Specifically, MIC will conduct two issuances. The first is a stock dividend issuance for the 2024 fiscal year at a ratio of 55% (shareholders owning 100 shares will receive an additional 55 shares). With over 5.5 million shares currently outstanding, the company plans to issue approximately 3.05 million new shares, thereby increasing its charter capital to approximately VND 86 billion.

| MIC share price movement from the beginning of 2025 to May 28 session |

Subsequently, MIC will offer up to 50 million shares to existing shareholders at a price of VND 10,000 per share (46% lower than the morning session price on May 28), at a ratio of 581% (shareholders owning 100 shares have the right to buy an additional 581 shares).

The total expected proceeds from this offering amount to VND 500 billion. The company will utilize VND 455.5 billion for investing in or contributing capital to companies in the same industry, VND 9 billion for investing in a mineral transportation route, VND 6 billion for environmental restoration escrow, and VND 29.5 billion for supplementary working capital.

According to MIC, investing in target companies aims to expand its scale and increase ownership of sand mines with large reserves and high-quality raw materials, thereby enhancing its market share in sand mining and processing. The criteria for selecting target companies include a minimum sand reserve of 5 million tons, an existing processing plant, a charter capital of over VND 100 billion, and a minimum return on equity (ROE) of 5% as per the latest audited financial statements. The company aims to hold at least 51% of the actual contributed charter capital in the target enterprise, with a maximum deal value of VND 480 billion.

Source: VietstockFinance

|

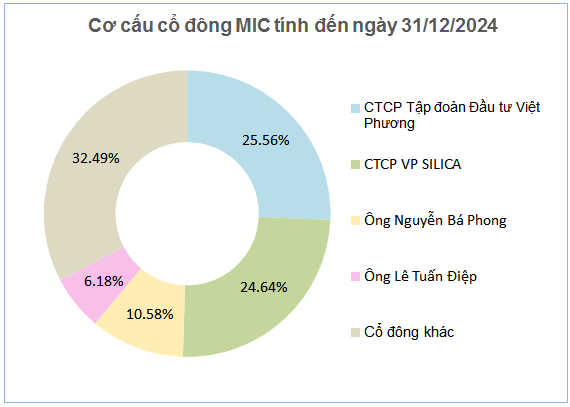

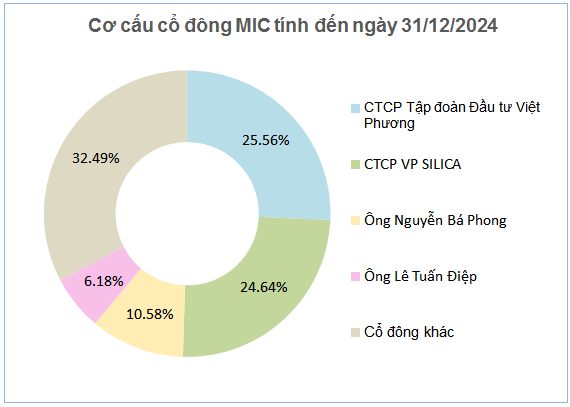

As of the end of 2024, MIC had four major shareholders, including two organizations and two individuals. Among them, Vietnam Investment Group was the largest shareholder, holding 25.56% of the charter capital. With this ownership ratio, if Vietnam Investment Group exercises its full subscription rights in the upcoming offering, it will need to invest approximately VND 128 billion.

| MIC’s Q1 financial results over the years |

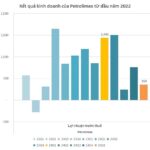

In terms of financial performance, in Q1 2025, MIC recorded net revenue of nearly VND 37 billion, a decrease of 32% from the previous year; net profit decreased by 13% to nearly VND 2 billion.

For the fiscal year 2025, the company targets revenue of nearly VND 219 billion (a decrease of 5%) and pre-tax profit of nearly VND 18 billion (an increase of 3%). After the first quarter, the company has accomplished 17% of its revenue plan and 9% of its profit target.

– 11:28 28/05/2025

The Brewing Industry: Navigating Competitive Pressures and Cost Control

The Vietnamese beer industry ended the first quarter of 2025 on a somber note. While Habeco turned a profit and reversed its fortunes, market leader Sabeco lost its growth momentum, and smaller players slid deeper into the red.

“Revolutionizing Credit Limits: DSC Secures an Impressive 1.3 Trillion VND Margin Facility”

On May 23, the Ho Chi Minh City Stock Exchange (HOSE) announced the removal of DSC Securities Corporation’s (DSC) shares from the list of ineligible securities for margin trading. On the same day, the company disclosed two board resolutions approving the receipt of credit limits totaling over VND 1,300 billion from two banks.