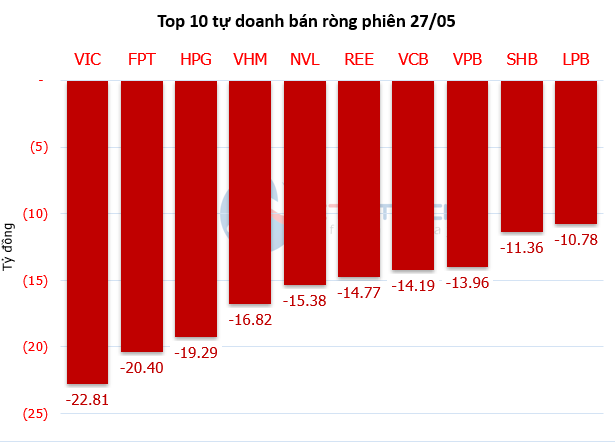

Self-financing securities companies recorded net selling of nearly VND 215 billion on HOSE, marking the third consecutive session of selling. Selling pressure fell on pillar stocks, with VIC suffering a net sell-off of VND 23 billion, FPT (VND 20 billion), HPG (VND 19 billion), and VHM (VND 17 billion). Other codes such as NVL, REE, VCB, and VPB also recorded net selling values ranging from VND 14-15 billion.

Source: VietstockFinance

|

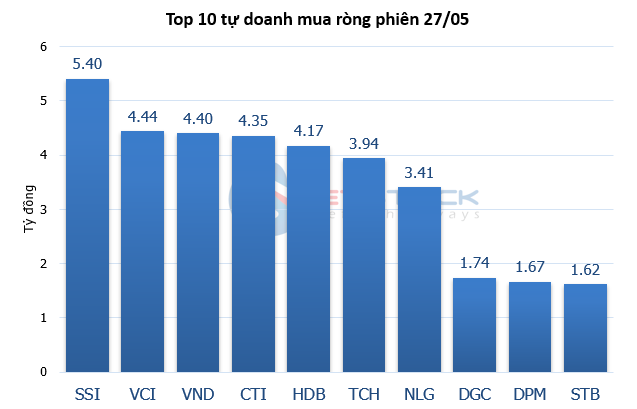

In contrast, buying from self-financing was rather modest. The stocks with the largest net purchases were SSI, with a value of over VND 5 billion. This was followed by VCI, VND, CTI, HDB, and TCH, each recording net purchases of about VND 4 billion.

Source: VietstockFinance

|

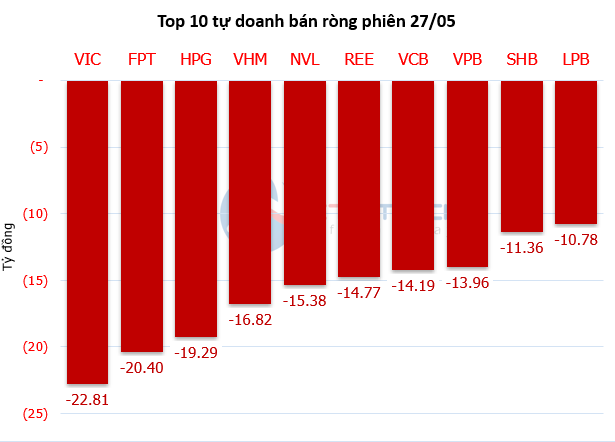

Foreigners extended their net selling streak to the third session, with a value of VND 1,192 billion, the highest in more than a month. Selling pressure focused on HPG with VND 157 billion, VIX (VND 144 billion), and VIC (VND 136 billion). Large caps such as VCB, NVL, and VRE also experienced strong net selling in the range of VND 97-100 billion.

| Block trading activities in the last 5 sessions |

However, there were bright spots in the foreign net buying. FPT led with a net purchase value of VND 127 billion, followed by GMD with VND 105 billion. Several other codes such as CTD, KBC, and HVN were lightly net bought, ranging from VND 34-43 billion.

| Top 10 stocks with the highest net trading volume of foreign investors on May 27 |

– 17:45 27/05/2025

The Stock Code: Unveiling the Sudden Sell-Off by Proprietary Trading Firms

The HoSE witnessed a notable development as proprietary securities firms recorded net sales of VND 243 billion. This significant activity underscores the dynamic nature of Vietnam’s securities market and highlights the pivotal role played by these firms in shaping the landscape of capital markets in the country.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)