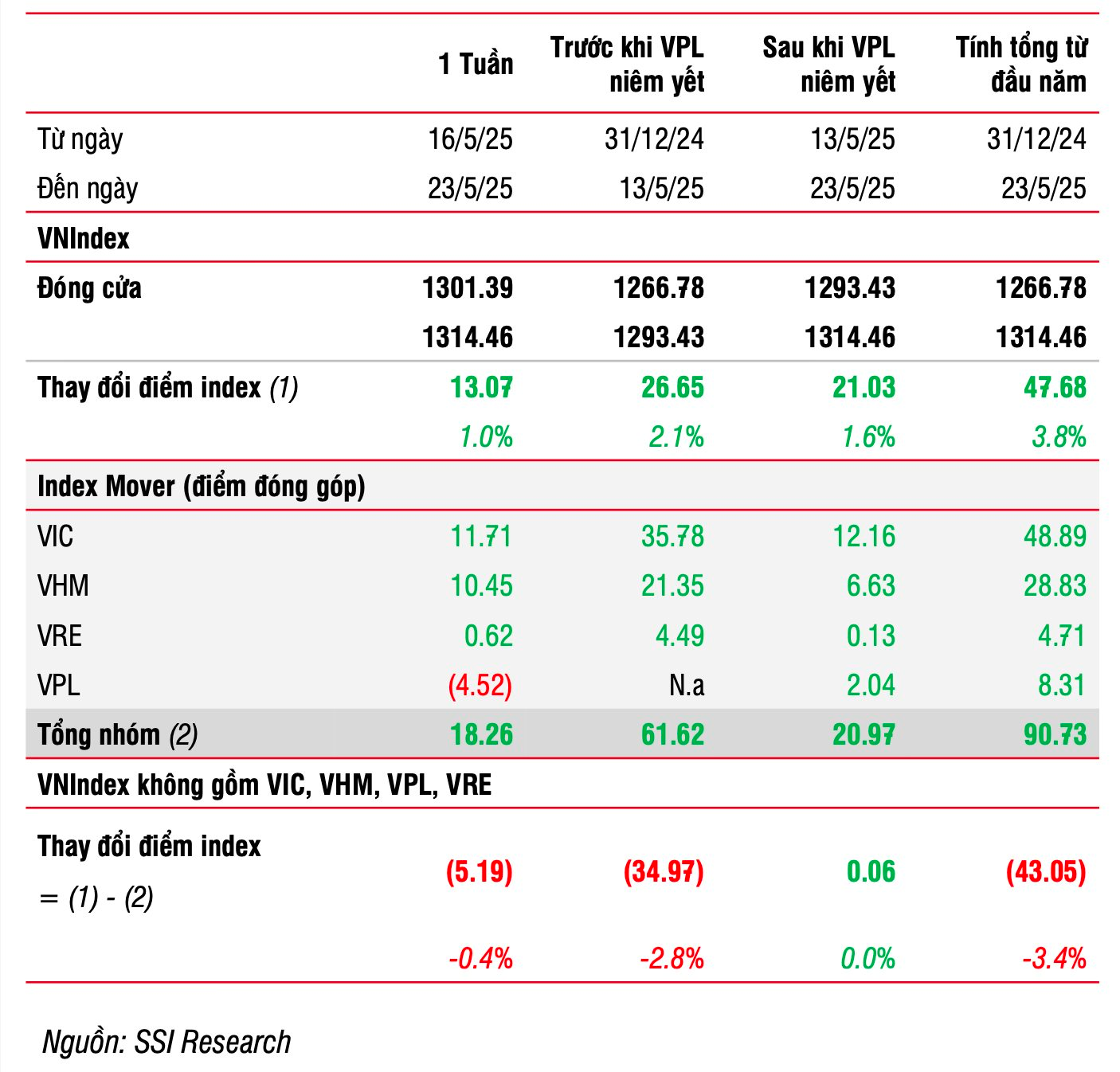

According to Mr. Hung, the main driver of the market’s gains came from large-cap stocks, especially the Vingroup group (VIC, VHM, VPL, VRE). “If it weren’t for the contribution of this stock group, the VN-Index would likely have fallen quite sharply and wouldn’t be at the 1,300 level as it is today,” SSI’s Chief Economist analyzed.

Source: SSI Research

Explaining the surge in some large-cap stocks, Mr. Hung attributed it to investor expectations regarding Resolution 68 on promoting the private sector. “In reality, Resolution 68 doesn’t just impact large enterprises; small and medium-sized enterprises can also benefit. However, parts 5 and 6 of the Resolution specifically mention building large private enterprises and supporting their participation in important national infrastructure projects. Large-cap stocks could benefit from this, so the price increase isn’t unreasonable,” assessed SSI’s Chief Economist.

Another factor influencing the market’s performance was foreign transaction activity. After strong net buying for two consecutive weeks, foreign transactions slowed and turned to net selling last week. However, Mr. Hung doesn’t consider this a significant issue for the Vietnamese stock market. Developed markets are experiencing strong capital outflow pressure, and there is a trend of capital flowing into emerging markets in many countries, and Vietnam could benefit from this trend.

In terms of valuation, SSI’s Chief Economist believes that the VN-Index’s P/E ratio is still relatively low compared to the average, making it reasonable for investment. However, it’s prudent to remain cautious in the short term as the number of stocks surpassing the MA20 (20-day moving average) is declining. Looking longer-term, Mr. Hung believes the situation is stable.

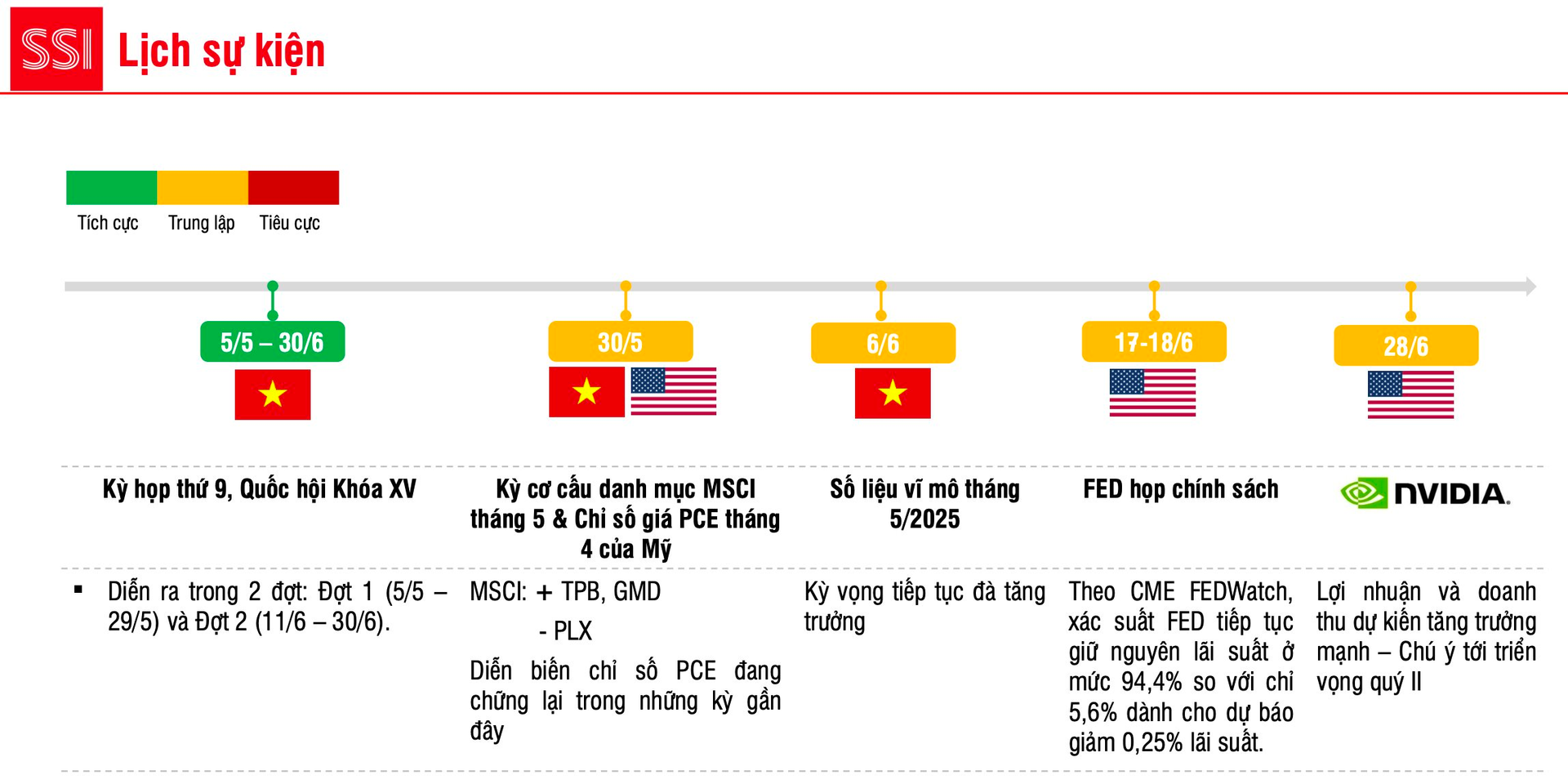

Additionally, SSI’s Chief Economist drew attention to upcoming events, both domestic and international, which could impact the Vietnamese stock market. He suggested that investors pay closer attention to the US market during this period, citing factors like the MSCI review, NVIDIA’s outlook, the PCE index, and the Fed’s meeting.

VN-Index and Foreigners’ Net Buying Value on HoSE

Another point to note, not included in the event calendar, is the issue of tariffs. According to SSI’s Chief Economist, an unexpected announcement regarding tariffs (if any), contrary to expectations, would impact the stock market. Mr. Hung also emphasized the market’s unpredictability during this period and for the rest of the year, likening it to “a north-easterly wind blowing in the middle of summer.”

The Great Exodus: Capital Fleeing Steel Stocks and Industrial Real Estate

Market liquidity took a hit last week. The steel and industrial real estate sectors witnessed prominent outflows, making them the most notable victims of this downturn.

“VN-Index Revisits Old Peak: Is it Time to Invest or Hold Back?”

“The VN-Index has once again reached the old peak range of 1,320-1,340 points. SHS believes that this is not an attractive price range for further investment.”

Market Beat: Afternoon Surge, VN-Index Soars Over 18 Points

The trading session concluded on a positive note, with the VN-Index climbing 18.05 points (+1.37%) to reach 1,332.51, while the HNX-Index gained 3.09 points (+1.43%), closing at 219.41. The market breadth tilted in favor of advancers, with 509 gainers versus 216 decliners. A dominant blue hue was observed in the VN30 basket, as 21 stocks advanced, 4 retreated, and 5 remained unchanged.