“DX Group Joint Stock Company’s Latest Shareholder Update: Bonus Share Issue”

Ho Chi Minh City Stock Exchange-listed DX Group Joint Stock Company (code: DXG) has announced that June 5th is the record date for shareholders to receive bonus shares issued to increase charter capital from owner’s equity.

On May 23rd, the State Securities Commission of Vietnam (SSC) received the report on the issuance of bonus shares to increase charter capital from the company’s owner’s equity.

DX Group will issue over 148 million bonus shares to its shareholders at a ratio of 100:17, meaning that for every 100 shares owned, shareholders will receive 17 new shares.

The newly issued shares will not be restricted from transfer, except for existing shareholders holding ESOP 2023 (bonus type) shares during the restricted transfer period. They will still receive the new shares, but these shares will be restricted from transfer for the same period as the initial ESOP shares.

The issuance capital amounts to VND 1,480.4 billion, comprising VND 1,200 billion from undistributed post-tax profits stated in the audited 2024 consolidated financial statements, and over VND 280.4 billion from the share premium reserve based on the company’s audited 2024 separate financial statements.

Upon completion of this issuance, DX Group’s charter capital is expected to increase from nearly VND 8,726 billion to over VND 10,206 billion.

Luong Tri Thin, Founder and Chairman of DX Group’s Strategy Council

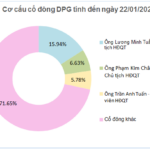

As of the end of 2024, founder and Chairman of the Strategy Council, Luong Tri Thin, held 122.3 million DXG shares and is expected to receive an additional 20.8 million new shares.

Bui Ngoc Duc, Member of the Board of Directors and General Director, owning 1.2 million DXG shares, is expected to receive an additional 204,005 new shares.

This issuance plan was approved by DX Group’s shareholders at the 2025 Annual General Meeting of Shareholders (AGM) held on May 9, 2025.

Following this bonus share issuance, DX Group will proceed with another capital increase plan approved at the 2024 AGM, involving a private placement of 93.5 million shares to no more than 20 strategic investors. The minimum offering price is expected to be VND 18,600 per share, and the proceeds will be used to contribute additional capital and increase ownership in the company’s subsidiaries.

The DX Group’s AGM also approved the 2025 consolidated revenue and net profit targets of VND 7,000 billion and VND 368 billion, respectively, representing a 46% and 44% increase compared to the previous year.

“FPTS Boosts Charter Capital to VND 3,365 Billion After Bonus Share Issuance”

On May 15th, FPTS successfully issued 30.59 million bonus shares to its 18,105 shareholders, thereby increasing its charter capital to VND 3,365 billion.

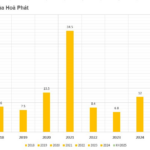

The New Issue of Nearly 1.3 Billion Shares as Dividend Payment by Hoa Phat Has Taken a New Turn

With approximately 6.4 billion shares currently in circulation, Hoa Phat Group is set to release an additional 1.28 billion new shares, equating to a nominal issuance value of VND 12,793 billion.