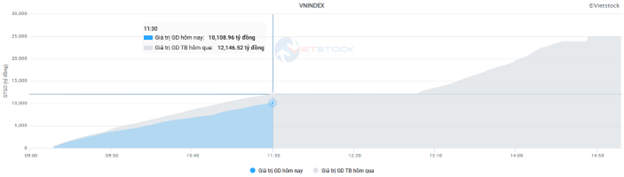

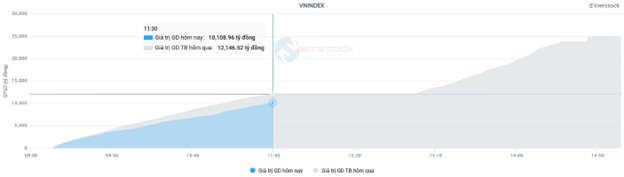

The VN-Index trading volume this morning reached over 425 million units, equivalent to a value of more than 10 trillion VND, a decrease of 17% compared to the same period in the previous session. Meanwhile, the HNX-Index recorded a volume of over 49 million units with a value of 905 billion VND.

Source: VietstockFinance

|

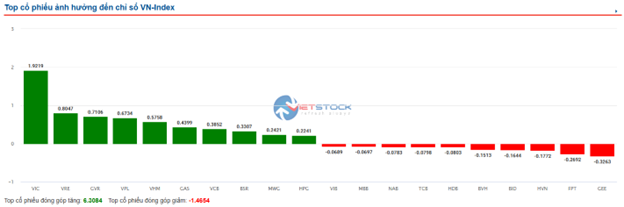

Vingroup’s stocks are mainly contributing to the index’s green. VIC returned to its familiar leading role, helping VN-Index gain nearly 2 points. Following are VHM, VRE and VPL, which also contributed a total of 2 points. On the other hand, GEE, FPT and HVN were the codes that put the most downward pressure, but the impact was generally not too large.

Source: VietstockFinance

|

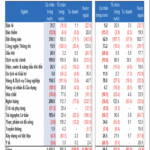

Most industry groups are maintaining their upward momentum but the differentiation is quite clear. Energy leads the market with a nearly 3% increase thanks mainly to BSR (+2.55%), PVS (+5.88%), PVD (+2.12%), PVB (+5.84%), PVC (+5.32%), TMB (+1.6%) and NBC (+1.03%). The groups of raw materials and real estate are also trading quite positively with an increase of more than 1%.

In the financial sector, the main demand focuses on securities stocks such as VIX (+2.21%), SSI (+1.05%), HCM (+1.16%), FTS (+2.46%), SHS (+1.49%) and MBS (+1.11%). Meanwhile, the “king stocks” traded quite erratically, fluctuating slightly around the reference mark. Insurance, on the other hand, faced selling pressure and sank into the red on a large scale. Overall, the general index of the financial sector rose slightly compared to the reference.

Foreigners continued to maintain a net sell position of more than 448 billion VND on the three exchanges this morning. FPT, NVL and SSI were the codes that were sold the most with a value of about 55 – 57 billion VND. On the buying side, except for MWG and DXG, which were net bought at 70 billion VND and 67 billion VND, respectively, the remaining codes all recorded quite modest net buying values, below 30 billion VND.

10:30 am: Energy group shines, VN-Index has not escaped the tug-of-war

Although the tug-of-war situation is still going on, the green still dominates the market, giving investors a positive psychology. The main indexes all maintained growth momentum, showing a bright outlook and capital inflows. The market is showing good recovery ability, with the lead of some key industry groups, while the adjustment pressure only appears locally in a few industry groups.

As of 10:30, VN-Index stood at 1,343.04 points, up 0.24%. Meanwhile, HNX-Index showed superior performance with a gain of 0.65% to 223.23 points, along with strong trading volume in the morning session, indicating that investors are quite active. Notably, the HNX30 index rose notably by 1.26%, to 453.41 points, reflecting the vibrancy and capital inflows into large-cap stocks on the HNX exchange. UPCOM-Index also contributed to the positive picture when it increased by 0.85% to 98.97 points. Capitalization indexes such as VS-LargeCap increased by 0.26%, VS-MidCap and VS-SmallCap both increased by 0.09%, while VS-MicroCap increased by 0.69%, reflecting the consensus of the market from different capitalization groups.

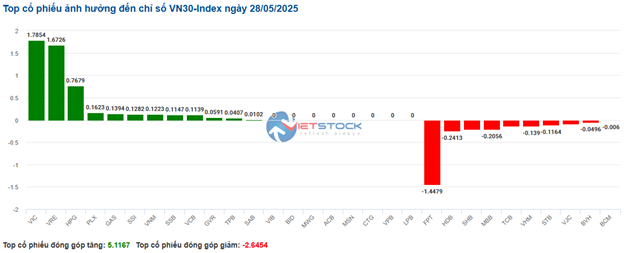

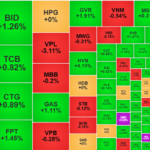

The breadth of the VN30 basket is showing a colorful picture. The number of gaining stocks slightly outweighs with 12 codes, while 10 codes decreased and 8 codes remained at the reference level. Notably, the group of stocks that had the most positive impact on the index included VIC up 1,100 VND contributing 1.79, VRE up 1,200 VND contributing 1.67, HPG up 150 VND contributing 0.77 points and PLX up 850 VND contributing 0.16 points to the overall index.

On the contrary, FPT had a significant impact when taking away 1.45 points. Following were HDB taking away 0.24 points, MBB taking away 0.21 points and SHB taking away 0.21 points. In addition, the differentiation is also quite clear in this large-cap group.

Source: VietstockFinance

|

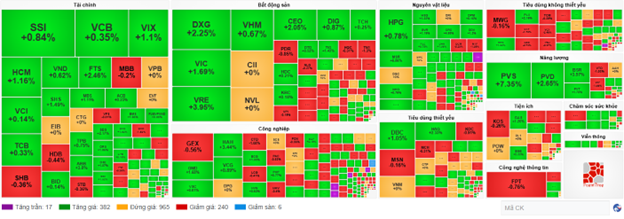

Going into each industry group, the market picture becomes clearer with notable highlights. The energy industry was the brightest spot, leading the gain with a 4.27% increase. PVS stock is one of the typical representatives of this industry, recording an impressive increase of 8.09%, and PVD also recorded green with an increase of 2.65%.

In the real estate group, VRE increased by 4.35%, VIC increased by 1.59%, CEO increased by 2.05%, and DXG increased by 2.54%, which were notable names.

The financial services industry also recorded an increase of 0.85%, with SSI up 0.63%, HCM up 1.16%, VCI up 0.27%, and SHS up 1.49%, indicating that capital is still circulating positively into this group.

On the contrary, a number of industries faced adjustment pressure. The consumer goods and decoration industry decreased by 1.32%, along with software down 1.09% and insurance down 1.00%, reflecting the clear differentiation of capital flow in this morning session. FPT in the software and services industry fell by 0.92%, reflecting the adjustment of technology stocks.

As of 10:30, the picture of the Vietnamese stock market showed a fairly clear differentiation, but the buying side still had the upper hand. The number of gaining stocks reached 382, of which 17 stocks hit the ceiling. On the contrary, there were 240 decreasing stocks, with 6 floor stocks. This signal reflects the cautious trading psychology and the balance between supply and demand.

Source: VietstockFinance

|

Opening: Advantage tilts towards the green

The early morning session showed a positive trend across most of the main indexes. The growth momentum spread, reflecting a certain optimism of capital in this trading session. Notably, large-cap industry groups played a leading role, along with the breakthrough of a number of specialized fields.

At the 9:30 mark, the VN-Index stood at 1,343.79 points, up 0.30% from the opening price. Green also spread to other exchanges, with HNX-Index reaching 223.54 points, up 0.79%, and UPCOM up 0.74% to 98.87 points.

The VN30 basket is painting a bright picture with 23 gaining stocks, overwhelming the 7 adjusting codes. On the positive side, the notable pillars included HPG contributing 1.53 points, SSI 0.35 points, VCB 0.29 points, and VPB 0.25 points. Conversely, the notable negative impacts came from VIC with a negative impact of 1.43 points, VHM 1.00 points, STB 0.12 points, and FPT 0.11 points. Overall, the breadth of the VN30 market is consolidating optimism in this session.

Looking at the fluctuations by industry, energy stood out as the group with the largest increase of 3.27%. In this industry, PVS stock with a gain of 5.15% was a notable highlight.

Next, financial services recorded an increase of 1.3%, accounting for 3.52% of the total market capitalization. Many securities stocks in this industry showed strong gains, such as SSI up 1.48%, VCI up 1.22%, and VIX up 1.10%.

On the contrary, a number of industries recorded slight decreases. Real estate, despite its large capitalization (16.15%), fell by 0.31%. However, in this industry, there were still codes that went against the trend, such as CEO up 2.74%, while KHG fell by 1.60%.

The breadth of the VN-Index market showed a clear differentiation. The stock at the reference price dominated with 1,110 stocks, the focus of the market. The number of gaining stocks stood out with 352 stocks, along with 14 ceiling stocks, reflecting the positive capital demand. Meanwhile, there were only 128 decreasing stocks and 6 floor stocks, indicating that the selling pressure was not too great.

Technical Analysis for May 28: Positive Signals Emerge

The VN-Index and HNX-Index rallied amidst a positive MACD indicator, which continued its upward trajectory, reinforcing the short-term recovery momentum.

The Stock Market: A Fresh Breeze of Opportunities

With a bright outlook for upgrades, positive Q2 earnings forecasts, and low-interest rates, the stock market is poised for a vibrant performance.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)