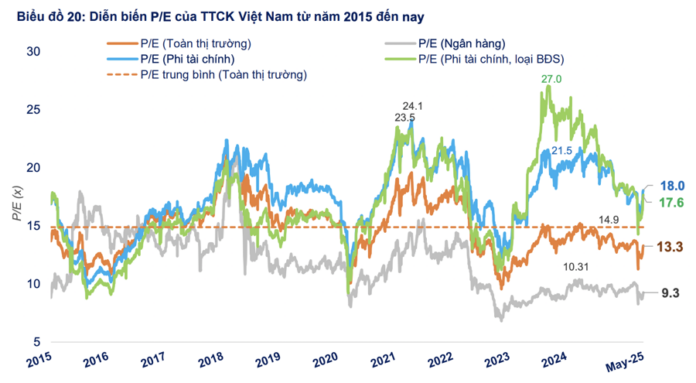

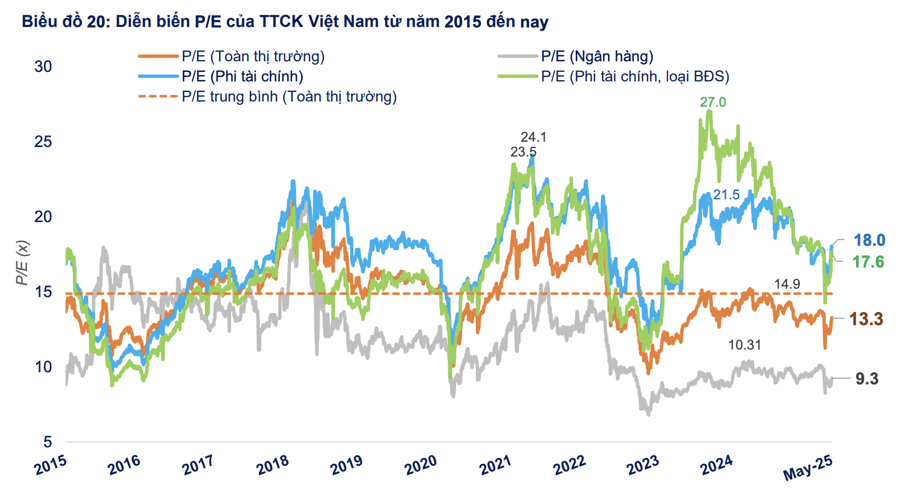

The market-wide P/E ratio dropped to 13.3x in early April 2025 due to tariff concerns and steady profit growth in Q1, according to FiinGroup. This is significantly lower than the 10-year average of 14.9x.

With a forward P/E of 12.1x for 2025, the current valuation is reasonable, reflecting the expected profit growth of 13.9% based on the business plans announced by executives at the beginning of the year.

Notably, the P/E ratio of the Non-financial group, excluding Real Estate, has dropped by 35% from its peak a year ago, which is a larger discount compared to the overall market when the market-wide P/E dropped by 14%, Banks by 10%, and Real Estate by 28%.

This discount is mainly due to the price decline of mid- and small-cap stocks in industries directly affected by tariff concerns, such as Seafood, Garment, and Chemicals, while the recovery remains modest despite improving profits. This indicates that the group’s valuation is becoming more attractive relative to earnings.

Ms. Do Hong Van, Head of Data Analysis at FiinGroup, believes that as trade negotiations with the US progress and tariff risks subside, this group of stocks, especially those with strong fundamentals and improving revenue and profit margins, are likely to attract market money again.

Looking at different sectors, valuations are polarizing based on profit expectations and risk levels. Specifically, for Real Estate and Construction, the current P/E ratios are high and comparable to the five-year average. It’s important to note that the Real Estate P/E is influenced by the Vingroup companies (VIC, VHM, VRE) and reflects the profit cycle bottom for residential real estate developers, leading to higher valuation multiples despite relatively stable prices.

In the case of Construction, the Q1 2025 profit picture contrasted with earlier expectations that the industry would benefit from the government’s efforts to promote the disbursement of public investment capital. High valuations, coupled with lower-than-expected public investment disbursement, limit money flow into this group.

For the Garment and Seafood industries, valuations are lower than the five-year average, and profit growth quality has improved. However, tariff risks make money flow hesitant towards these export-oriented industries. As for Retail, while the P/E is lower than the five-year average, it is currently quite high at 26x, and positive profit expectations will help bring valuations of some retail businesses to more reasonable levels.

In the Food sector, low valuations are seen in leading stocks such as VNM and SAB due to less-than-positive financial results and unclear profit prospects. This hinders the return of money flow, even though the allocation of money flow into food stocks has reached a 10-month low.

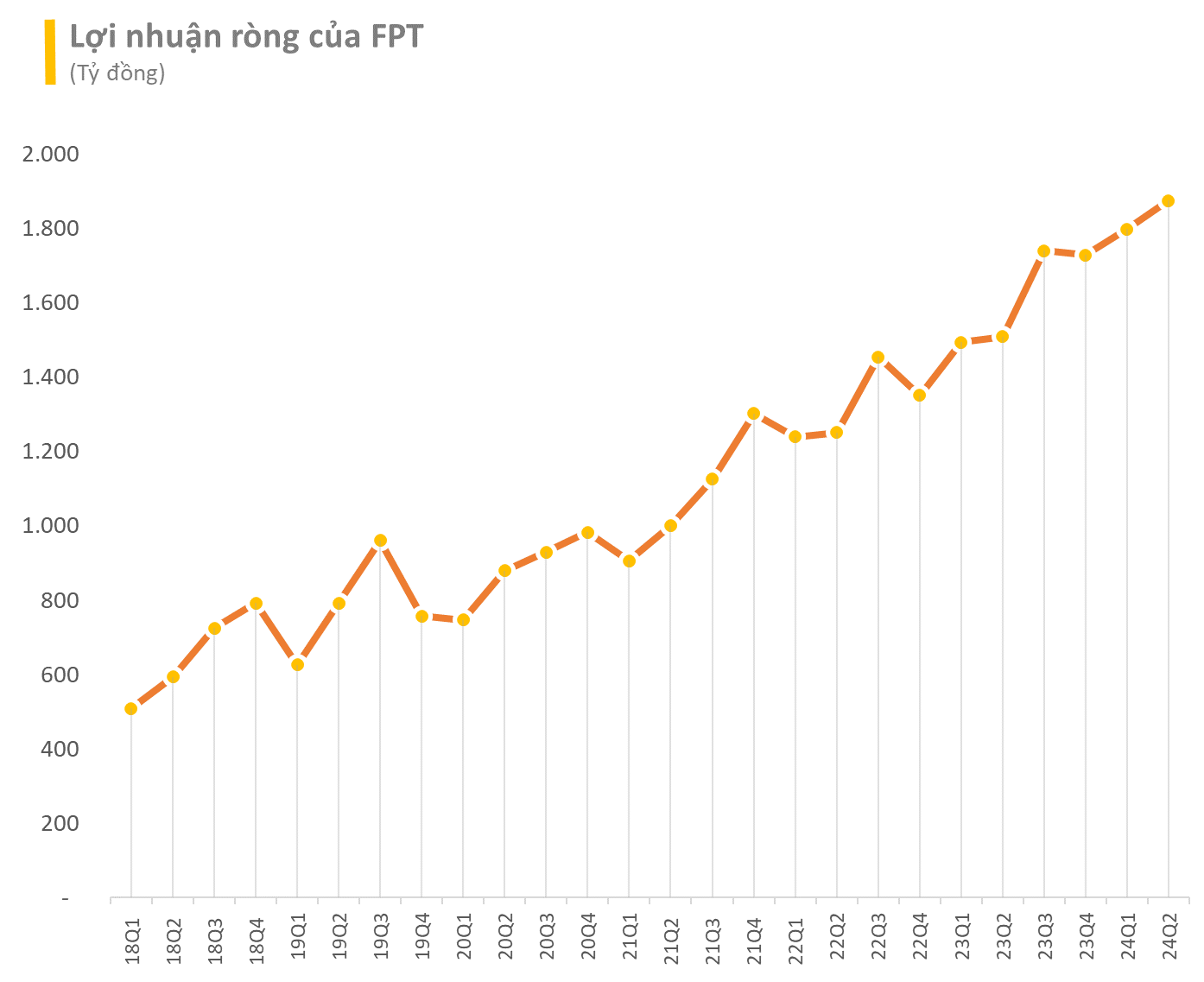

On the other hand, some sectors, such as Aviation, Information Technology, Oil and Gas, and Securities, are trading at higher valuation multiples than the average. This requires sufficiently strong financial results in the coming quarters or unique and compelling narratives to sustain current price levels.

Bank stocks are currently trading at a 12-month P/B ratio of 1.43x, which is 1 standard deviation below the long-term average and rarely seen. Since 2019, there have only been two occasions when bank P/B ratios traded at similar levels: the onset of the Covid-19 pandemic and the Van Thinh Phat incident.

Despite the rare low P/B valuation of bank stocks, this has not been enough to sustainably and evenly attract money flow back to the entire industry. The main reason is the modest profit growth expectations, while asset quality risks are on the rise again.

The Chemical-Fertilizer Business Booms: What’s Next?

The first quarter of 2025 witnessed a remarkable surge in the fertilizer and chemical industries, with most players in the sector experiencing significant growth.

“A Bright Start: PJICO’s Impressive Performance in Q1”

In the recently released Q1 2025 financial report, Petrolimex Insurance Joint-Stock Corporation (PJICO, code: PGI) recorded a total revenue of VND 1,343 billion, a 3.3% increase, amounting to 26% of the yearly plan. The original insurance revenue reached VND 1,114 billion, a slight 1.3% uptick compared to the same period in 2024.

Unlocked and Unleashed: Stock Soars 140% to All-Time High, Delivering a Whopping $120 Billion Profit to Major Shareholders in Just One Month

Over the past month, the stock has witnessed an impressive streak, with five consecutive sessions closing at the upper circuit.