On Sunday, May 25, US President Donald Trump stated that his tariff policies aim to boost domestic production of tanks and tech products, not sneakers or t-shirts.

Speaking to reporters before boarding Air Force One in New Jersey, President Trump reiterated recent comments by Treasury Secretary Scott Bessent that the US does not necessarily need a booming textile industry – a stance that has been criticized by the National Council of Textile Organizations.

“We don’t want to make sneakers and t-shirts. We want to make military equipment. We want to make, do AI technology… Frankly, I don’t want to make t-shirts. I don’t want to make socks. We can do that very inexpensively in other places. We want to make chips, computers, and many other things, tanks and planes,” President Trump said.

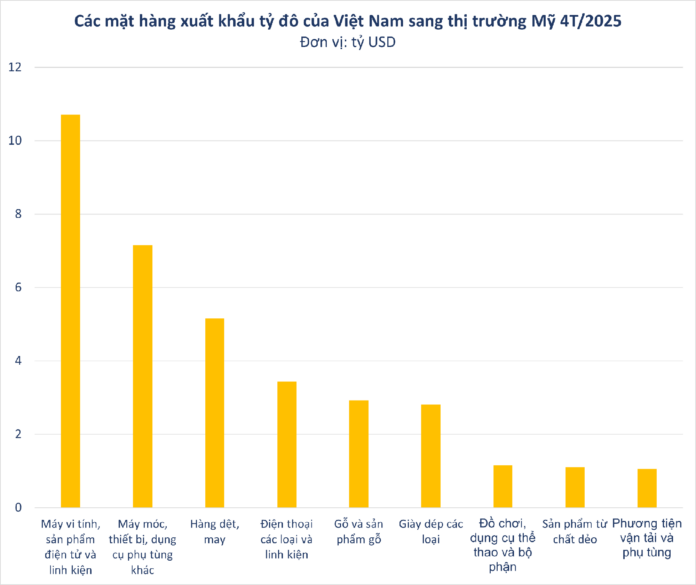

Notably, footwear and apparel are two of Vietnam’s key export commodities to the US market, with positive growth in recent times. Specifically, according to statistics from the General Department of Vietnam Customs, textile and garment exports reached USD 3.64 billion in April, up 15% over the same period. Accumulated in the first four months of 2025, this item brought in more than USD 13.9 billion, up 11% over the same period.

The US was Vietnam’s largest export market in 4/2025, with export turnover reaching more than USD 5.1 billion, up 17.12% over the same period in 2024. Free trade agreements and global supply chain shifts have helped Vietnam consolidate its position in this market.

Textiles and garments are one of the four industries with the largest export turnover in the country, accounting for more than 10% of total export turnover. Therefore, the growth of the textile and garment industry plays a very important role in Vietnam’s exports and economic growth. The textile and garment industry also has a large trade surplus and provides stable jobs for millions of workers.

In 2025, the Vietnamese textile and garment industry sets an export target of USD 47-48 billion (up USD 3-4 billion compared to 2024).

US inventory is currently low, so orders in the third quarter of 2025 may still be good, but the fourth quarter of 2025 may decrease by about 10% due to reduced US consumption. Demand in this market is expected to decrease by about 5% in 2025. Along with that, the current tariff negotiation policies are being implemented according to commodity groups, so there may be opportunities for Vietnam’s textile and garment industry.

Meanwhile, footwear exports reached USD 2.2 billion, up 16.9% over the previous month. In the first four months of the year, Vietnam earned USD 7.6 billion, up 14.5% over the previous year, making it one of Vietnam’s 10 billion-dollar export items.

In terms of market, the US is also the largest export market for this item, with more than USD 2.8 billion, up 17.4% over the same period last year.

Vietnam is currently the second largest exporter of footwear in the world, with an estimated export volume accounting for 10% of the world and present in 150 markets such as the US, EU, China, Japan, UK… Vietnam has more than 1,000 footwear factories and provides jobs for about 1.5 million workers, contributing about 8% of the country’s GDP.

Vietnam’s footwear export industry in 2025 is expected to continue to recover and grow, with a target of reaching a turnover of about USD 29 billion, up 10% compared to 2024 (USD 26-27 billion). As the third largest footwear producer in the world (1.4 billion pairs/year) and the second largest exporter, Vietnam is taking advantage of free trade agreements (FTAs) such as EVFTA, CPTPP, and UKVFTA to increase exports to key markets such as the US (36.5%), EU (26%), and China (9%).

Since taking office, President Donald Trump has continuously introduced new policies to affirm his approach, arguing that this is the “necessary price to rebuild America”. In fact, after the tax hikes in the first term, some industries such as semiconductors, electric vehicle manufacturing, and defense have seen a return of domestic investment, especially in strategic states such as Texas, Ohio, and Pennsylvania.

However, this trend has not spread to the entire economy. Labor-intensive industries such as textiles, leather, and footwear are mostly still shifting to Southeast Asian and South Asian countries. The lack of skilled labor and high production costs in the US remain significant barriers to realizing the “Made in America” vision on a large scale.

US-Bound Export Sector Soars: Trump’s Statement Spurs Sector-Wide Rally

Let me know if you would like me to tweak it further or provide additional variations.

“Previously, at the May seminar organized by the Vietnam Textile Group (Vinatex), Dr. Le Tien Truong, Chairman of Vinatex’s Board of Directors, shared his insights on the industry’s market opportunities. He stated that the textile industry would witness an abundance of orders in the first half of the year, with the potential for this trend to extend through the third quarter of 2025.”

The Stock Market Conundrum: Experts Advise Caution as VN-Index Surges in Banking and Real Estate Sectors.

The Vietnamese market has demonstrated remarkable resilience, bouncing back from the challenges posed by the US government’s tariff policies. This recovery can be largely attributed to the strong performance of the VN30, particularly the real estate and banking sectors, which have played a pivotal role in driving the market’s resurgence.

Legamex: A Legacy of Saigon’s Textile Industry Fades Away

Once a leading garment manufacturer in Vietnam, Legamex is now embroiled in a financial crisis, with cumulative losses surpassing VND 166 billion and negative equity. The company has been compelled to halt its core contract manufacturing operations and revise its plans for utilizing capital raised through equity offerings to repay its financial obligations.

The Trade Tensions Weave Uncertainty for Vietnam’s Textile Industry

In light of the US-China trade truce, while Vietnam is still in negotiations, Vinatex forecasts a stable order volume for Q3 due to low US inventory levels. However, the company predicts a potential 10% decline in orders for Q4 as purchasing power may weaken. Chairman Le Tien Truong emphasizes the industry’s need to seize the negotiation “lull” to proactively adapt and stay resilient.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)